Kraft Heinz Outlook Disappoints, Leading To Downgrade By BofA And Citi

13 Fevereiro 2025 - 10:46AM

IH Market News

Kraft Heinz (NASDAQ:KHC) has seen its stock downgraded by Bank

of America and Citi after poor results and a disappointing

outlook.

The company posted a fourth straight quarter of missed sales

targets, with net sales down 4.1% to $6.6bn in the three months to

28 December, as higher prices pushed shoppers away to cheaper

alternatives. Sales for the full year were down 3% to

$25.8bn.

The company forecasts revenue will fall by up to 2.5% in 2025

while the profit outlook is lower than expectations. This does not

account for the potential impact of a tariff war or stricter

food regulations, the company said.

BofA double-downgraded the stock from Buy to Underperform and

cut the price target from $36 to $30, arguing that Kraft Heinz

continues to struggle with organic sales growth.

“We struggle to see a path forward to meaningful organic sales

improvement over the next 12 months,” the firm stated, pointing to

declining volumes in key product categories such as condiments, mac

& cheese, and Lunchables. Citi also downgraded Kraft

Heinz, moving the stock to Neutral from Buy and reducing its price

target from $34 to $28.

The bank’s analysts expressed skepticism over the company’s

ability to achieve its long-term growth targets, particularly given

its limited planned investments in marketing and

promotions.

“The company’s 2025 sales and earnings outlook disappointed,”

said Citi. “We are not sure that the outlook is fully

de-risked.”

Both banks lowered their earnings estimates, with BofA cutting

its 2025 EPS forecast from $2.97 to $2.65, while Citi reduced its

projection from $2.97 to $2.68. Analysts warned that additional

investment may be necessary in 2026 to reignite growth, potentially

keeping earnings under pressure.

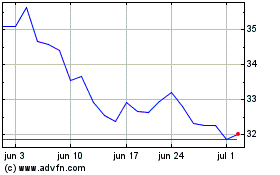

Kraft Heinz (NASDAQ:KHC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

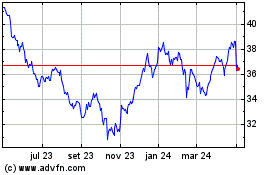

Kraft Heinz (NASDAQ:KHC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025