The major U.S. index futures are currently

pointing to a higher open on Friday, with stocks likely to move

back to the upside after ending yesterday’s lackluster session

mostly lower.

Early buying interest may be generated in reaction to a

continued decrease by treasury yields, as the yield on the

benchmark ten-year note is moving lower for the fourth straight day

after reaching its highest closing level in over a year on

Monday.

The recent retreat by treasury yields comes as the U.S.

inflation data released over the past few days has led to renewed

optimism about the outlook for interest rates.

Adding to the interest rate optimism, Federal Reserve Governor

Christopher Waller told CNBC the central bank could lower interest

rates multiple times this year if inflation eases as he is

expecting.

“As long as the data comes in good on inflation or continues on

that path, then I can certainly see rate cuts happening sooner than

maybe the markets are pricing in,” Waller said during an interview

with Sara Eisen on CNBC’s “Squawk on the Street” on Thursday.

Waller said the number of rate cuts would be driven by the data,

suggesting the Fed could cut rates three or four times if there is

a lot of progress on inflation or cut rates twice or only once if

inflation remains sticky.

The upward momentum on Wall Street may also reflect optimism

about the outlook for the markets under President-elect Donald

Trump, who is due to be sworn in for the second time on Monday.

Stocks surged in reaction to Trump’s election in November amid

expectations of more pro-business policies in the new

administration, although there are also concerns about impact of

proposed tariffs.

Following the substantial rally seen during Wednesday’s session,

stocks turned in a relatively lackluster performance during trading

on Thursday. The major averages fluctuated over the course of the

trading day before eventually closing in negative territory.

The tech-heavy Nasdaq ended the day more firmly in the red amid

a slump by shares of Apple (NASDAQ:AAPL), sliding 172.94 points or

0.9 percent to 19,338.29.

The Dow and the S&P 500 posted more modest losses. The Dow

dipped 68.42 points or 0.2 percent to 43,153.13 and the S&P 500

slipped 12.57 points or 0.2 percent to 5,937.34.

The choppy trading on Wall Street came as traders took a step

back to assess the near-term outlook for the markets following

Wednesday’s rally, which saw the major averages post their largest

daily percentage gains in over two months.

Traders were also digesting a slew of U.S. economic data,

including reports on weekly jobless claims, retail sales and import

prices.

The Labor Department released a report showing initial jobless

claims climbed to 217,000 in the week ended January 11th, an

increase of 14,000 from the previous week’s revised level of

203,000. Economists had expected jobless claims to rise to

210,000.

The bigger than expected increase came after jobless claims fell

to their lowest level since hitting 200,000 in the week ended

February 17, 2024.

The Commerce Department also released a report showing retail

sales in the U.S. increased by less than expected in the month of

December.

The report said retail sales rose by 0.4 percent in December

after advancing by an upwardly revised 0.8 percent in November.

Economists had expected retail sales to climb by 0.6 percent.

Meanwhile, the report said core retail sales, which exclude

automobiles, gasoline, building materials and food services,

climbed by 0.7 percent in December after rising by 0.4 percent in

November.

“Retail sales in December were flattered by a price-related

increase in gasoline station sales, but the details were generally

encouraging, with a broad-based underlying control group rising at

a strong pace,” said Michael Pearce, Deputy Chief U.S. Economist at

Oxford Economics.

Following yesterday’s more closely watched report on consumer

price inflation, the Labor Department also released a report

showing import prices in the U.S. crept up in line with estimates

in the month of December.

The Labor Department said import prices inched up by 0.1 percent

in December, matching the upticks seen in November and October as

well as expectations.

“Import prices rose modestly in December, capping off an

encouraging week of inflation data and keeping the Fed on track to

cut rates in the first half of this year,” said Matthew Martin,

Senior U.S. Economist at Oxford Economics.

He added, “The recent rise in global oil prices will feed

through to higher fuel import prices and some volatility to the

data, but we expect the Fed will look through any temporary sources

of inflation.”

Reflecting the lackluster performance by the broader markets,

most of the major sectors ended the day showing only modest

moves.

Interest rate-sensitive utilities and commercial real estate

stocks saw considerable strength, however, with the Dow Jones

Utility Index and the Dow Jones U.S. Real Estate Index jumping by

2.3 percent and 2.2 percent, respectively.

Brokerage stocks also added to the strong gains posted on

Wednesday, driving the NYSE Arca Broker/Dealer Index up by 1.7

percent to its best closing level in over a month.

Natural gas and pharmaceutical stocks also saw

notable strength on the day, while some weakness was visible among

computer hardware and gold stocks.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

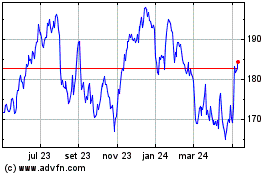

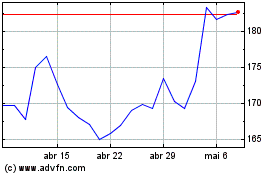

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025