Stronghold Digital Mining, Inc. (NASDAQ: SDIG)

(“Stronghold”, the “Company”, or “we”) today announced

financial and operational results for the first quarter of 2024 and

provided other strategic updates:

Recent Financial Highlights

- The Company generated

revenues of $27.5 million during the first quarter of 2024, up 27%

sequentially and 59% year-over-year. Revenues comprised

$26.7 million from cryptocurrency operations, $0.7 million from the

sale of energy, and $0.1 million from other activities.

- First quarter 2024 fixed

costs were down 3% sequentially and 11% year-over-year,

demonstrating Stronghold’s operating leverage and cost

controls. Fixed costs include operations & maintenance

expenses and general & administrative expenses, excluding

stock-based compensation.

- The Company earned GAAP Net

Income of $5.8 million and non-GAAP Adjusted EBITDA of $8.7 million

during the first quarter of 2024. 1

Strategic Alternatives

Stronghold and its Board of Directors (“Board”)

have initiated a formal strategic review process with the

assistance of outside financial and legal advisors. The Company is

considering a wide range of alternatives to maximize shareholder

value, including, but not limited to, the sale of all or part of

the Company, or another strategic transaction involving some, or

all of, the assets of the Company. There is no deadline or

definitive timetable set for the completion of the strategic

alternatives process, and there can be no assurance any proposal

will be made or accepted, any agreement will be executed, or any

transaction will be consummated in connection with this review.

Stronghold does not intend to make further announcements regarding

the review process unless and until the Board approves a specific

transaction or otherwise determines that further disclosure is

appropriate. The Company has retained Cohen and Company Capital

Markets as financial advisor and Vinson & Elkins LLP as legal

advisor to support Stronghold’s management team and Board during

the review process.

“Stronghold’s Board and management team are

committed to maximizing value for our shareholders and, to that

end, have commenced a comprehensive and thorough review of

strategic alternatives,” said Greg Beard, chairman and chief

executive officer of Stronghold. “We have observed what we believe

to be valuation dislocation when comparing Stronghold’s market

value to valuations of public Bitcoin mining peers, merchant power

companies, and data center and power generation assets trading in

the market. We own over 130 megawatts of fully energized data

center capacity with 4.1 exahash per second (“EH/s”) of installed

hash rate capacity and potential to expand to beyond 7 EH/s through

high-grading our fleet with current-generation Bitcoin miners.

“Unlike most other Bitcoin miners, we own over

750 acres of land with expansive access to water and fiber; we own

the transmission lines that connect our assets to the attractive

PJM grid; and our two wholly owned merchant power plants have over

160 megawatts (“MW”) of net output capacity and significant carbon

capture potential. We believe that our 130 MW of existing Bitcoin

mining capacity could potentially be expanded to over 400 MW for

either Bitcoin mining or advanced computing, such as that which is

used for artificial intelligence and machine learning.”

____________1 See Non-GAAP reconciliation table

below.

Bitcoin Mining Update and Voltus

Agreement

Stronghold generated 546 Bitcoin during the

first quarter of 2024, $0.7 million of energy revenue which

represented the equivalent of 15 Bitcoin at the average price of

Bitcoin during the period, and a total of 561 of Bitcoin-equivalent

during the quarter, which was down approximately 11% versus the

Bitcoin-equivalent production during the fourth quarter of 2023.

Bitcoin mining economics began to recover over the course of 2023

and into early 2024 prior to the Bitcoin halving that took place on

April 19, 2024. Bitcoin hash price, which is Stronghold’s preferred

measure of conveying Bitcoin mining economics and represents

revenue per unit of hash rate, thus capturing Bitcoin price,

transaction fees, and network hash rate, averaged $92/PH/s per day

during the first quarter of 2024, a 14% improvement from the fourth

quarter 2023 average of $81/PH/s per day. Bitcoin price averaged

$53,536 during the first quarter of 2024, up approximately 48%

versus the $36,247 during the fourth quarter of 2023. The

improvement in Bitcoin price was partially offset by the drop in

transaction fees, which averaged 7.2% of block subsidies during the

first quarter of 2024, down 740 basis points compared to 14.6% of

block subsidies during the fourth quarter of 2023, and the rise in

network hash rate, which averaged 554 EH/s during the first quarter

of 2024, up 20% compared to the 460 EH/s network hash rate during

the fourth quarter of 2023.

