Is Bitcoin Peak In? This Data Suggests Otherwise, Analytics Firm Says

15 Março 2025 - 1:00PM

NEWSBTC

An analytics firm has explained how the data related to the

stablecoins could hint at whether the Bitcoin market top is in or

not. Stablecoins Have Seen Their Market Cap Touch New Highs

Recently In a new post on X, the market intelligence platform

IntoTheBlock has discussed about the trend in the combined

stablecoin market cap. “Stablecoins” refer to cryptocurrencies that

are pegged to a fiat currency (with USD being the most popular

choice). Generally, investors make use of these assets when they

want to avoid the volatility associated with other coins like

Bitcoin. Traders who invest into stablecoins, however, usually do

so because they plan to venture (back) into the volatile side of

the sector. Related Reading: Dogecoin Can Still Go Parabolic If

This Support Holds, Analyst Says As such, the supply of these

fiat-tied tokens is often considered as the available ‘dry powder’

for Bitcoin and other cryptocurrencies. Given this placement of the

stables in the sector, their market cap can be worth keeping an eye

on. Here is the chart shared by the analytics firm that shows the

trend in the stablecoin market cap over the past few years: As

displayed in the above graph, the market cap of the stablecoins has

been riding an uptrend recently and exploring new all-time highs

(ATHs). Following the latest continuation to the increase, the

metric has hit a whopping $219 billion. To put things into

perspective, the market cap of Ethereum (ETH), the second largest

asset in the sector, is just under $233 billion. Thus, the stables

are less than $14 billion away. IntoTheBlock has pointed out an

interesting pattern related to this indicator. In the chart, it’s

visible that the metric’s top last cycle was when it hit $187

billion in April 2022. Evidently, this peak in the market cap of

the stables coincided with the start of the bear market.

“Historically, stablecoin supply peaks align with cycle highs,”

notes the analytics firm. So far in the current cycle, the

indicator has continued to rise, despite the decline in the asset’s

price. If the previous trend is anything to go by, this could be an

indication that Bitcoin and other coins are yet to enter a bear

market. That said, the latest market conditions haven’t exactly

been entirely bullish. The most positive scenario occurs whenever

both BTC and the stablecoins enjoy an increase in their market

caps. In such a period, a net amount of fresh capital inflows are

entering into the sector. Related Reading: Bitcoin & Altcoin

Volume Fades—Investor Exhaustion Setting In? At present, though,

the stablecoins have been rising while Bitcoin and others have been

falling. This could potentially imply a rotation of capital has

been occurring, rather than fresh inflows. During the mid-2021

correction, a similar pattern emerged, but the market was able to

find its footing and the second half of the rally took place. It

now remains to be seen whether something similar would happen for

Bitcoin this time as well, or if the market will go the way it did

in 2022. Bitcoin Price At the time of writing, Bitcoin is trading

around $84,700, down over 4% in the last seven days. Featured image

from Dall-E, IntoTheBlock.com, chart from TradingView.com

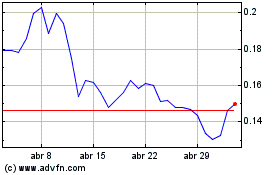

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025