Positive Vibes: 18,000 Bitcoin Purchased By Diamond Hands In One Week

28 Fevereiro 2023 - 6:00PM

NEWSBTC

Bitcoin has been moving sideways the past week after experiencing

rejection at the $25,000 region. The cryptocurrency has been

reacting to macroeconomic uncertainty pushing its price to the

downside, but BTC continues to flash long-term buying signals.

Related Reading: Optimism (OP) Rallies 12% In One Week, But Can It

Keep Going? As of this writing, BTC trades at $23,500 with 1%

profits in the last 24 hours. Over the previous week, Bitcoin

records a 5% loss. Other cryptocurrencies in the crypto top 10 by

market cap are recording similar price action, with Cardano (ADA)

and Polygon (MATIC) leading the losers with a 10% and 16% loss,

respectively. Lon Term Bitcoin Holders Display Relentless

Accumulation According to a report from Bitfinex Alpha, the recent

downside price action in Bitcoin has led to a spike in accumulation

from long-term holders. These investors took advantage of the

decrease in the BTC price to accumulate massive amounts of the

cryptocurrency. The report claims that long-term Bitcoin holders

bought over 18,000 BTC in the past week. Bitfinex Alpha claims that

these market dynamics suggest the crypto market is showing

characteristics of an end of its bear cycle. Whenever long-term BTC

holders come into the picture and accumulate, the price of Bitcoin

trends to the upside. The chart below shows that the 2021 bull run

was preceded by a spike in the long-term holder supply, the amount

of Bitcoin in the hands of multi-year investors. Unlike

speculators, these investors hold the cryptocurrency for higher

timeframes, reducing the amount of BTC available to sell. Thus,

Bitcoin moves in tandem with this metric. The report claims: The

Long-Term Holder Supply has continued to push higher. Long-term

hodlers constituting a sizable portion of the BTC supply is a

crucial on-chain feature of bear market bottoms, and is a positive

signal, taking place amid a 40 percent increase in price, since the

start of this year. Related Reading: Ethereum Whales Shake Off

Market Uncertainty, Break 7-Year Accumulation Record In addition to

the increase in long-term BTC holders, the report noted whale

wallet inflows since last Friday, February 25. These inflows hint

at confidence from large investors in the BTC price. The report

concluded: Historically, whales have continued to accumulate

through even 100 percent moves (for example when the price rose

from $3k-6k in 2019) during the end of the bear market; such was

the case during the 2019 bear market rally and the 2020 flash crash

when the pandemic sent risk assets crashing.

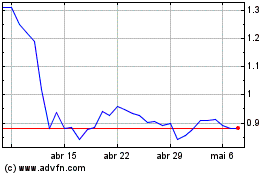

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024