Spirit Airlines (NYSE:SAVE) – Spirit Airlines

managed to extend its $1.1 billion debt refinancing deadline by two

months, until December 23, with the help of U.S. Bank. The company,

which has been facing losses and doubts about its ability to pay

debts, seeks to increase revenues and reduce costs. Shares rose

56.5% in pre-market trading after closing down 3.3% on Friday.

Kenvue (NYSE:KVUE) – Hedge fund Starboard Value

acquired a stake in Kenvue, the maker of products like Band-Aid and

Tylenol, after its shares fell 18% since the IPO in May 2023.

Starboard may seek changes in the positioning and pricing of brands

to improve performance. Kenvue’s market value is $41 billion.

Shares rose 4.8% in pre-market trading after closing up 1.3% on

Friday.

Boeing (NYSE:BA) – Boeing has reached a deal to

sell its subsidiary Digital Receiver Technology, a manufacturer of

surveillance equipment for the U.S. military, to Thales Defense

& Security. The goal is to strengthen its finances, already

weakened by production delays and safety issues. The terms of the

agreement were not disclosed. On another front, Boeing’s machinists

will vote on a new contract proposal that includes a 35% wage

increase over four years, plus bonuses and retirement plan

improvements. The strike, now in its fifth week, has affected the

production of planes and the company’s finances. The vote will take

place on Wednesday. Shares rose 3.7% in pre-market trading after

closing down 0.2% on Friday.

Spirit AeroSystems (NYSE:SPR) – Spirit

AeroSystems announced it will temporarily lay off 700 employees for

21 days due to Boeing’s strike, which is draining its cash and

stockroom space. The strike by over 33,000 Boeing workers has

disrupted the production of 767 and 777 jets, impacting the

manufacturer’s supply chain.

Cigna Group (NYSE:CI), Humana

(NYSE:HUM) – Cigna has resumed talks for a potential merger with

Humana after halting efforts last year. Recently, the companies

held preliminary discussions, but no deal was reached.

MetLife (NYSE:MET) – New York-based insurer

MetLife is in advanced negotiations to acquire PineBridge

Investments’ non-China assets, in a deal estimated between $1

billion and $1.5 billion. These assets, valued at $100 billion, are

mostly owned by billionaire Richard Li’s Pacific Century Group.

Sanofi (NASDAQ:SNY) – Sanofi has entered

negotiations to sell 50% of its consumer health unit, Opella, to

Clayton Dubilier & Rice. The transaction values Opella at

$16.29 billion, with completion expected in 2025. The sale aims to

fund the development of new immunological and anti-inflammatory

drugs. The French government secured guarantees on job retention

and production in the country, and Bpifrance would take a 1% stake

in Opella. Shares fell 0.8% in pre-market trading after closing up

0.1% on Friday.

Embraer (NYSE:ERJ) – Embraer delivered 57

non-defense aircraft in the third quarter, a 33% increase from the

previous year. These included 16 commercial jets and 41 executive

jets, with the firm order backlog reaching $22.7 billion, the

highest in nine years.

Southwest Airlines (NYSE:LUV) – Elliott

Investment Management and Southwest Airlines are negotiating a deal

to avoid a board control dispute. Elliott proposed board

representation without full control. Negotiations are still

ongoing, and Elliott has called a special meeting for December,

seeking to replace eight directors and review strategy. Shares fell

0.3% in pre-market trading after closing up 3.0% on Friday.

Delta Airlines (NYSE:DAL) – A Delta Airlines

Boeing 767 bound for New York made an emergency stop after taking

off from Blaise Diagne Airport in Senegal due to a technical issue.

The plane, carrying 216 passengers, landed safely with no injuries.

Senegalese aviation authorities will investigate the incident.

Shares fell 1.2% in pre-market trading after closing up 1.0% on

Friday.

IBM (NYSE:IBM) – IBM launched the new version

of its “Granite 3.0” AI models, aimed at enterprises, adopting an

open-source approach, unlike competitors like Microsoft that charge

for their models. The models are available on the Watsonx platform

and Nvidia’s toolset, trained with Nvidia GPUs.

Apple (NASDAQ:AAPL) – Apple’s recruitment

executive, Sjoerd Gehring, is leaving the company to become Chief

People Officer at Citadel, a hedge fund based in Miami. His

departure comes amid several HR team changes at Apple, including

the exit of Chief People Officer Carol Surface after 18 months.

Shares fell 0.3% in pre-market trading after closing up 1.2% on

Friday.

Alphabet (NASDAQ:GOOGL) – A federal judge in

California temporarily halted an order requiring Google to overhaul

its Play Store by November 1, as part of an antitrust lawsuit filed

by Epic Games. Google argued the change posed security risks. The

Appeals Court will review the case. Shares fell 0.1% in pre-market

trading after closing up 0.3% on Friday.

Meta Platforms (NASDAQ:META) – Meta announced

on Friday the launch of new AI models, including the

“Self-Supervised Evaluator,” which reduces the need for human

intervention in AI development. This model uses a “chain of

thought” technique to improve accuracy in complex tasks. Meta used

AI-generated data to train the model. Shares rose 0.1% in

pre-market trading after closing down 0.1% on Friday.

