PEPE’s Future: Will Prices Of Meme Coins Continue To Drop?

07 Agosto 2023 - 6:05AM

NEWSBTC

In the realm of meme coins, PEPE’s Network Realized Profit/Loss

(NPL) metric has emerged as a critical barometer, shedding light on

price trends within the cryptocurrency landscape. This metric has

now indicated a glimmer of a price floor for the frog-themed token

that has been facing its fair share of challenges. As a result, a

ray of positivity has dawned upon numerous investors who have been

expecting a much-needed rebound, following a prolonged period of

decline within the meme coins arena. However, a more meticulous

analysis of the situation unveils a contrasting reality, suggesting

that the token’s woes might be far from over. At first glance, the

dip in PEPE’s NPL metric appeared to be an encouraging sign.

Historically, a significant drop in this metric has often coincided

with a price bottom in many cryptocurrencies. PEPE NPL

metric on the downward trend. Source: Santiment. Related

Reading: Shiba Inu: More Bite Than Bark Over The Weekend With Over

15% Jump PEPE’s Misleading NPL Dip Conceals Ongoing Selling

Pressure The recent uptick in PEPE’s 24-hour performance, with a

1.7% rally, seemed to lend credence to this belief. Nevertheless,

deeper scrutiny of on-chain data reveals a less optimistic picture.

While the NPL suggested a potential price floor, the broader

on-chain performance of PEPE contradicts this notion. The token has

experienced consistent and sustained selling pressure. PEPE

seven-day slump. Source: Coingecko Holders have continued to

offload their tokens including meme coins, thwarting the

possibility of a substantial price rebound. The 9.1% seven-day

slump underscores the persistent challenges PEPE faces, casting

doubt on the immediate potential for recovery. Insights From The

Broader Crypto Market Struggle PEPE’s struggle is not occurring in

isolation. The wider cryptocurrency market has been grappling with

a plethora of challenges, including regulatory uncertainties,

market sentiment shifts, and macroeconomic factors. The volatility

that has become synonymous with the crypto landscape has impacted

tokens across the spectrum, including well-established ones. This

backdrop of uncertainty has resulted in heightened caution among

investors. The fear of further price drops, according to a recent

PEPE price analysis, prompts them to liquidate their holdings

preemptively, even when metrics like NPL seem favorable. This

collective behavior contributes to the sustained selling pressure

observed in tokens like PEPE, despite signs that might hint at a

price recovery. The market cap of cryptocurrencies reached $1.12

trillion today. Chart: TradingView.com PEPE And Meme Coins: The

Road Ahead While the dip in PEPE’s NPL initially raised hopes of a

price bottom, a meticulous analysis uncovers the underlying

challenges that continue to suppress the token’s recovery. The

on-chain data reflects a consistent trend of token holders selling,

which overshadows the potential for an immediate price rebound.

Moreover, the broader struggles of the crypto market further

exacerbate the situation, making it crucial for investors to manage

their expectations. Related Reading: Bone ShibaSwap Among Weekend

100 Biggest Hitters With 25% Rally While metrics like NPL provide

insights, they must be viewed within the larger context of market

dynamics. Only by taking a holistic approach and considering

multiple factors can investors make informed decisions that

mitigate risks and capitalize on opportunities in this highly

volatile environment. (This site’s content should not be construed

as investment advice. Investing involves risk. When you invest,

your capital is subject to risk). Featured image from Earth.com

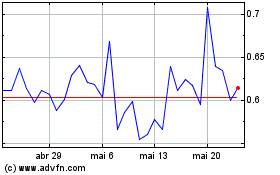

BONE SHIBASWAP (COIN:BONEUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

BONE SHIBASWAP (COIN:BONEUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025

Notícias em tempo-real sobre BONE SHIBASWAP da Criptomoeda bolsa de valores: 0 artigos recentes

Mais Notícias de BONE SHIBASWAP