Higher Treasury Yields May Lead To Extended Pullback On Wall Street

22 Outubro 2024 - 10:08AM

IH Market News

The major U.S. index futures are currently pointing to initial

weakness on Tuesday, with stocks likely to see further downside

after ending the previous session mostly lower.

Renewed concerns about the outlook for interest rates may weigh

on Wall Street following a recent surge by U.S. treasury

yields.

The yield on the benchmark ten-year note has jumped to its

highest levels in almost three months amid worries about the U.S.

fiscal deficit and comments from Federal Reserve officials hinting

at gradual rate cuts.

After the Fed slashed interest rates by 50 basis points last

month, CME Group’s FedWatch Tool is currently indicating an 87.6

chance of just a 25 basis point rate cut next month.

A steep drop by shares of Verizon (NYSE:VZ) is also likely to

weigh on the Dow, with the telecom giant tumbling by 3.0 percent in

pre-market trading.

The slump by Verizon comes after the company reported third

quarter earnings that beat analyst estimates but weaker than

expected revenues.

Meanwhile, fellow Dow component 3M (NYSE:MMM) is likely to see

initial strength after the industrial conglomerate reported third

quarter earnings that exceeded expectations.

Overall trading activity may be somewhat subdued, however, with

a lack of major U.S. economic data likely to keep some traders on

the sidelines.

Following recent strength on Wall Street, the major U.S. stock

indexes turned in a mixed performance during trading on Monday.

While the Dow showed a notable pullback, the tech-heavy Nasdaq

managed to end the day in positive territory.

The Dow slid 344.31 points or 0.8 percent to 42,931.60 and the

S&P 500 dipped 10.69 points or 0.2 percent to 5,853.98, but the

Nasdaq rose 50.45 points or 0.3 percent to 18,540.01.

The pullback by the Dow partly reflected significant declines by

American Express (NYSE:AXP), Merck (NYSE:MRK) and Travelers

(NYSE:TRV).

The blue chip index gave back ground after reaching a record

closing high last Friday, as some traders cashed in on the recent

strength.

Meanwhile, the Nasdaq fluctuated over the course of the session

before eventually ending the day at its best closing level since

setting a record closing high in July.

Overall trading activity was relatively subdued, as traders

looked ahead to the release of a slew of corporate earnings news

from big-name companies.

Reports on durable goods orders and new and existing home sales

are also likely to attract attention in the coming days along with

the Federal Reserve’s Beige Book.

The Conference Board released a report this morning showing its

reading on leading U.S. economic indicators fell by more than

expected in the month of September.

The report said the leading economic index slid by 0.5 percent

in September after falling by a revised 0.3 percent in August.

Economists had expected the leading economic index to decrease

by 0.3 percent compared to the 0.2 percent dip originally reported

for the previous month.

Housing stocks saw substantial weakness on the day, with the

Philadelphia Housing Sector Index plunging by 3.0 percent after

ending last Friday’s trading at a record closing high.

Considerable weakness was also visible among commercial real

estate stocks, as reflected by the 2.0 percent slumped by the Dow

Jones U.S. Real Estate Index.

Telecom, banking and pharmaceutical stocks also saw significant

weakness, while airline stocks showed a strong move to the

upside.

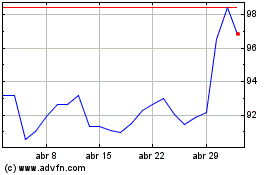

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024