Amazon (NASDAQ:AMZN) – Amazon employees

publicly voiced criticism of the company’s culture after a viral

LinkedIn post by former employee Stephanie Ramos. She criticized

bureaucracy and inefficient management, and her post received

support from current employees, who also expressed dissatisfaction

with changes under Andy Jassy’s leadership, including mandatory

return-to-office policies. Additionally, Amazon, which has been the

largest sponsor of H-1B visas over the last three years, faces a

labor shortage and runs a hiring program for refugees. Despite

this, the company may face public opposition if it pushes for more

immigration, as public sentiment has hardened against undocumented

immigrants. Shares fell 0.3% in pre-market trading after closing up

0.8% on Friday.

AT&T (NYSE:T) – AT&T ratified

agreements with the Communications Workers of America union,

covering 23,000 employees across 11 states. Workers in the West

will receive a 15% raise over four years, while those in the

Southeast will get a 19% raise over five years. Southeast

technicians will receive an additional 3% raise. Shares fell 0.1%

in pre-market trading after closing up 0.6% on Friday.

Verizon Communications (NYSE:VZ), US

Cellular (NYSE:USM) – Verizon will purchase spectrum

licenses from US Cellular for $1 billion, part of a larger asset

sale. This deal is contingent upon the completion of a transaction

announced in May, where US Cellular will sell wireless operations

and spectrum assets to T-Mobile for $4.4 billion. Verizon shares

rose 0.3% in pre-market trading. US Cellular shares remained stable

after closing up 7.2% on Friday.

Western Digital (NASDAQ:WDC) – Western Digital

was ordered to pay $315.7 million for infringing a data encryption

patent owned by SPEX Technologies. The jury found that Western

Digital’s hard drive products infringed the patent. The company,

which denies the allegations, plans to appeal the verdict if

necessary. Shares rose 0.4% in pre-market trading after closing

down 0.5% on Friday.

BHP Group (NYSE:BHP) – A hearing on the 2015

Mariana dam disaster will begin in the UK’s Supreme Court, with

claimants seeking up to $47 billion in damages from BHP. The

disaster, which killed people and caused environmental destruction,

led to a joint lawsuit by over 600,000 Brazilians and 46 local

governments. Shares rose 0.1% in pre-market trading after closing

up 0.4% on Friday.

Starbucks (NASDAQ:SBUX) – Starbucks announced

that food marketing veteran Tressie Lieberman will become the new

Executive Vice President and Global Chief Brand Officer, effective

November 4. Lieberman, who worked at Chipotle, will be responsible

for marketing and product development. This move is part of the

executive reshuffling led by new CEO Brian Niccol. Shares rose 0.1%

in pre-market trading after closing up 1.7% on Friday.

Mondelez International (NASDAQ:MDLZ) – JAB

announced that it has distributed shares of JDE Peet’s, previously

held by Mondelez International, to more than 70 limited partners of

its consumer fund, increasing the coffee company’s free float.

Additionally, JAB plans to expand its insurance business after some

consumer investments underperformed. Shares rose 0.5% in pre-market

trading after closing up 0.7% on Friday.

Philip Morris (NYSE:PM) – Philip Morris,

British American Tobacco, and Japan Tobacco have agreed to pay

$23.6 billion (C$32.5 billion) to settle a long-running lawsuit in

Canada over tobacco-related health damages. The settlement, the

largest outside the U.S., still needs approval and includes

compensation for health damages caused by smoking.

Bank of America (NYSE:BAC) – Bank of America

has extended its guaranteed foreign exchange rates for up to one

year, helping companies reduce currency risks and simplify treasury

management. This allows businesses to protect themselves from

currency fluctuations, easing cash flow forecasting and

reconciliation, especially in sectors like e-commerce and

manufacturing. Shares fell 0.1% in pre-market trading after closing

down 0.7% on Friday.

UBS Group (NYSE:UBS), American

Express (NYSE:AXP) – UBS has decided to sell its 50% stake

in Swisscard, acquired from Credit Suisse, to American Express,

which will become the sole owner. The terms of the deal were not

disclosed. Credit Suisse customers will be moved to UBS’s credit

card platform, with no immediate impact on cardholders. UBS shares

fell 0.2% in pre-market trading, while American Express shares fell

0.3%.

JPMorgan Chase (NYSE:JPM) – JPMorgan noted that

South Africa could see an increase in initial public offerings

(IPOs) and capital raising in 2024, driven by an economic recovery.

The bank highlights optimism around a pro-business coalition

forming and improvements in the stock market, making IPOs a viable

option for local companies.

Berkshire Hathaway (NYSE:BRK.A) – Berkshire

Hathaway bought 1.6 million shares of Sirius XM last week for about

$42 million, raising its stake to 32%. The company now holds 110.3

million shares, valued at around $3 billion, taking advantage of

Sirius XM’s 50% stock drop this year.

Interactive Brokers (NASDAQ:IBKR) – Interactive

Brokers, Altor Equity Partners, and Centerbridge Partners are among

those interested in acquiring Saxo Bank. Investors have made

initial offers, but Saxo Bank may still decide against the sale.

With $120 billion in assets, the company is being advised by

Goldman Sachs to find new owners.

Robinhood Markets (NASDAQ:HOOD) – Robinhood is

launching margin investing in the UK, offering competitive rates,

allowing investors to use existing assets as collateral to purchase

additional securities. Approval came after discussions with the

Financial Conduct Authority. Margin trading is risky and typically

limited to high-net-worth investors. Shares rose 0.2% in pre-market

trading after closing up 1.9% on Friday.

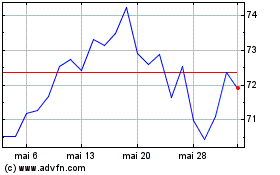

MetLife (NYSE:MET)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MetLife (NYSE:MET)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024