Dow Jones Drops More Than 500 Points After US Hits Key Trading Partners With Tariffs

03 Fevereiro 2025 - 1:05PM

IH Market News

U.S. stocks started February lower after President Donald Trump

imposed tariffs on several key U.S. trading partners, raising fears

that a full-blown trade war would disrupt global supply chains,

reignite inflation and slow the economy.

The Dow Jones (DOWI:DJI) opened Monday’s trading session down

more than 500 points (-1.20%) at the opening bell. The S&P 500

(SPI:SP500) fell 1.5%, and the Nasdaq Composite (NASDAQI:COMPX)

fell 1.9%.

President Donald Trump on Saturday slapped a 25% tariff on goods

from Mexico and Canada. He also put a 10% tariff on imports from

China. Canadian energy imports received a smaller 10% tariff.

Canada responded with retaliatory tariffs of its own, while Mexico

said it would explore tariffs on U.S. imports. China, meanwhile,

said it would file a lawsuit with the World Trade Organization.

Trump also signaled over the weekend that tariffs on the

European Union would be imposed next.

“While the direct impact on U.S. growth from the announced

tariffs is still quite modest, the risk is that these policy

changes will amplify concerns about future trade policy risks and

potential retaliation,” Goldman’s Dominic Wilson wrote in a note

Sunday. “Stocks could also challenge market confidence that the

Administration will avoid policies that push growth down or

inflation up.”

U.S. automakers with large supply chains in North America led

the decline, with General Motors Corp (NYSE:GM) down 7% and Ford

Motor Co (NYSE:F) down 4% in premarket trading. Suppliers including

Aptiv Corp (NYSE:APTV) lost 5%, and engine maker Cummins Corp

(NYSE:CMI) lost 2%.

Nike (NYSE:NKE) fell 2%, while apparel maker (NASDAQ:LULU)

Lululemon lost 3%.

One of the positive groups was steelmakers, with Nucor

(NYSE:NUE) gaining 2% and Steel Dynamics (NASDAQ:STLD) up 1% in

premarket trading.

“Markets may now need to take the rest of Trump’s tariff agenda

literally rather than just seriously,” Tobin Marcus, head of U.S.

policy and politics at Wolfe Research, said in a note. “If this new

level of seriousness is suddenly priced in, Monday could be a tough

day for markets.”

The emerging trade war comes as investors are grappling with the

longest stretch yet for fourth-quarter earnings reports and a key

economic reading on the jobs market this week. More than 120

companies in the S&P 500 are set to report results, including

tech names Alphabet, Amazon and Palantir, as well as consumer

giants including Walt Disney and Mondelez. January payrolls are due

out on Friday, with economists surveyed by Dow Jones expecting

175,000 jobs to have been added last month.

Stocks are coming off a volatile few weeks to start 2025 as

investors grapple with constant headlines of a new White House

administration and cracks in the artificial intelligence trade that

led the market higher. All three major U.S. indexes ended Friday’s

trading session in the red, but traders still closed the first

month of the year with gains. The S&P 500 added 2.7% and the

tech-heavy Nasdaq Composite added 1.6% in January, while the Dow

Jones Industrial Average outperformed in the period, jumping

4.7%.

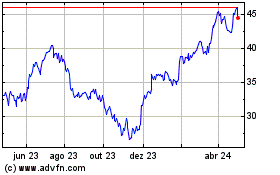

General Motors (NYSE:GM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

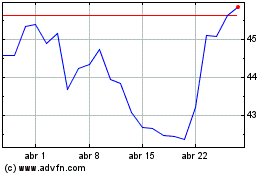

General Motors (NYSE:GM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025