Stablecoin Market Capitalization Nears $200 Billion — Bitcoin Price To Resume Rally?

30 Novembro 2024 - 10:30AM

NEWSBTC

The latest on-chain data shows that the stablecoin market is

nearing a new milestone in terms of valuation. Here’s how the

increasing liquidity could impact Bitcoin and the general

cryptocurrency market. Can The Increasing Stablecoin Cap Push

Bitcoin Price To $100,000? Market intelligence platform

IntoTheBlock has revealed in its weekly report that the stablecoin

market capitalization has experienced notable growth in the past

month. According to the crypto firm, the stablecoin market cap

surged past $190 billion this week for the first time since late

April 2022 when Bitcoin price was hovering around the $40,000 mark.

This impressive growth comes on the back of Bitcoin’s unprecedented

run to a six-figure valuation and the explosion of the total market

capitalization to over $3.4 trillion. IntoTheBlock noted that

stablecoins have seen increased adoption in the past few weeks, as

investors continue to run toward riskier assets like

cryptocurrencies. Related Reading: Ethereum Struggles Below $3,659

Resistance: Is Momentum Fading? Specifically, this expansion has

primarily been in favor of Tether’s USDT, which continues to

completely dominate the stablecoin market. Data from IntoTheBlock

shows that USDT holds about 72% of the market share, with a market

capitalization of over $133 billion — reminiscent of the crypto

market highs of 2021. Interestingly, the demand for the Tether

stablecoin appears to be climbing, with a weekly mint of over $3

billion of new USDT tokens. Most notably, over $13 billion USDT has

been minted since the start of November, with the stablecoins

largely flowing toward centralized exchanges. This injection of

fresh liquidity into centralized exchanges has been reflected in

the market, especially with the strong bullish momentum witnessed

in the past few weeks. Historically, increasing stablecoin inflows

into exchanges is positively correlated with market prices, as they

often represent higher “buying power” for the investors. As

such, the continuation of this positive trend could be pivotal to

the dream of Bitcoin price surpassing $100,000. While the flagship

cryptocurrency has seemingly recovered from its recent slump

beneath the $93,000 level, it has not exactly shown strength

sufficient to surpass the six-figure milestone. As of this writing,

the price of Bitcoin continues to hover around the $96,500 mark,

reflecting a more than 2% increase in the last 24 hours. According

to data from CoinGecko, the premier cryptocurrency is still in the

red on the weekly timeframe, with a 3% decline in the past seven

days. BTC Market Becoming Stable And Mature: IntoTheBlock

IntoTheBlock also disclosed in its weekly report that Bitcoin’s

market climate seems to be maturing, as volatility is currently

trending downwards. According to the blockchain platform, the

market’s high volatility has been a long-standing criticism point

for BTC as a store of value. Related Reading: Ethereum Open

Interest Sets New Record, Analyst Says Fireworks ‘Guaranteed’

However, IntoTheBlock noted that investors can expect the Bitcoin

price performance to be more stable, as retail and institutional

adoption increases and volatility diminishes. Hence, the premier

cryptocurrency could become an even more reliable store of value.

Featured image from iStock, chart from TradingView

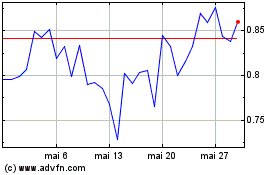

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025