Deribit Moves $783M in Ethereum To Cold Storage: A Bullish Signal for ETH?

23 Novembro 2024 - 2:30PM

NEWSBTC

While Ethereum seems to have begun its own major rally, the asset

has recently experienced significant activity on the Deribit

Options Exchange which begs the question of what it means for ETH’s

price. A CryptoQuant analyst known as Amr Taha detailed these

developments in a post on the CryptoQuant QuickTake platform. The

analysis focused on substantial outflows from the exchange to cold

wallets, highlighting potential implications for market sentiment

and liquidity. Related Reading: Ethereum Sees Neutral Netflow On

Binance: What Does This Signal? ETH Netflows On Deribit And The

Implications According to Taha, the Deribit Options Exchange

recorded a notable transaction involving 233,000 ETH transferred to

a cold wallet. Valued at approximately $783 million, the

transaction was executed at an average price of $3,350 per

Ethereum. This was not limited to Ethereum alone—Bitcoin also

witnessed a similar outflow, with 31,000 BTC worth $3.038 billion

moved to cold storage. These transfers have sparked speculation

about the motivations behind such activity and their potential

impact on the broader market. As a result, the CryptoQuant analyst

highlighted four major implications of this movement. First, the

reduction in selling pressure is notable. Assets stored in cold

wallets are less likely to be sold immediately, which can decrease

liquidity on exchanges. Taha noted that this scenario may

contribute to price stability or even further boost the bullish

trend in the market if demand remains steady or increases. Another

key takeaway from these transactions is the possibility of

institutional accumulation. Such large-scale transfers often

indicate that institutional investors or high-net-worth individuals

are confident in Ethereum’s long-term value. Furthermore, Taha

highlighted Deribit’s strategy of moving these funds as part of a

risk management approach. The analyst wrote: Moving assets to cold

storage is a security practice to minimize exposure to hacking

risks. It also reflects a cautious approach, likely due to

regulatory scrutiny or anticipated market volatility. Additionally,

Taha highlighted that this move could also have impact on market

sentiment where by traders could interpret these transactions as

bullish, “leading to increased buying activity.” Ethereum Market

Performance Meanwhile, Ethereum currently trades above the $3,300

mark following an increase of 8.2% in the past week and 1.3% in the

past 24 hours. The asset’s market cap has also significantly surged

alongside its price with a current valuation nearing $400 billion.

According to renowned crypto analyst known as EᴛʜᴇʀNᴀꜱʏᴏɴᴀL on X,

Ethereum current price chart appears to be mirroring that of

2016-2017 where it experienced a “mega bull” run. Related Reading:

Ethereum Attempts Key Breakout: Analysts Set Next Target As ETH

Reclaims $3,200 According to the analyst, “altcoins will follow” as

Ethereum continues to increase. #Ethereum $10k+ step by step!$ETH

repeats the bullish megaphone pattern it drew while heading towards

the 2016-2017 mega bull period, before the 2024-2025 mega bull

period.#Alts will follow! pic.twitter.com/VRVI8lwnsS —

EᴛʜᴇʀNᴀꜱʏᴏɴᴀL 💹🧲📈 (@EtherNasyonaL) November 22, 2024 Featured image

created with DALL-E, Chart from TradingView

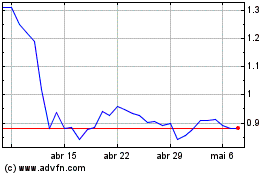

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024