During April 2024, Stronghold mined 155 Bitcoin.

The Company’s average hash rate was 3.6 EH/s during April,

approximately flat versus the March 2024 average of 3.6 EH/s.

Stronghold generated an estimated $9.4 million of revenue in April,

down approximately 15% compared to the $11.1 million of revenue in

April.

On March 22, 2024, PJM issued “Guidance on

Co-Located Load,” and Stronghold believes that it qualifies as a

PJM “Network” load which has the potential to enable ancillary

revenue streams such as demand response earned by in-network loads,

like the Company’s data centers. On April 26, 2024, Stronghold

executed a Distributed Energy Resource and Peak Saver Agreement

with Voltus, Inc. (“Voltus”) pursuant to which Voltus will assist

the Company in registering for certain demand response and sync

reserve programs in PJM that the Company believes will allow it to

capture additional revenue.

Stronghold Carbon Capture Update

Stronghold has continued to progress the

development of its carbon capture project. As previously announced,

recent test results from the Scrubgrass Plant have demonstrated

carbonation of up to 14% by starting weight of ash, up from prior

estimates of up to 12%. Puro.earth Carbon Registry (“Puro”)

registered the Company’s carbon capture project at the Scrubgrass

Plant in late February. The Company is now in the audit process

with Puro, with the goal of accreditation at the Scrubgrass Plant

as early as the end of the second quarter of 2024. Please see the

Carbon Capture Forum Presentation and the disclosures made in the

Company’s Securities and Exchange Commission (“SEC”) filings for

additional details and assumptions relating to the carbon capture

initiative.

Liquidity and Capital Resources

As of March 31, 2024, and April 30, 2024, the

Company had approximately $7.5 million and $8.0 million,

respectively, of cash, cash equivalents, and Bitcoin on its balance

sheet, which included zero Bitcoin and 26 Bitcoin, respectively. As

of March 31, 2024, and April 30, 2024, the Company had principal

amount of outstanding indebtedness of approximately $55.5 million

and $55.3 million, respectively. Stronghold currently has

approximately $0.3 million of remaining capital expenditures

required related to its previously announced miner purchase

agreements in 2024, and currently has no material capital

commitments beyond June of 2024. As of April 30, 2024, Stronghold

had approximately $3.4 million of capacity remaining under its

at-the-market offering agreement (“ATM”) with H.C. Wainwright &

Co., LLC. In 2023, Stronghold issued approximately $11.6 million of

Class A common stock at an average price of $6.47 per share under

its ATM for approximately $11.2 million of net proceeds, with

approximately $0.4 million paid in commissions. The Company has not

sold any of its shares under the ATM during 2024.

Conference Call

Stronghold will host a conference call today,

May 2, 2024 at 11:00 a.m. Eastern Time (8:00 a.m. Pacific Time)

with an accompanying presentation to discuss these results. To

participate, a live webcast of the call will be available on the

Investor Relations page of the Company’s website at

ir.strongholddigitalmining.com. To access the call by phone, please

use the following link Stronghold Digital Mining First Quarter 2024

Earnings Call. After registering, an email will be sent, including

dial-in details and a unique conference call access code required

to join the live call. To ensure you are connected prior to the

beginning of the call, please register a minimum of 15 minutes

before the start of the call.

A replay will be available on the Company's

Investor Relations website shortly after the event at

ir.strongholddigitalmining.com.

About Stronghold Digital Mining,

Inc.

Stronghold is a vertically integrated Bitcoin

mining company with an emphasis on environmentally beneficial

operations. Stronghold houses its miners at its wholly owned and

operated Scrubgrass Plant and Panther Creek Plant, both of which

are low-cost, environmentally beneficial coal refuse power

generation facilities in Pennsylvania.

Cautionary Statement Concerning

Forward-Looking Statements

Certain statements contained in this press

release, including guidance, constitute “forward-looking

statements.” within the meaning of the Private Securities

Litigation Reform Act of 1995. You can identify forward-looking

statements because they contain words such as “believes,”

“expects,” “may,” “will,” “should,” “seeks,” “approximately,”

