This Bitcoin Halving May Not Result In Supply Squeeze: Glassnode

22 Março 2024 - 1:00PM

NEWSBTC

Glassnode has suggested that the upcoming Bitcoin halving might not

result in a supply squeeze that the market may have anticipated.

Bitcoin Halving May Not Carry Same Impact Due To Spot ETFs In a new

report, the on-chain analytics firm Glassnode has discussed the

impact the next Bitcoin halving may have on the economics of the

cryptocurrency. The “halving” is a periodic event for BTC where its

block rewards (the rewards the miners receive for adding blocks on

the network) are permanently cut in half. Related Reading: Bitcoin

Cash (BCH) Surges 15% As Coinbase Plans Futures Listing This event

is built into the coin’s code, meaning it happens automatically.

The halving kicks in after every 210,000 blocks, or approximately

every four years. The next such event will take place sometime in

the coming month. Historically, the halving has been considered an

important event for the asset due to how it influences its supply

dynamics. The block rewards the miners receive are the only way to

introduce new BTC tokens into circulation. Since they get tightened

during these events, the cryptocurrency’s production rate slows

down following them. As such, halvings are considered bullish

events, with the price increasing following them due to the

constrained supply, as supply-demand dynamics would dictate.

“However, the current market conditions differ from historical

norms,” says Glassnode. The reason behind that is simple; there is

something now that was never there in the past: the spot

exchange-traded funds (ETFs). Spot ETFs are investment vehicles

that buy and hold Bitcoin and allow their users to gain indirect

exposure to the cryptocurrency’s price action through them. Since

the spot ETFs are available on traditional exchanges, they can be

preferable for those not looking to dabble with digital asset

platforms and wallets. Thus, the ETFs have introduced a notable

amount of fresh demand for the asset, with supply rapidly leaving

the market and entering these funds. To put this demand into

perspective, the analytics firm has compared it against the BTC

amount miners issue on the chain daily. The trend in the spot ETF

flows and miner issuance since the start of the year | Source:

Glassnode As the above chart shows, the Bitcoin ETF flows have

generally been much higher than what the miners have been

introducing into circulation. Based on this, Glassnode believes

“the upcoming halving might not result in the supply squeeze once

anticipated.” Related Reading: Bitcoin Traders Capitulate: Here’s

What Happened Last 2 Times The report further says: The ETFs are,

in essence, preempting the halving’s impact by already tightening

the available supply through their substantial and continuous

buying activity. In other words, the supply squeeze usually

expected from halvings may already be in effect due to ETFs’

large-scale bitcoin acquisitions. Something to note, however, is

that the ETFs aren’t certain to always be a bullish influence for

the market. Should the current inflow-heavy regime flip to one

dominated by outflows, the cryptocurrency could naturally witness

extraordinary selling pressure. In fact, the spot ETF netflows have

been negative for Bitcoin for four straight days now, so such a

trend shift may already be in action. BTC Price Bitcoin had

recovered beyond the $68,000 level yesterday, but the coin has

since declined again, falling back towards $64,200. Looks like the

price of the asset has has retraced a chunk of its recovery |

Source: BTCUSD on TradingView Featured image from Traxer on

Unsplash.com, Glassnode.com, chart from TradingView.com

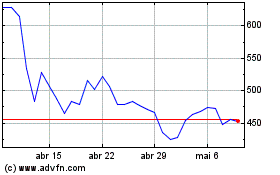

Bitcoin Cash (COIN:BCHUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Bitcoin Cash (COIN:BCHUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025