Bitcoin Retail Demand Levels Return to Neutral Zone—What Next?

24 Fevereiro 2025 - 9:00PM

NEWSBTC

Bitcoin’s price performance remains under pressure, with the asset

experiencing a drop of 2.3% over the past week. This decline pushes

BTC’s value even further from its January all-time high of over

$109,000. Amid the bearish momentum, analysts are observing signs

of renewed interest from retail investors—a critical market segment

that could shape Bitcoin’s near-term direction. Related Reading: Is

The Bitcoin Price Manipulated? Expert Exposes The Truth Bitcoin

Retail Demand Slowly Recovers A new analysis by CryptoQuant analyst

Darkfost has highlighted a promising shift in Bitcoin’s retail

demand metrics. Specifically, the 30-day demand change has climbed

back into the neutral zone around 0%, recovering from a highly

negative -21% seen late last year. According to the insight shared

by Darkfost, this is the first time since 2021 that retail demand

has shown such a notable turnaround. Historically, periods of

recovering retail demand have been linked to eventual price

rebounds. For example, in July 2024, retail demand reached a

similar low point before beginning to recover. Although it took

roughly three months for Bitcoin’s price to respond positively, the

subsequent upward movement demonstrated the impact of growing

retail interest. Bitcoin retail Investor demand is brewing

“Notably, past instances of recovering retail demand have often

coincided with upward price movements in the short-term.” – By

@Darkfost_Coc Full post ⤵️https://t.co/lvhC8JnvBD

pic.twitter.com/YdBr6F78W7 — CryptoQuant.com (@cryptoquant_com)

February 24, 2025 Darkfost noted that if this trend holds true this

time, the current recovery in retail demand could lay the

groundwork for future price gains—though such changes may take time

to materialize. Network Activity and Investor Sentiment on the

Decline Despite the positive signs from retail demand, overall

network activity and investor sentiment tell a more cautious story.

Darkfost in a separate post revealed a downward trend in the number

of active Bitcoin wallets and transactions used for deposits and

withdrawals. The accumulation of Bitcoin by spot ETFs has also

slowed, with minor outflows suggesting a more hesitant investor

base. Additionally, the number of unspent transaction outputs

(UTXOs) is decreasing at a pace reminiscent of previous market

corrections. Although this alone does not confirm a market cycle

peak, it does raise questions about the underlying strength of

current market participants. Investor sentiment has also been

weighed down by broader macroeconomic and geopolitical factors.

Darkfost highlighted that while initial bullish sentiment was

buoyed by optimism surrounding Trump’s election and the possibility

of favorable US crypto regulations, no substantial policy changes

or legislative actions have yet emerged. Related Reading: Bitcoin’s

Bullish Case Hinges On $94,645 Support: Will Buyers Step In?

Meanwhile, global trade tensions and risk-averse market behavior

continue to dampen enthusiasm. With earlier bullish narratives

already factored into Bitcoin’s price, the market will likely

require new catalysts or improved conditions to regain upward

momentum. Featured image created with DALL-E, Chart from

TradingView

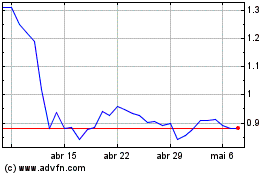

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025