“intends,” “plans,” “estimates” or “anticipates” or the negative of

these words and phrases or similar words or phrases which are

predictions of or indicate future events or trends and which do not

relate solely to historical matters. Forward-looking statements and

the business prospects of Stronghold are subject to a number of

risks and uncertainties that may cause Stronghold’s actual results

in future periods to differ materially from the forward-looking

statements, including with respect to its potential carbon capture

initiative and with respect to completing a strategic review

process or entering into a transaction. These risks and

uncertainties include, among other things: the hybrid nature of our

business model, which is highly dependent on the price of Bitcoin;

our dependence on the level of demand and financial performance of

the crypto asset industry; our ability to manage growth, business,

financial results and results of operations; uncertainty regarding

our evolving business model; our ability to retain management and

key personnel and the integration of new management; our ability to

raise capital to fund business growth; our ability to maintain

sufficient liquidity to fund operations, growth and acquisitions;

our substantial indebtedness and its effect on our results of

operations and our financial condition; uncertainty regarding the

outcomes of any investigations or proceedings; our ability to enter

into purchase agreements, acquisitions and financing transactions;

public health crises, epidemics, and pandemics such as the

coronavirus pandemic; our ability to procure crypto asset mining

equipment from foreign-based suppliers; our ability to maintain our

relationships with our third-party brokers and our dependence on

their performance; our ability to procure crypto asset mining

equipment including to upgrade our current fleet; developments and

changes in laws and regulations, including increased regulation of

the crypto asset industry through legislative action and revised

rules and standards applied by The Financial Crimes Enforcement

Network under the authority of the U.S. Bank Secrecy Act and the

Investment Company Act; the future acceptance and/or widespread use

of, and demand for, Bitcoin and other crypto assets; our ability to

respond to price fluctuations and rapidly changing technology; our

ability to operate our coal refuse power generation facilities as

planned; our ability to remain listed on a stock exchange and

maintain an active trading market; our ability to avail ourselves

of tax credits for the clean-up of coal refuse piles; legislative

or regulatory changes, and liability under, or any future inability

to comply with, existing or future energy regulations or

requirements; our ability to replicate and scale the carbon capture

project; our ability to manage costs related to the carbon capture

project; and our ability to monetize our carbon capture project,

including through the private market; our ability to qualify for,

obtain, monetize or otherwise benefit from the Puro registry and

Section 45Q tax credits and our ability to timely complete a

strategic review process and our ability to consummate a

transaction in connection with such process, in part or at all.

More information on these risks and other potential factors that

could affect our financial results are included in our filings with

the SEC, including in the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” sections of our Annual Report on Form 10-K filed on

March 8, 2024, and in our subsequently filed Quarterly Reports on

Form 10-Q. The Company expects to file its Quarterly Report on Form

10-Q for the first quarter of 2024 on or around May 3, 2024. Any

forward-looking statement or guidance speaks only as of the date as

of which such statement is made, and, except as required by law, we

undertake no obligation to update or revise publicly any

forward-looking statements or guidance, whether because of new

information, future events, or otherwise.

In January 2021, the Internal Revenue Service

issued final regulations under Section 45Q of the Internal Revenue

Code, which provides a tax credit disposed of in secure geological

storage (in the event of direct air capture that results in secure

geological storage, credits are valued at $180 per ton of carbon

dioxide (“CO2” captured) or utilized in a manner that satisfies a

series of regulatory requirements (in the event of direct air

capture that results in utilization, credits are valued at $130 per

ton of CO2 captured). We may benefit from Section 45Q tax credits

only if we satisfy the applicable statutory and regulatory

requirements, and we cannot make any assurances that we will be

successful in satisfying such requirements or otherwise qualifying

for or obtaining the Section 45Q tax credits currently available or

that we will be able to effectively benefit from such tax credits.

Additionally, the amount of Section 45Q tax credits from which we

may benefit is dependent upon our ability to satisfy certain wage

and apprenticeship requirements, which we cannot assure you that we

will satisfy. We are currently exploring whether our carbon capture

initiatives discussed herein would be able to qualify for any

Section 45Q tax credit. It is not entirely clear whether we will be

able to meet any required statutory and regulatory requirements,

and qualification for any amount of Section 45Q credit may not be

feasible with our currently planned direct air capture initiative.

