Major Averages Close Higher Following Significant Late-Day Volatility

30 Janeiro 2025 - 6:44PM

IH Market News

Stocks saw considerable volatility over the course of the

trading session on Thursday, with the major averages showing wild

swings back and forth across the unchanged line before eventually

closing in positive territory.

The Dow climbed 168.61 points or 0.4 percent to 44,882.13,

ending the day within striking distance of the record closing high

set in early December.

The S&P 500 (SPI:SP500) also advanced 31.86 points or 0.5

percent to 6,071.17, while the Nasdaq rose 49.43 points or 0.3

percent to 19,681.75.

The major averages moved sharply lower late in the session after

President Donald Trump said he would follow through on his threat

to impose 25 percent tariffs on imports from Canada and Mexico on

Saturday, February 1st.

However, the major averages rebounded going into the close,

reflecting the significant volatility seen throughout the

session.

The choppy trading on the day came amid a mixed reaction to

earnings news from several big-name companies.

Shares of IBM Corp. (NYSE:IBM) skyrocketed by 13.0 percent after

the tech giant reported fourth quarter earnings that exceeded

analyst estimates.

Facebook parent Meta Platforms (NASDAQ:META) also posted a

notable gain after reporting fourth quarter results that beat

estimates on both the top and bottom lines.

On the other hand, shares of Microsoft (NASDAQ:MSFT) plunged by

6.2 percent after the software giant reported better than expected

fiscal second quarter results but provided disappointing revenue

guidance for the current quarter.

Delivery giant UPS (NYSE:UPS) also showed a substantial move to

the downside, plummeting by 14.1 percent after reporting fourth

quarter earnings that beat expectations but forecasting full-year

revenue below analyst estimates.

UPS also announced it has reached an agreement with Amazon

(NASDAQ:AMZN) to lower its volume by more than 50 percent by the

second half of 2026.

In U.S. economic news, the Commerce Department released a report

showing U.S. economic growth in the fourth quarter of 2024 slowed

by more than expected.

Sector News

Gold stocks moved sharply higher as the price of the precious

metal reached highs, driving the NYSE Arca Gold Bugs Index up by

4.1 percent to its best closing level in well over a month.

Interest rate-sensitive utilities and housing stocks also saw

considerable strength, with the Dow Jones Utility Average and the

Philadelphia Housing Sector Index surging by 2.4 percent and 2.3

percent, respectively.

Significant strength was also visible among semiconductor

stocks, as reflected by the 2.3 percent jump by the Philadelphia

Semiconductor Index.

Networking, airline and pharmaceutical stocks also saw notable

strength, while the steep drop by Microsoft weighed on the software

sector.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly higher on Thursday, with many markets still

closed for Lunar New Year. Japan’s Nikkei 225 Index rose by 0.3

percent, while Australia’s S&P/ASX 200 Index climbed by 0.6

percent.

The major European markets also moved to the upside on the day.

While the U.K.’s FTSE 100 Index jumped by 1.0 percent, the French

CAC 40 Index advanced by 0.9 percent and the German DAX Index

increased by 0.4 percent.

In the bond market, treasuries moved higher after ending the

previous session roughly flat. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, fell

4.3 basis points to a one-month closing low of 4.512 percent.

Looking Ahead

A Commerce Department report on personal income and spending is

likely to be in focus on Friday, as it includes readings on

consumer price inflation preferred by the Federal Reserve.

On the earnings front, Apple (AAPL) and Intel (INTC) are among

the companies releasing their quarterly results after the close of

today’s trading.

Energy giants Exxon Mobil (XOM) and Chevron (CVX) are also among

the companies due to report their quarterly results before the

start of trading on Friday.

SOURCE: RTTNEWS

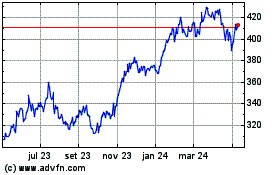

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

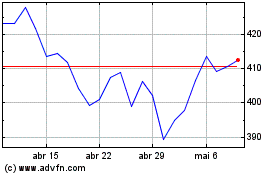

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025