Mixed Earnings, Economic News May Lead To Choppy Trading

30 Outubro 2024 - 10:09AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Wednesday, with stocks likely to show a lack of

direction following the mixed performance seen in the previous

session.

A mixed batch of corporate earnings and U.S. economic news may

lead to choppy trading on Wall Street early in the session.

Shares of Alphabet (NASDAQ:GOOGL) are surging by 6.7 percent in

pre-market trading after the Google parent reported third quarter

results that beat analyst estimates on both top and bottom

lines.

Snapchat parent Snap (NYSE:SNAP) is also spiking in pre-market

trading after reporting better than expected third quarter results

and announcing a $500 million stock repurchase program.

Meanwhile, shares of Advanced Micro Devices (NASDAQ:AMD) are

plunging by 7.8 percent in pre-market trading after the chipmaker

reported third quarter revenues that beat expectations but provided

disappointing fourth quarter revenue guidance.

Dow component Caterpillar (NYSE:CAT) is also likely to come

under pressure after the construction equipment maker reported

weaker than expected third quarter earnings.

On the U.S. economic front, payroll processor ADP released a

report showing private sector employment in the U.S. shot up by

much more than anticipated in the month of October.

ADP said private sector employment surged by 233,000 jobs in

October after jumping by an upwardly revised 159,000 jobs in

September.

Economists had expected private sector employment to climb by

115,000 jobs compared to the addition of 143,000 jobs originally

reported for the previous month.

However, a separate report released by the Commerce Department

showed U.S. economic growth unexpectedly slowed in the third

quarter.

The Commerce Department said gross domestic product shot up by

2.8 percent in the third quarter after surging by 3.0 percent in

the second quarter. Economists had expected another 3.0 percent

jump.

The unexpected slowdown in the pace of GDP growth primarily

reflected a downturn in private inventory investment and a larger

decrease in residential fixed investment.

The major U.S. stock indexes all moved higher during trading on

Monday but returned to the mixed performance seen to close out the

previous week on Tuesday.

While the tech-heavy Nasdaq showed a notable advance to reach a

new record closing high, the Dow closed lower for the sixth time in

the past seven sessions.

The Nasdaq climbed 145.56 points or 0.8 percent to 18,712.75,

extending its winning streak to four days. The S&P 500 also

rose 9.40 points or 0.2 percent to 5,832.92, but the Dow fell

154.52 points or 0.4 percent to 42,233.05.

The climb by the Nasdaq came ahead of the release of earnings

news from big-name tech companies, with Alphabet and Advanced Micro

Devices among the companies reporting their quarterly results after

the close of trading.

Tech giants Meta Platforms (NASDAQ:META), Microsoft

(NASDAQ:MSFT), Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) are

also due to release their quarterly results in the coming days.

Semiconductor stocks showed a particularly strong move to the

upside, driving the Philadelphia Semiconductor Index up by 2.3

percent.

Significant strength was also visible among networking stocks,

as reflected by the 1.7 percent gain posted by the NYSE Arca

Networking Index.

Gold and software stocks also saw notable strength on the day,

while airline stocks moved sharply lower, dragging the NYSE Arca

Airline Index down by 3.6 percent.

Shares of JetBlue (NASDAQ:JBLU) plummeted after the airline

reported better than expected third quarter results but forecast a

decrease in fourth quarter revenue.

Housing stocks also saw substantial weakness, with the

Philadelphia Housing Sector Index plunging by 2.3 percent.

Homebuilder D.R. Horton (NYSE:DHI) posted a steep loss after

reporting fiscal fourth quarter results that missed estimates and

providing disappointing guidance.

The decrease by the Dow came amid significant losses by Home

Depot (NYSE:HD), Coca-Cola (NYSE:KO) and Travelers (NYSE:TRV).

In U.S. economic news, the Conference Board released a report

showing a substantial improvement by U.S. consumer confidence in

the month of October.

The Conference Board said its consumer confidence index surged

to 108.7 in October after tumbling to a revised 99.2 in

September.

Economists had expected the consumer confidence index to inch up

to 99.1 from the 98.7 originally reported for the previous

month.

A separate report released by the Labor Department showed job

openings in the U.S. fell to 7.44 million in September from a

downwardly revised 7.86 million in August.

Economists had expected job openings to edge down to 7.99

million from the 8.04 million originally reported for the previous

month.

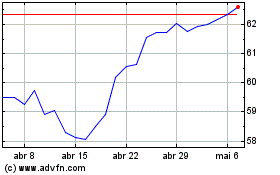

Coca Cola (NYSE:KO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Coca Cola (NYSE:KO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024