Commodity Currencies Slide As Asian Stock Markets Traded Lower

03 Setembro 2024 - 2:25AM

RTTF2

The Commodity currencies such as the Australia, the New Zealand

and the Canadian dollars weakened against their major currencies in

the late Asian session on Tuesday, as Asian stock markets traded

lower, giving up early gains due to jitters over China's economy

and a significant escalation of geopolitical tensions after two

crude oil tankers, the Saudi-flagged Amjad and Panama-flagged Blue

Lagoon I, were attacked in the Red Sea by Yemen's Iran-backed

Houthi rebels.

Meanwhile, intense diplomatic efforts are underway involving the

United States, Egypt and Qatar to secure a ceasefire in Gaza.

Oil and gold prices dipped in Asian trading as the dollar

extended its rebound ahead of the release of manufacturing and

service PMI readings.

Investors cautiously await more U.S. economic data, including

Friday's non-farm payrolls report for August to gauge the size of

the Federal Reserve's rate cut later this month.

In the late Asian trading today, the Australian dollar fell to a

6-day low of 1.6427 against the euro and a 4-day low of 98.39

against the yen, from Friday's closing quotes of 1.6300 and 99.75,

respectively. If the aussie extends its downtrend, it is likely to

find support around 1.68 against the euro and 92.00 against the

yen.

Against the U.S. and the Canadian dollars, the aussie slipped to

nearly a 2-week low of 0.6730 and nearly a 3-week low of 0.9105

from last week's closing quotes of 0.6790 and 0.9160, respectively.

On the downside, 0.65 against the greenback and 0.88 against the

loonie are seen as the next support levels for the aussie.

The aussie edged down to 1.0875 against the NZ dollar, from

Friday's closing value of 1.0892. The AUD/NZD pair may test support

near the 1.07 region.

The NZ dollar fell to nearly a 2-week low of 0.6183 against the

U.S. dollar, from Friday's closing value of 0.6230. The NZD/USD

pair is likely to find its support level around the 0.59

region.

Against the euro and the yen, the kiwi slipped to a 6-day low of

1.7877 and a 5-day low of 90.28 from last week's closing quotes of

1.7759 and 91.52, respectively. If the kiwi extends its downtrend,

it is likely to find support around 1.85 against the euro and 85.00

against the yen.

The Canadian dollar fell to nearly a 2-week low of 1.3531

against the U.S. dollar, from Friday's closing value of 1.3491. The

loonie is likely to find its support around the 1.36 region.

Against the euro and the yen, the loonie slid to a 5-day low of

1.4960 and a 4-day low of 107.80 from last week's closing quotes of

1.4936 and 108.85, respectively. If the loonie extends its

downtrend, it is likely to find support around 1.51 against the

euro and 104.00 against the yen.

Meanwhile, the safe-haven currency or the yen rose against its

major counterparts in the Asian session amid risk aversion.

The yen rose to a 4-day high of 145.65 against the U.S. dollar,

from an early 2-week low of 147.21. The yen may test resistance

around the 144.00 region.

Against the Swiss franc, the euro and the pound, the yen

advanced to 4-day highs of 170.77, 160.94 and 191.08 from early

highs of 172.67, 162.80 and 193.37, respectively. If the yen

extends its uptrend, it is likely to find resistance around 169.00

against the franc, 160.00 against the euro and 189.00 against the

pound.

Looking ahead, U.S. and Canada S&P Global manufacturing PMI

reports for August, U.S. Redbook report, ISM manufacturing PMI for

August and U.S. construction spending for July are slated for

release in the New York session.

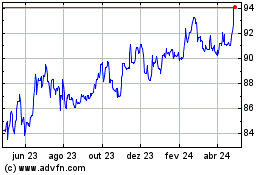

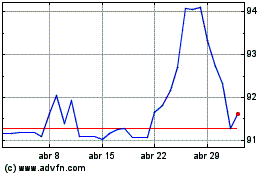

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Ago 2024 até Set 2024

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Set 2023 até Set 2024