Brace For Impact, Bitcoin Price Holds At $20,400 Ahead Of FOMC

02 Novembro 2022 - 2:54PM

NEWSBTC

The Bitcoin price has been moving sideways over the past two days,

but market participants expect volatility over today’s trading

session. The U.S. Federal Reserve (Fed) will announce another

interest rate hike during its Federal Open Market Committee (FOMC)

meeting. Related Reading: Litecoin Recovery To End Ongoing Crypto

Darkness? LTCUSD November 2, 2022 At the time of writing, the

Bitcoin price trades at $20,400 with sideways movement in the last

24 hours and a 2% profit over the previous seven days. In general,

the crypto market is moving with the same sentiment except for

Dogecoin (DOGE), which is trending on its own. Macros Forces Ready

To Take Over The Bitcoin Price Action Market participants know and

price in a new interest rate hike at 75 basis points (0.75% bps).

The uncertainty revolves around the post-FOMC press conference.

Traditional markets have the pre-FOMC meeting jitters. Crypto

holding up quite nicely, absorption at the lows. The FOMC

announcement is due in 1.5 hours time – that will be followed by

the press conference 30 minutes later – be prepared for volatility!

pic.twitter.com/vw3dC3u5cv — tedtalksmacro (@tedtalksmacro)

November 2, 2022 During this event, Fed Chairman Jerome

Powell and another high member of the financial institution will

provide insight into their economic perception. The Fed

representatives can stay within expectations, further hikes in

2022, exceed them, or announce a less aggressive monetary policy.

As NewsBTC reported yesterday, the latter is the least likely

scenario. The Fed is facing backlash from the U.S. international,

but Powell and others are adamant about slowing down inflation. The

metric reached a 40-year high and threatens to continue wreaking

havoc across the world’s economies. However, there are potential

signs that the Fed might pivot or, at least, take a dovish approach

in the coming months. Other central banks are taking this route. If

the Fed follows, the decision would be bullish for the Bitcoin

price. Market participants are pricing in higher a possibility of a

lower hike in December, according to analyst Caleb Franzen: Why are

financial markets pricing in +0.75% tomorrow, +0.5% in December,

+0.25% in January 2023, then pause? These hikes equal an aggregate

of +150bps… Again, the markets expect further hikes, so any sign of

dovishness could trigger an extension of BTC’s current bullish

momentum. Data from The King Fisher shows a spike in downside

liquidity for Bitcoin. In case of further downside pressure, as

seen in the chart below, there is a lot of liquidity at around

$19,000 to $20,000. These levels will be tapped if the market takes

the short side. The upside presents less liquidity from leverage

positions. Related Reading: Institutional Investors Remain Bullish

As Short Bitcoin Sees Outflows In other words, if there is

volatility, there is a higher chance of it trending to the downside

based on King Fisher’s data alone.

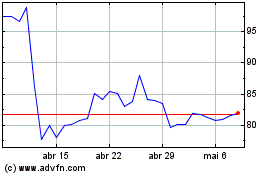

Litecoin (COIN:LTCUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Litecoin (COIN:LTCUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024