U.S. Stocks May See Further Downside After Friday’s Sell-Off

30 Dezembro 2024 - 11:12AM

IH Market News

The major U.S. index futures are currently

pointing to a lower open on Monday, with stocks likely to see

further downside following the sharp pullback seen last Friday.

Concerns about a recent increase by U.S. treasury yields may

weigh on Wall Street, as the yield on the benchmark ten-year note

closed above 4.6 percent for the first time since late May on

Friday.

Treasury yields have surged in recent weeks due in part to the

Federal Reserve forecasting fewer than previously estimated

interest rate cuts in 2025.

The increase by treasury yields may also reflect worries about

the impact President-elect Donald Trump’s policies will have on the

U.S. budget deficit.

A slump by shares of Boeing (NYSE:BA) is also likely to weigh on

the Dow after South Korea’s Transport Ministry ordered an

inspection of B737-800 aircraft after the deadly Jeju Air crash

over the weekend.

Trading activity may be relatively subdued, however, as some

traders are likely to remain away from their desks ahead of the New

Year’s Day holiday on Wednesday.

U.S. stocks tumbled on Friday and the major averages all closed

notably lower, with the tech-laden Nasdaq suffering a more

pronounced loss as the yield on ten-year note rose to a nearly

eight-month high.

The Dow closed down 333.59 points or 0.8

percent at 42,992.21, well off the day’s low of 42,761.56. The

S&P 500, which dropped as low as 5,932.95, settled at 5,970.84

with a loss of 66.75 points or 1.1 percent, while the Nasdaq ended

lower by 298.33 points or 1.5 percent at 19,722.03, recovering from

a low of 19,533.40.

However, the Dow posted a weekly gain of about 1.4 percent,

while the S&P 500 and the Nasdaq both moved up by more than 1.5

percent during the week.

Tesla (NASDAQ:TSLA) closed nearly 5 percent down, while Apple

(NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOGL),

Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Oracle (NYSE:ORCL),

Netflix (NASDAQ:NFLX), Accenture (NYSE:ACN), Morgan Stanley

(NYSE:MS) and Micron Technology (NASDAQ:MU) lost 1 to 3

percent.

On the economic front, data showed U.S. retail inventories,

excluding autos, increased by 0.6 percent month-over-month in

November following an upwardly revised 0.3 percent rise in the

prior month, according to preliminary estimates.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

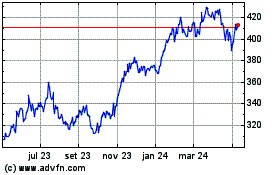

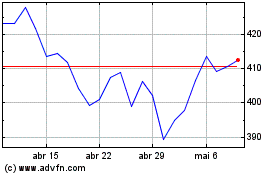

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025