How The Israel-Iran War Could Shake Crypto Prices, Explains Arthur Hayes

16 Outubro 2024 - 1:30PM

NEWSBTC

Arthur Hayes, the co-founder and former CEO of BitMEX, published an

essay titled “Persistent Weak Layer” on October 16, where he

examines the potential impact of escalating tensions between Israel

and Iran on the crypto markets. Drawing an analogy from avalanche

science, Hayes explores how the geopolitical situation in the

Middle East could act as a “persistent weak layer” (PWL) that might

trigger significant financial market upheavals, affecting Bitcoin

and crypto prices. How Will The Crypto Market React? Hayes begins

the essay by recounting his recent skiing trip, stating. “One of

the scariest conditions is a persistent weak layer (PWL), which

could trigger a persistent slab avalanche when stressed. He

parallels this to the Middle East’s geopolitical situation

post-World War II, suggesting it serves as a PWL atop which the

modern global order rests. “The trigger usually has something to do

with Israel,” Hayes observes. He emphasizes that the financial

markets’ primary concern is how energy prices will respond, the

impact on global supply chains, and the potential for a nuclear

exchange if hostilities between Israel and another Middle Eastern

nation, particularly Iran or its proxies, escalate. Related

Reading: Crypto Prices Go Up: A ‘Cautious Bullish’ Outlook Amid Fed

Worries And Market Volatility Hayes outlines two scenarios. In the

first, the Israel-Iran conflict fizzles into minor, tit-for-tat

military actions. “Israel continues assassinating folks and

decapitating dicks, and the Iranian response is telegraphed,

non-threatening missile strikes,” he describes bluntly. No critical

infrastructure is destroyed, and there are no nuclear strikes;

thus, the PWL holds. In the second scenario, the conflict escalates

dramatically, culminating in the destruction of Middle Eastern oil

infrastructure, closure of the Straits of Hormuz, or a nuclear

attack, leading to the PWL failing and causing an “avalanche in the

financial markets.” Expressing his concerns, Hayes states: “War is

uninvestable, as they say.” He faces a strategic choice regarding

his investment portfolio: whether to continue converting fiat

currency into crypto or to reduce his crypto exposure in favor of

cash or US Treasury bonds. “I don’t want to be under-allocated if

this truly is the start of the next leg higher in the crypto bull

market,” he explains. “Still, I also don’t want to incinerate

capital if Bitcoin drops 50% in a day because Israel/Iran triggered

a persistent slab financial markets’ avalanche. Forget about

Bitcoin; it always bounces back; I’m more worried about some of the

utter dogshit I have in my portfolio … meme coins.” Buy Or Sell

Now? To navigate this dilemma, Hayes conducts a scenario analysis

focusing on how the second, more severe scenario could impact

crypto markets, particularly Bitcoin, which he refers to as the

“crypto reserve asset.” He considers three primary risks: physical

destruction of Bitcoin mining rigs, a dramatic rise in energy

prices, and monetary implications resulting from the conflict.

Regarding the physical destruction of mining infrastructure, Hayes

identifies Iran as the only Middle Eastern country with notable

Bitcoin mining operations, accounting for up to 7% of the global

hash rate. Reflecting on the 2021 scenario when China banned

Bitcoin mining, he concludes that even the complete elimination of

Iranian mining capacity would have negligible impact on the Bitcoin

network and its price. Addressing the risk of a dramatic rise in

energy prices, Hayes considers the potential consequences if Iran

retaliated by destroying major oil and natural gas fields or

closing the Straits of Hormuz. Such actions would cause oil prices

to spike, driving up energy costs globally. Hayes argues that this

scenario would actually increase Bitcoin’s value in fiat terms.

“Bitcoin is stored energy in digital form. Therefore, if energy

prices rise, Bitcoin will be worth more in terms of fiat currency,”

he explains. Related Reading: SEC Strikes Again: Cumberland DRW

Charged For ‘Unregistered Crypto Operations’ He draws historical

parallels to the 1970s oil shocks. During the Arab oil embargo of

1973 and the Iranian Revolution of 1979, oil prices surged

significantly. “Oil rose 412%, and gold nearly matched its rise at

380%,” Hayes points out. He illustrates that while gold maintained

its purchasing power relative to oil, stocks lost substantial value

when measured against energy prices. Hayes suggests that Bitcoin,

as a form of “hard money,” would similarly preserve its value or

even appreciate relative to rising energy costs. Lastly, Hayes

examines the monetary implications, particularly how the United

States might respond to the conflict financially. He emphasizes

that US support for Israel involves providing weapons, funded

through increased government borrowing rather than savings. “The US

government purchases goods on credit and not from savings,” he

highlights, referencing data that shows US national net savings are

negative. He questions who will buy this debt and indicates that

the Federal Reserve and the US commercial banking system would

likely step in, effectively expanding their balance sheets and

printing more money. Hayes notes historical instances where

negative national savings corresponded with sharp increases in the

Federal Reserve’s balance sheet, such as after the 2008 Global

Financial Crisis and during the COVID-19 pandemic. “The Fed and the

US commercial banking system will buy this debt by printing money

and growing their balance sheets,” he asserts. He suggests that

this monetary inflation would significantly bolster Bitcoin’s

price. “Bitcoin has outperformed the rise in the Fed’s balance

sheet by 25,000%,” Hayes emphasizes, indicating Bitcoin’s strong

performance relative to monetary base expansion. However, he

cautions investors about the potential for intense price volatility

and uneven performance across different crypto assets. “Just

because Bitcoin will rise over time doesn’t mean there won’t be

intense price volatility, nor does it mean every shitcoin will

share in the glory,” he warns. Hayes reveals that he had invested

in several meme coins but reduced those positions dramatically

after Iran launched missile attacks. “When Iran launched its latest

barrage of missiles at Israel, I cut those positions dramatically.

My size was too big, given the unpredictability of how crypto

assets will react to increased hostilities in the short term,” he

admits. Currently, he holds only one meme coin, noting, “The only

meme coin I own is the Church of Smoking Chicken Fish (symbol:

SCF). R’amen.” At press time, BTC traded at $66,907. Featured image

created with DALL.E, chart from TradingView.com

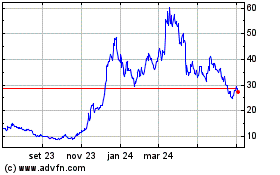

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

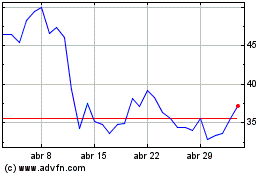

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024