U.S. Stocks Move To The Downside But Post Strong Weekly Gains

24 Janeiro 2025 - 6:44PM

IH Market News

After turning in a relatively lackluster performance early in

the session, stocks moved mostly lower over the course of the

trading day on Friday. The major averages all moved to the

downside, with the S&P 500 (SPI:SP500) giving back ground after

reaching a new record intraday high.

The major averages climbed off their worst levels going into the

close but remained in negative territory. The Dow fell 148.82

points or 0.3 percent to 44,424.25, the Nasdaq slid 99.38 points or

0.5 percent to 19,954.30 and the S&P 500 dipped 17.37 points or

0.3 percent to 6,101.24.

Despite the pullback on the day, the major averages still posted

strong gains for the holiday-shortened week. While the Dow surged

by 2.2 percent, the Nasdaq and the S&P 500 both jumped by 1.7

percent.

The weakness that emerged on Wall Street may have reflected

concerns about the outlook for interest rates ahead of the Federal

Reserve’s monetary policy meeting next week.

While the Fed is almost universally expected to leave interest

rates unchanged, traders are likely to pay close attention to the

accompanying statement for clues about the outlook for rates.

Recent economic data has led to concerns about the Fed leaving

rates on hold for a prolonged period, but many economists still

expect the central bank to resume cutting rates sometime in the

first half of the year.

CME Group’s FedWatch Tool is currently indicating a 71.1 percent

chance rates will be lower by at least a quarter point following

the Fed’s June meeting.

On U.S. economic front, revised data released by the University

of Michigan showed consumer sentiment unexpectedly deteriorated by

more than previously estimated in the month of January.

The University of Michigan said its consumer sentiment index for

January was downwardly revised to 71.1 from the preliminary reading

of 73.2. Economists had expected the index to be unrevised.

The consumer sentiment index is down from the final December

reading of 74.0, marking the first decrease in six months.

Meanwhile, a report released by the National Association of

Realtors showed existing home sales jumped by much more than

expected in the month of December, reaching their highest level

since last February.

Sector News

Semiconductor stocks showed a significant move to the downside

on the day, dragging the Philadelphia Semiconductor Index down by

1.9 percent.

Texas Instruments (NASDAQ:TXN) led the semiconductor sector

lower, plunging by 7.5 percent after reporting better than expected

fourth quarter results but providing disappointing earnings

guidance for the current quarter.

Oil and networking stocks also saw notable weakness, while

pharmaceutical stocks showed a strong move to the upside, driving

the NYSE Arca Pharmaceutical Index up by 1.4 percent.

U.S.-listed shares of Danish drug maker Novo Nordisk (NYSE:NVO)

surged by 8.5 percent after the company announced positive trial

results for its obesity drug.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly higher on Friday. Hong Kong’s Hang Seng Index

surged by 1.9 percent and South Korea’s Kospi advanced by 0.9

percent, although Japan’s Nikkei 225 Index bucked the uptrend and

edged down by 0.1 percent.

Meanwhile, the major European markets moved to the downside over

the course of the session. While the U.K.’s FTSE 100 Index slid by

0.7 percent, the French CAC 40 Index and the German DAX Index both

edged down by 0.1 percent.

In the bond market, treasuries gave back ground after an early

advance but remained modestly higher. Subsequently, the yield on

the benchmark ten-year note, which moves opposite of its price,

edged down by 1.2 basis points to 4.626 percent.

Looking Ahead

The Fed’s monetary policy announcement is likely to be in the

spotlight next week, although several key economic reports may also

attract attention, including a report on personal income and

spending that includes the central bank’s preferred inflation

readings.

On the earnings front, Apple (APPL), Intel (INTC), Microsoft

(MSFT), Tesla (TSLA), IBM Corp. (IBM), Exxon Mobil (XOM), ATT&T

(T), Boeing (BA), General Motors (GM) and Starbucks (SBUX) are

among a slew of big-name companies due to report their quarterly

results.

SOURCE: RTTNEWS

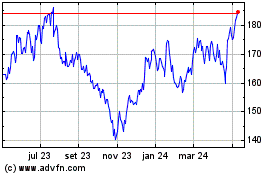

Texas Instruments (NASDAQ:TXN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

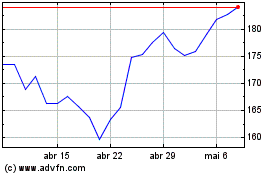

Texas Instruments (NASDAQ:TXN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025