ARGAN: RENTAL INCOME 2024 - TONIC GROWTH OF +8%

03 Janeiro 2025 - 1:45PM

UK Regulatory

ARGAN: RENTAL INCOME 2024 - TONIC GROWTH OF +8%

Quarterly financial information –

Neuilly-sur-Seine, Friday,

January 3, 2025 - 5.45 pm

Rental income 2024: tonic growth of

+8%

- Yearly target fully achieved: €198 million in rental

income

- Maximum occupancy (100%) for the

2nd year in a

row

Rental income (IFRS) as at December 31, 2024

(unaudited figures)

|

€ million |

2024 |

2023 |

Trends |

|

1st quarter (Jan. – March) |

48.1 |

45.2 |

+6% |

|

2nd quarter (Apr. – June) |

50.0 |

45.7 |

+9% |

|

3rd quarter (Jul. – Sept.) |

51.1 |

46.3 |

+10% |

|

4th quarter (Oct. – Dec.) |

49.1 |

46.4 |

+6% |

|

Yearly total (Jan. –

Dec.) |

198.3 |

183.6 |

+8% |

€198 million in rental income at the end of December

2024

ARGAN, the leading French real estate

company specializing in the development and rental of PREMIUM

warehouses, is still driven by a solid

momentum as it recorded tonic growth

of +8% in the rental income for the

year, standing at €198 million at the end of

December. The real estate company thus fully met the target for the

year, which was raised along the release of the rental income for

the first nine months.

ARGAN maintained a full occupancy of its

warehouses of 100% for the second year in a row, a result that

particularly stands out in the company’s market. The

growth in rental income over the period was thus the result

of the Group’s confirmed successful commercial strategy

through the full-year impact of 2023

deliveries and the effect of 2024

delivered projects, along rents’ indexation

(+4.6%) that took place on January 1, 2024.

The sequential decline in rental income from the

third (€51.1 million) to the fourth

quarter (€49.1 million) of 2024 was

linked to the mechanical impact of the sale of a datacenter

in Wissous in October1.

A remarkable year: €180 million in

investments for 170,000 sq.m of new warehouses in 2024, generating

€12 million in rental income, i.e., a yield of 6.6%

Over 12 months, ARGAN delivered 8 new

sites, all pre-let conforming with its policy, and located in PRIME

areas. The new platforms, all operational, are rented

to:

- DSV

Road for an Aut0nom® -labelled

distribution centre of 4,600 sq.m, delivered in

February, located in

Eslettes (76), close to Rouen. As part of a

nine-year fixed-term lease, this second partnership with

DSV comes with a Net Carbon Zero footprint for the

‘in-use’ phase;

-

CARREFOUR for a multi-temperature

site for urban logistics of 4,300

sq.m, delivered in May, located in Castries

(34), very close to

Montpellier, rented as part of a fixed-term 6-year

lease;

- U

PROXIMITE (a new client) for an Aut0nom®-labelled

tri-temperature warehouse of 31,300 sq.m, delivered in

June. Located in St-Jean-sur-Veyle (01), near

Mâcon and close to the warehouse delivered to BACK

EUROP France in 2023, it is rented as part of a fixed-term

lease of 12 years;

-

DACHSER (a new client), for an

Aut0nom®-labelled warehouse of

15,200 sq.m, delivered in June, in

Bolbec (76), close to Le Havre,

alongside a site previously delivered to DIDACTIC in 2022;

-

CARREFOUR, for a second site this

year, delivered in July, for a built area of

82,000 sq.m and

Aut0nom® -labelled. This new site is located in

Mondeville (14), on the beltway of

Caen, on an industrial brownfield of

Stellantis, with a nine-year fixed-term

lease;

-

4MURS (a new client) for an Aut0nom® warehouse of

9,500 sq.m, delivered in December, in the

neighbourhood of Metz and close to the warehouse rented to

AMAZON. It is operated as part of a

12-year lease, including a 9-year fixed-term;

- A new

client in the health industry for an Aut0nom®

warehouse of 18,000 sq.m,

delivered in December. This new site is located in

an activity area that is the economic heart of the

metropolitan district of Chartres (28) and is operated

through a fixed-term ten-year lease;

-

GEODIS, as works to rehabilitate and

extend the fulfillment hub (of 13,400 sq.m) came

to an end, with a delivery in December. Located in

Bruguières (31), near Toulouse, the site is

operated through a signed lease with a fixed-term

period of 12 years.

As planned, ARGAN has thus achieved

close to €180 million in developments for a total of 170,000 sq.m

in 2024, representing a remarkable volume.

