Ethereum Whales Shake Off Market Uncertainty, Break 7-Year Accumulation Record

28 Fevereiro 2023 - 2:00PM

NEWSBTC

Ethereum has already seen a slowdown in its price over the past

couple of days. Now, while investors mainly seem indifferent to the

crypto market at the moment, some whales have taken this time to

fill up their bags. This has brought their balances to a new

seven-year high. Ethereum Whales Go On Buying Spree Santiment

reported on Tuesday that top Ethereum whales have been filing up

their bags recently. These top ETH whales which are not exchange

addresses added a significant sum to bring their collective total

to more than 25 million ETH. Related Reading: Dogecoin Holders’

Profit Margin Remains High As Most Opt To Hold For Longer

Interestingly, the last time that the balances of these top 10

non-exchange addresses held this much ETH was back in 2016. Now, in

2016, when the top wallets held this much ETH, the price of the

digital asset exploded over 1,000%, going from a meager $0.93 to

over $12 by the time the rally was done. Top 10 non-exchange

addresses now hold 25 million ETH | Source: Santiment According to

Santiment, these whales had increased their holdings to this level

over the last week. This was when the prices of digital assets in

the space were beginning their descent, triggering panic in the

space. Another factor that could signal a resumption of the bull

trend for ETH is the fact that the digital asset is still dominant

for fee distribution. There is more ETH spent than WETH and USDC

combined, which shows that the cryptocurrency is still very much

dominant and front of mind for investors. But Could ETH Face

Pressure From Shanghai? It is no longer a secret that the Ethereum

Shanghai upgrade is set to happen sometime in March and will

reportedly enable withdraws for staked ETH. Given that there is

currently over 17 million ETH worth more than $28 billion staked on

the Beacon Contract, there are already expectations of a dump. ETH

price struggles to hold above $1,600 | Source: ETHUSD on

TradingView.com However, Ethereum developers have already assured

the community that all of the ETH will not be available for

withdrawal immediately. Perhaps a staggered withdrawal process will

help to mitigate the effects of stakers who decide to sell their

tokens. Related Reading: Here’s The Reason Behind Solana’s (SOL)

12% Jump It is still important to bear in mind that some of these

investors have not had access to their tokens for over a year,

which could lead to immediate selling once they get their hands on

them. But with the price of the digital asset already down so much

from its 2021 all-time high, it is possible that stakers will want

to wait for better prices before selling. Nevertheless, the

Shanghai upgrade will no doubt have implications for the crypto

market. But whether these implications will be good or bad remains

to be seen. Right now, crypto investors are still neutral, dragging

prices to a standstill. Follow Best Owie on Twitter for market

insights, updates, and the occasional funny tweet… Featured image

from Cryptorobin, chart from TradingView.com

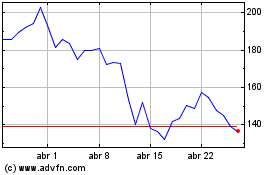

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024