BlackRock Expands Crypto Reach: BUIDL Fund Goes Multi-Chain Across These 5 Blockchainsc

14 Novembro 2024 - 3:30AM

NEWSBTC

Crypto ETF issuer and asset manager BlackRock announced on

Wednesday the expansion of its USD Institutional Digital Liquidity

Fund (BUIDL) to include five new blockchain ecosystems: Aptos,

Arbitrum, Avalanche, Optimism, and Polygon. Initially

launched on the Ethereum network in March 2024, BUIDL rapidly

gained traction among investors, becoming the largest tokenized

fund globally regarding assets under management (AUM) within just

40 days. BNY Mellon To Custody BUIDL The expansion will allow BUIDL

to interact with more blockchain-based financial products and

infrastructures. BlackRock aims to enhance accessibility for

investors, decentralized autonomous organizations (DAOs), and

digital asset firms, enabling them to leverage BUIDL within the

ecosystems of their choice. Related Reading: Bitcoin Consolidates

After Recent Surge – Metrics Reveal Moderate Selling Pressure

Carlos Domingo, CEO and co-founder of Securitize, the firm

responsible for tokenizing BUIDL, emphasized the importance of this

multi-chain approach in Wednesday’s press release by saying:

Real-world asset tokenization is scaling, and we’re excited to have

these blockchains added to increase the potential of the BUIDL

ecosystem. With these new chains we’ll start to see more investors

looking to leverage the underlying technology to increase

efficiencies on all the things that until now have been hard to do.

With the addition of these blockchains, BlackRock aims to provide

increased options and access for investors, allowing developers to

build applications that integrate seamlessly with the BUIDL fund.

BNY Mellon, which recently received a Bitcoin and crypto custody

license for institutional services, will play a key role in this

initiative as the fund administrator and custodian for BUIDL.

BlackRock Bitcoin ETF Achieves Unprecedented Growth On the crypto

ETF front, BlackRock’s Bitcoin ETF, IBIT, has reached a remarkable

milestone, surpassing the $40 billion mark in assets under

management (AUM) just two weeks after hitting $30 billion.

This achievement comes in a record 211 days, shattering the

previous record of 1,253 days held by the iShares Core MSCI

Emerging Markets ETF (IEMG). IBIT is now positioned in the

top 1% of all ETFs by assets and at just 10 months old, it has

outperformed all 2,800 ETFs launched in the past decade, according

to ETF expert Eric Balchunas. Balchunas further highlighted that

Bitcoin ETFs collectively have crossed the $90 billion asset

threshold, following a significant $6 billion surge in the past few

days. This increase comprises $1 billion in new inflows and

$5 billion in market appreciation. The growing popularity of

Bitcoin ETFs indicates that they are now 72% of the way toward

surpassing gold ETFs in total assets. Related Reading: Justin Drake

Unveils ‘The Beam Chain’: A Vision For Ethereum Final Design The

rise in Bitcoin ETF assets has coincided with a surge in investor

confidence, particularly following Donald Trump’s recent victory

over Kamala Harris in the presidential elections. This

political shift has positively influenced market sentiment,

contributing to a broader uptick in cryptocurrency prices. Bitcoin,

in particular, has experienced a substantial rally, climbing over

24% to reach a record high of $93,000 in the past week alone.

Featured image from DALL-E, chart from TradingView.com

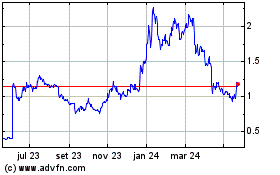

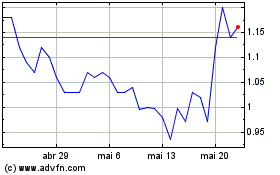

Arbitrum (COIN:ARBUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Arbitrum (COIN:ARBUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024