The average yield of

projects delivered in 2024 approached 7% by standing at

6.6%, vs. 5.2 % in 2023. This high ratio testifies to

ARGAN’s ability to capture value through the PRIME quality

of assets that are rented before their delivery and

through a unique level of

execution recognized on the French market

for the development of its warehouses (quality of

the Aut0nom® standard and respected lead times) along the

tight management of its asset-property teams (anticipating

the needs of the client and maintaining the quality of assets on

the long run).

2024 assets disposals’ program successfully

completed

ARGAN successfully completed the assets

disposals’ program as planned for 2024, for a total of €77

million, including:

- €18

million, with the sale, in the second

quarter, of a logistics platform in

Caen (14) of 18,000 sq.m;

- €59

million, as part of the disposal

of a datacenter located in Wissous (91), at the

beginning of the fourth quarter, for a surface of

22,000 sq.m.

A PREMIUM portfolio of 3.7 million sq.m,

appraised at €3.9 billion excluding duties at the end of December

2024:

As at December 31, 2024, the built portfolio

represented 3,710,000 sq.m. Standing at €3.91 billion

excluding duties (vs. €3.68 billion excluding duties

at the end of 2023), the increase in value recorded over the year

(+6%) primarily reflected an increase in the fair value of

the portfolio, driven by the growth in the market rents of

the warehouses, despite capitalization rates excluding duties that

slightly decompressed over the year, edging up from 5.10% at the

end of 2023 (4.85% including duties) to 5.20% excluding

duties as at December 2024 (i.e., 4.90% including

duties). Note that the capitalization rate excluding duties

nonetheless reflects a compression after a peak of 5.30% excluding

duties reached as at June 30, 2024 (i.e., 5.00% including

duties).

The weighted average residual lease

term, computed as at December 31, 2024, decreased

slightly to 5.3 years (vs. 5.7 years at December 31,

2023).

The occupancy rate of the portfolio

remained at a maximum of 100% for the second year

in a row with a weighted average age of 11.6

years (vs. 11.1 years as at December 31, 2023).

2025 financial calendar (Publication of the

press release after closing of the stock exchange)

- January 16: Annual results 2024

- March 20: General Assembly 2025

- April 1: Net sales of 1st quarter 2025

- July 1: Net sales of 2nd quarter 2025

- July 17: Half-year results 2025

- October 1: Net sales of 3rd quarter 2025

2026 financial calendar (Publication of the

press release after closing of the stock exchange)

- January 5: Net sales of 4th quarter 2025

- January 22: Annual results 2025

- March 19: General Assembly 2026

About ARGAN

ARGAN is the only French real

estate company specializing in the DEVELOPMENT & RENTAL OF

PREMIUM WAREHOUSES listed on EURONEXT and is the leading player of

its market in France. Building on a unique customer-centric

approach, ARGAN develops PREMIUM and Au0nom®

-labelled – i.e., carbon-neutral in use – pre-let warehouses for

blue-chip companies, with tailor-made services throughout all

project phases from the development milestones to the rental

management.

As at December 31, 2024, ARGAN represented a

portfolio of 3.7 million sq.m, with about a hundred warehouses

solely located in the continental area of France. Appraised at a

total of €3.9 billion, this portfolio generates a yearly rental

income of close to €205 million (yearly rental income based on the

portfolio delivered as at Dec. 31, 2024).

Profitability, well-mastered debt and sustainability are at the

heart of ARGAN’s DNA. The financial solidity of

the Group’s model is notably reflected in its Investment-grade

rating (BBB- with a stable outlook) with Standard & Poor’s.

ARGAN is also deploying a committed ESG policy

addressing all its stakeholders. Achievements as part of this

roadmap are regularly recognized by third-party agencies such as

Sustainalytics (low extra-financial risk), Ethifinance (gold medal)

and Ecovadis (sliver medal – top 15% amongst rated companies).

ARGAN is a listed real estate investment company (French SIIC), on

Compartment A of Euronext Paris (ISIN FR0010481960 - ARG) and is

included in the Euronext SBF 120, CAC All-Share, EPRA Europe and

IEIF SIIC France indices.

www.argan.fr

Francis Albertinelli – CFO

Aymar de Germay – General Secretary

Samy Bensaid – Head of Investor Relations

Phone: +33 1 47 47 47 40

E-mail: contact@argan.fr

www.argan.fr |

Marlène Brisset – Media relations

Phone: +33 6 59 42 29 35

E-mail: argan@citigatedewerogerson.com

|

|

|

1 For more information, please refer to the press release dated

October 8, 2024.

- 20250103 - Rental Income Q42024

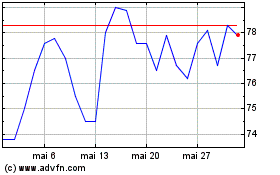

Argan (EU:ARG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Argan (EU:ARG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025