Yen Falls As Traders Doubt On BoJ Rate Hike

09 Janeiro 2025 - 11:47PM

RTTF2

The Japanese yen weakened against major currencies in the Asian

session on Friday, as investors continued to have doubts about

whether the Bank of Japan (BoJ) would likely raise interest rates

once more.

Meanwhile, the investors brace for the all-important U.S. jobs

reports later in the day.

Economists expect to see an increase of 155,000 jobs in

December, less than the gain of 227,000 in November's reading. The

jobless rate is seen holding at 4.2 percent.

A stronger report may fuel ongoing worries that the Federal

Reserve may not lower interest rates this year.

Fed funds futures trading data currently price in only about a 7

percent chance of a quarter-point cut at the next policy meeting

later this month.

In economic news, data from the Ministry of Internal Affairs and

Communications showed that the average of household spending in

Japan was down 0.4 percent on year in November, coming in at

295,518 yen. That beat forecasts for a decline of 0.6 percent

following the 1.3 percent contraction in October.

On a seasonally adjusted monthly basis, household spending rose

0.4 percent, also beating expectations for a drop of 0.9 percent

following the 2.9 percent increase in the previous month.

Data from the Cabinet Office showed that Japan's leading index

as well as coincident index declined in November. The leading

index, which measures future economic activity, dropped to 107.0 in

November from 109.1 in October.

A similar lower reading was last seen in August. The score was

forecast to drop less markedly to 107.2.

Likewise, the coincident index that measures the current

economic situation registered 115.3, down from 116.8 in the

previous month.

In the Asian trading today, the yen fell to a 2-day low of

158.43 against the U.S. dollar, from yesterday's closing value of

162.85. The next possible downside target for the yen is seen

around the 159.00 region.

Against the euro, the pound and the Swiss franc, the yen slid to

163.12, 194.78 and 173.61 from Thursday's closing quotes of 162.85,

194.58 and 173.30, respectively. If the yen extends its downtrend,

it is likely to find support around 165.00 against the euro, 200.00

against the pound and 176.00 against the franc.

Against Australia, the New Zealand and the Canadian dollars, the

yen slipped to 98.20, 88.62 and 109.95 from Thursday's closing

quotes of 97.94, 88.54 and 109.86, respectively. On the downside,

100.00 against the aussie, 90.00 against the kiwi and 111.00

against the loonie are seen as the next support levels for the

yen.

Looking ahead, Canada and U.S. jobs data for December, U.S.

University of Michigan's consumer sentiment index for January, U.S.

WASDE Report and U.S. Baker Hughes oil rig count data are slated

for release in the New York session.

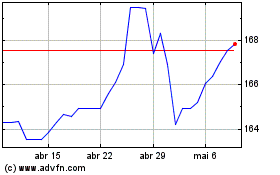

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Dez 2024 até Jan 2025

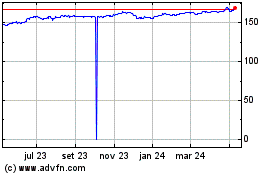

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Jan 2024 até Jan 2025