Bitcoin Crashes Following Trump’s Tariffs, Ethereum And Other Cryptos Follow

03 Fevereiro 2025 - 6:00AM

IH Market News

Bitcoin (COIN:BTCUSD) crashed on Monday morning as a wave of

selling swept through the cryptocurrency market. It fell 10% to

$91,695.8 before rebounding slightly to $95,137.6. This steep drop

came after President Trump announced he was imposing trade tariffs

on China, Canada, and Mexico. This sparked fears of a trade war

which sent the markets into panic.

Ethereum (COIN:ETHUSD), the second-largest cryptocurrency, saw

an even steeper drop. It fell 22.7% to $2,434.84. Ripple-linked XRP

(COIN:XRPUSD) was down 17% to $2.20. The President’s memecoin,

$TRUMP lost over 15% to hit a record low of $16.349.

The sell-off wiped $400 billion from the total crypto market

cap, the largest liquidation event of 2025 as over $2.2 billion in

leveraged positions were wiped out in just a few hours.

President Trump’s sweeping new tariffs, of 25% on imports from

Canada and Mexico and 10% from China, prompted retaliatory measures

from the countries. Investors’ fears of a trade war sent shockwaves

through riskier asset classes such as cryptocurrency.

The market reaction was amplified by crypto’s close ties to

Trump’s presidency, as he openly supports digital assets.

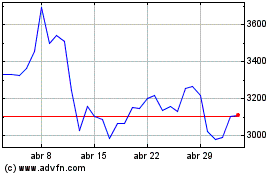

Ethereum (COIN:ETHUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Ethereum (COIN:ETHUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025