Bitcoin ETFs Coming To Japan? Government Prepares To End Ban

11 Fevereiro 2025 - 2:00PM

NEWSBTC

The sun could be set to shine brighter in Japan’s financial

horizon, as regulators take another look at how Bitcoin will play a

role in the country’s financial landscape. Authorities are now

considering lifting a long-standing ban on Bitcoin and crypto

exchange-traded funds (ETFs). This might signal a new era in the

government’s outlook on digital currencies. Related Reading: Can

XRP Hit $10,000? A Quadrillion Market Cap For The Coin If That

Happens – Analyst If given the green light, this action would open

doors for both institutional and retail investors by aligning Japan

with other big financial hubs embracing crypto-based investment

products. Crypto ETFs May Soon Become A Reality In Japan Japan’s

top financial regulator, the Financial Services Agency (FSA), is

apparently considering approving Bitcoin and cryptocurrency

exchange-traded funds (ETFs). This will change the investing

environment of the country greatly. For years, the ban on these

funds has limited the ways in which investors might have access to

digital assets via regulated financial instruments. Japan appears

to be closely monitoring the United States’ recent approval of

numerous Bitcoin spot ETFs. The introduction of crypto ETFs,

according to analysts, would offer investors a more structured and

secure method of participating in the digital asset market, without

the risks associated with direct ownership. Japan Advocates For Tax

Reforms That Favor Crypto Apart from the acceptance of ETFs, Japan

is looking at major tax changes that would boost the attractiveness

of bitcoin investments. Currently, profits from cryptocurrencies

are liable to taxes at rates ranging from up to 55%, which has

discouraged investors. Still, authorities are thinking about

lowering the rate to 20% to match the taxation of stocks and other

traditional financial assets. This change most likely would be a

motivation for other traders and institutions to enter the market.

If implemented, the new tax policy has the potential to establish

Japan as one of the most crypto-friendly economies in Asia, thereby

attracting substantial capital inflows. Related Reading: Analyst

Eyes $387 For Solana As Key Support Levels Strengthen—Details

Reclassifying Cryptocurrencies As Financial Products Along with a

bigger plan to make regulations clearer, the FSA is also

considering whether cryptocurrencies should be considered regular

financial assets, like stocks or bonds. If this goes into action,

crypto assets will have to follow stricter rules for reporting and

disclosing information. This will make the industry more open and

protect investors. This change in the law may calm big investors’

fears of price manipulation, fraud, and a lack of oversight, which

have been holding them back in the past. Japan’s move to recognize

digital assets as a safe form of investment could be a model for

other countries to follow. Featured image from Gemini Imagen, chart

from TradingView

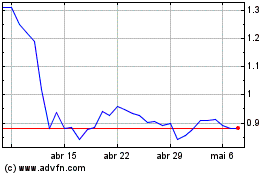

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025