Easing Tariff Concerns Contribute To Rebound On Wall Street

04 Fevereiro 2025 - 6:58PM

IH Market News

Stocks moved mostly higher during trading on Tuesday, largely

offsetting the weakness seen in the previous session. The major

averages all moved to the upside on the day, with the tech-heavy

Nasdaq leading the charge.

The major averages finished the session just off their best

levels of the day. The Nasdaq jumped 262.06 points or 1.4 percent

to 19,654.02, the S&P 500 (SPI:SP500) climbed 43.31 points or

0.7 percent to 6,037.88 and the Dow rose 134.13 points or 0.3

percent to 44,556.04.

The strength on Wall Street partly reflected easing concerns

about a global trade war after President Donald Trump agreed to

pause 25 percent tariffs on imports from Mexico and Canada for a

month.

Positive sentiment may also have been regenerated in reaction to

a report from the Labor Department showing job openings in the U.S.

fell by much more than expected in the month of December.

The report said job openings tumbled to 7.6 million in December

after climbing to an upwardly revised 8.2 million in November.

Economists had expected job openings to dip to 8.0 million from

the 8.1 million originally reported for the previous month.

The data led to some optimism about the outlook for interest

rates ahead of the release of the Labor Department’s more closely

watched monthly jobs report on Friday.

Meanwhile, traders largely shrugged off news that China has

slapped retaliatory tariffs on U.S. imports in response to a 10

percent trade duty imposed on Chinese goods.

China’s Finance Ministry said it will impose a 15 percent duty

on imports of coal and liquefied natural gas from the U.S.

In addition, there will be a 10 percent tariff on imports from

the U.S. of crude oil, agricultural equipment and automobiles

beginning February 10.

Sector News

Oil stocks moved sharply higher despite a decrease by the price

of crude oil, resulting in a 3.0 percent surge by the NYSE Arca Oil

Index.

Considerable strength was also visible among computer hardware

stocks, as reflected by the 2.5 percent jump by the NYSE Arca

Computer Hardware Index.

Steel, retail and networking stocks also saw significant

strength on the day, moving higher along with most of the other

major sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly higher during trading on Thursday. Japan’s

Nikkei 225 Index advanced by 0.7 percent, while Hong Kong’s Hang

Seng Index surged by 2.8 percent.

Meanwhile, the major European markets turned in a mixed

performance on the day. While the U.K.’s FTSE 100 Index slipped by

0.2 percent, the German DAX Index rose by 0.4 percent and the

French CAC 40 Index climbed by 0.7 percent.

In the bond market, treasuries recovered from early weakness to

end the day moderately higher. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, dipped

3.0 basis points to 4.513 percent after reaching a high of 4.598

percent.

Looking Ahead

Trading activity on Wednesday may be impacted by reaction to

reports on the U.S. trade deficit, private sector employment and

service sector activity.

Reaction to earnings news from Alphabet (NASDAQ:GOOGL) may also

impact trading, with the Google parent releasing its quarterly

results after the close of today’s trading.

Disney (NYSE:DIS), Uber (UBER) and Yum! Brands (YUM) are also

among the companies due to report their quarterly results before

the start of trading on Wednesday.

SOURCE: RTTNEWS

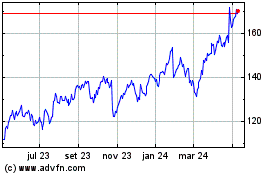

Alphabet (NASDAQ:GOOGL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

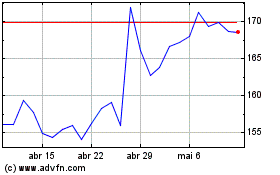

Alphabet (NASDAQ:GOOGL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025