Social Media Storm Gives Dogecoin 14% Price Boost – Details

25 Março 2024 - 11:00AM

NEWSBTC

Dogecoin (DOGE), the meme-inspired cryptocurrency, has experienced

a rollercoaster ride in recent days. A surge in social media

activity surrounding the coin coincided with a price increase of

over 14% within the last week. However, technical indicators hint

at a potential pullback, leaving investors to grapple with mixed

signals. Related Reading: Analyst Bullish On Polkadot (DOT),

Predicts $17 Price Target Before April Social Media Frenzy Fuels

Optimism Data from LunarCrush, a crypto analytics platform,

revealed a significant uptick in social media interactions related

to DOGE. Likes, comments, retweets, and upvotes on various

platforms reached a staggering 30 million within a 24-hour period.

This surge in social volume not only placed DOGE at the forefront

of meme coin discussions but also suggests renewed investor

interest. Regulatory Integration Paves The Way For Institutional

Adoption Adding fuel to the fire, Coinbase Derivatives recently

filed with the CFTC to introduce US-regulated futures contracts for

DOGE, alongside Litecoin and Bitcoin Cash. This regulatory move

signifies a growing acceptance of established cryptocurrencies

beyond the realm of traditional financial institutions. Integration

with established players could lead to greater market stability and

wider adoption for DOGE. April: Historically A Bullish Month For

Dogecoin? The report also highlights a historical trend – April has

proven to be a particularly strong month for DOGE in previous

years. This historical data injects a dose of optimism into the

current scenario, hinting at a potential price upswing in the

coming weeks. However, past performance doesn’t guarantee future

results, and investors should be cautious about relying solely on

historical trends. Total crypto market cap is currently at $2.472

trillion. Chart: TradingView Technical Indicators Flash Caution

Despite the positive social media sentiment and historical

precedent, technical indicators paint a somewhat contrasting

picture. The Aroon Up Line, an indicator that gauges trend

strength, suggests a weakening uptrend for DOGE. Additionally, the

Chaikin Money Flow (CMF) – a measure of money flow – currently

displays a negative value, indicating potential selling pressure.

DOGE seven-day price action. Source: Coingecko Dogecoin Bearish

Signals The Moving Average Convergence Divergence (MACD)

indicator, often used to identify trend changes, further reinforces

the bearish sentiment. Readings show the MACD line crossing below

the signal line in mid-March, potentially marking the beginning of

a short-term downtrend. Related Reading: Fantom (FTM) Bull Run: Can

FTM Hit $2 After 20% Price Spike? Lastly, the Parabolic SAR

indicator, which identifies potential trend reversals, positions

its dotted lines above the current DOGE price, suggesting increased

selling activity. Navigating The Uncertain Waters The current

situation surrounding DOGE presents a complex scenario with both

positive and negative factors at play. While social media buzz and

regulatory progress offer reasons for optimism, technical

indicators warn of a potential short-term price correction.

Featured image from Pexels, chart from TradingView

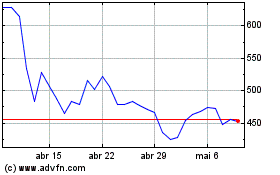

Bitcoin Cash (COIN:BCHUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Bitcoin Cash (COIN:BCHUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024