Futures Pointing To Modestly Lower Open On Wall Street

29 Outubro 2024 - 10:09AM

IH Market News

The major U.S. index futures are currently pointing to modestly

lower open on Tuesday, with stocks likely to give back ground after

ending the previous session mostly higher.

Uncertainty ahead of the release of key U.S. economic data in

the coming days may lead some traders to cash in on yesterday’s

gains.

The monthly jobs report as well as a report on personal income

and spending that includes the Federal Reserve’s preferred

inflation readings are likely to be in the spotlight.

Reports on third quarter GDP, pending home sales and

manufacturing sector activity may also attract some attention.

The data could impact the outlook for the economy as well as

expectations regarding how quickly the Fed will lower interest

rates.

Traders are also looking ahead to the release of earnings news

from big-name tech companies, with Google parent Alphabet

(NASDAQ:GOOGL) and Advanced Micro Devices (NASDAQ:AMD) among the

companies due to report their quarterly results after the close of

today’s trading.

Shares of Ford (NYSE:F) are likely to come under pressure after

the auto giant reported better than expected third quarter earnings

but forecast full-year earnings toward the low end of its previous

guidance.

Fast food giant McDonald’s (NYSE:MCD) is also seeing pre-market

weakness despite reporting third quart results that exceeded

analyst estimates on both the top and bottom lines.

Meanwhile, shares of Pfizer (NYSE:PFE) are likely to see initial

strength after the drug giant beat third quarter estimates and

raised its full-year guidance.

After showing a strong move to the upside early in the session,

stocks gave back ground over the course of the trading day on

Monday but managed to end the day mostly higher. The major averages

all finished the day in positive territory after turning in mixed

performances over the two previous sessions.

The Dow advanced 273.17 points or 0.7 percent to 42,387.57, the

Nasdaq climbed 48.58 points or 0.3 percent to 18,567.19 and the

S&P 500 rose 15.40 points or 0.3 percent to 5,821.52.

The strength on Wall Street comes amid a steep drop by the price

of oil. Oil prices plunged after Israel’s retaliatory attack

against Iran over the weekend did not damage the Islamic republic’s

energy facilities.

Meanwhile, traders were also looking ahead to the release of key

U.S. economic data later in the week.

Airline stocks saw substantial strength on the day, with the

NYSE Arca Airline Index soaring by 3.0 percent to its best closing

level in over a year.

Delta Air Lines (NYSE:DAL) posted a standout gain after filing a

lawsuit against CrowdStrike (NASDAQ:CRWD) over the July outage that

led to thousands of flight cancellations.

Significant was also visible among steel stocks, as reflected by

the 3.0 percent surge by the NYSE Arca Steel Index.

Financial, computer hardware and biotechnology stocks also saw

considerable strength, while energy stocks moved to the downside

along with the price of crude oil.

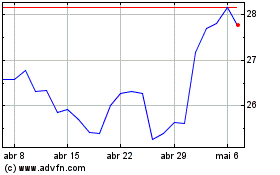

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024