Bitcoin Long-Term Holders & Price Top: Glassnode Reveals Pattern

22 Março 2024 - 9:30PM

NEWSBTC

The on-chain analytics firm Glassnode has explained that Bitcoin

tends to reach a potential top when the long-term holders show this

pattern. Bitcoin Long-Term Holders Have Been Ramping Up

Distribution In a new report, Glassnode discussed the influence

that the BTC long-term holders have on the cryptocurrency’s supply

dynamics. The “long-term holders” (LTHs) here refer to the Bitcoin

investors who have been holding onto their coins for more than 155

days. The LTHs comprise one of the two main divisions of the BTC

user base based on holding time, with the other cohort known as the

“short-term holders” (STHs). Related Reading: Bitcoin Cash (BCH)

Surges 15% As Coinbase Plans Futures Listing Historically, the LTHs

have proven themselves to be the persistent hands of the market.

They don’t quickly sell their coins regardless of what is happening

in the broader sector. The STHs, on the other hand, often react to

FUD and FOMO events. As such, it’s not unusual to see the STHs

participating in selling. However, the LTHs showing sustained

distribution can be something to note, as selling from these

HODLers, who usually sit tight, may have implications for the

market. There are many different ways of tracking the behavior of

the LTHs, but in the context of the current discussion, Glassnode

has used the “LTH Market Inflation Rate” metric. As the report

explains: It shows the annualized rate of Bitcoin accumulation or

distribution by LTHs relative to daily miner issuance. This rate

helps identify periods of net accumulation, where LTHs are

effectively removing Bitcoin from the market, and periods of net

distribution, where LTHs add to the market’s sell-side pressure.

Now, here is a chart that shows the trend in the BTC LTH Market

Inflation Rate over the past several years: The value of the metric

seems to have been on the rise in recent days | Source: Glassnode

In the chart, the analytics firm has also attached the data for the

asset’s Inflation Rate, which is basically the amount that the

miners are introducing into the circulating supply by solving

blocks and receiving rewards for them. When the LTH Market

Inflation Rate equals 0%, these HODLers are accumulating amounts

exactly equal to what the miners are issuing. This implies that the

indicator below the 0% mark suggests the LTHs are pulling coins out

of the supply, while it being above is a sign that they are either

distributing or just not buying enough to absorb what the miners

are producing. The graph shows that historically, the

cryptocurrency’s price has tended to reach a state of equilibrium

and potentially even a top when the LTH distribution has peaked.

Related Reading: Bitcoin Traders Capitulate: Here’s What Happened

Last 2 Times The LTH Market Inflation Rate has been increasing

recently, but it’s yet to reach any significant levels. As for what

this could mean for the market, Glassnode says: Currently, the

trend in the LTH market inflation rate indicates we are in an early

phase of a distribution cycle, with about 30% completed. This

suggests significant activity ahead within the current cycle until

we achieve a market equilibrium point from the supply and demand

perspective and potential price tops. BTC Price Bitcoin has

retraced most of its recovery from the past few days, as its price

has now declined to $63,800. Looks like the price of the asset has

witnessed a drawdown again | Source: BTCUSD on TradingView Featured

image from Kanchanara on Unsplash.com, Glassnode.com, chart from

TradingView.com

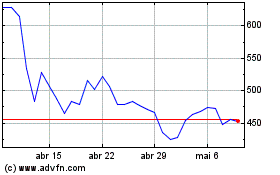

Bitcoin Cash (COIN:BCHUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Bitcoin Cash (COIN:BCHUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025