Additionally, the availability of Section 45Q tax credits may be

reduced, modified or eliminated as a matter of legislative or

regulatory policy. Any such reduction, modification or elimination

of Section 45Q tax credits, or our inability to otherwise benefit

from Section 45Q tax credits, could materially reduce our ability

to develop and monetize our carbon capture program. These and any

other changes to government incentives that could impose additional

restrictions or favor certain projects over our projects could

increase costs, limit our ability to utilize tax benefits, reduce

our competitiveness, and/or adversely impact our growth. Any of

these factors may adversely impact our business, results of

operations and financial condition.

| |

|

STRONGHOLD DIGITAL MINING, INC.CONDENSED

CONSOLIDATED BALANCE

SHEETS(UNAUDITED) |

| |

| |

March 31,2024 |

|

December 31,2023 |

| ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

7,537,607 |

|

|

$ |

4,214,613 |

|

|

Digital currencies |

|

2,704 |

|

|

|

3,175,595 |

|

|

Accounts receivable |

|

1,739,187 |

|

|

|

507,029 |

|

|

Inventory |

|

4,085,923 |

|

|

|

4,196,812 |

|

|

Prepaid insurance |

|

2,391,206 |

|

|

|

3,787,048 |

|

|

Due from related parties |

|

97,288 |

|

|

|

97,288 |

|

|

Other current assets |

|

2,215,805 |

|

|

|

1,675,084 |

|

|

Total current assets |

|

18,069,720 |

|

|

|

17,653,469 |

|

|

Equipment deposits |

|

— |

|

|

|

8,000,643 |

|

|

Property, plant and equipment, net |

|

144,269,680 |

|

|

|

144,642,771 |

|

|

Operating lease right-of-use assets |

|

1,283,338 |

|

|

|

1,472,747 |

|

|

Land |

|

1,748,440 |

|

|

|

1,748,440 |

|

|

Road bond |

|

299,738 |

|

|

|

299,738 |

|

|

Security deposits |

|

348,888 |

|

|

|

348,888 |

|

|

Other noncurrent assets |

|

170,488 |

|

|

|

170,488 |

|

| TOTAL

ASSETS |

$ |

166,190,292 |

|

|

$ |

174,337,184 |

|

|

LIABILITIES: |

|

|

|

|

Accounts payable |

$ |

11,510,296 |

|

|

$ |

11,857,052 |

|

|

Accrued liabilities |

|

9,599,950 |

|

|

|

10,787,895 |

|

|

Financed insurance premiums |

|

1,513,704 |

|

|

|

2,927,508 |

|

|

Current portion of long-term debt, net of discounts and issuance

fees |

|

12,058,049 |

|

|

|

7,936,147 |

|

|

Current portion of operating lease liabilities |

|

729,821 |

|

|

|

788,706 |

|

|

Due to related parties |

|

619,947 |

|

|

|

718,838 |

|

|

Total current liabilities |

|

36,031,767 |

|

|

|

35,016,146 |

|

|

Asset retirement obligation |

|

1,089,471 |

|

|

|

1,075,728 |

|

|

Warrant liabilities |

|

13,532,709 |

|

|

|

25,210,429 |

|

|

Long-term debt, net of discounts and issuance fees |

|

43,153,392 |

|

|

|

48,203,762 |

|

|

Long-term operating lease liabilities |

|

639,586 |

|

|

|

776,079 |

|

|

Contract liabilities |

|

67,244 |

|

|

|

241,420 |

|

|

Total liabilities |

|

94,514,169 |

|

|

|

110,523,564 |

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

| REDEEMABLE COMMON

STOCK: |

|

|

|

|

Common Stock – Class V; $0.0001 par value; 34,560,000 shares

authorized; 2,405,760 shares issued and outstanding as of

March 31, 2024, and December 31, 2023. |

|

9,704,926 |

|

|

|

20,416,116 |

|

|

Total redeemable common stock |

|

9,704,926 |

|

|

|

20,416,116 |

|

| STOCKHOLDERS’

EQUITY: |

|

|

|

|

Common Stock – Class A; $0.0001 par value; 685,440,000 shares

authorized; 12,900,076 and 11,115,561 shares issued and outstanding

as of March 31, 2024, and December 31, 2023,

respectively. |

|

1,290 |

|

|

|

1,112 |

|

|

Series C convertible preferred stock; $0.0001 par value; 23,102

shares authorized; 0 and 5,990 shares issued and outstanding as of

March 31, 2024, and December 31, 2023, respectively. |

|

1 |

|

|

|

1 |

|

|

Series D convertible preferred stock; $0.0001 par value; 15,582

shares authorized; 0 and 7,610 shares issued and outstanding as of

March 31, 2024, and December 31, 2023, respectively. |

|

— |

|

|

|

1 |

|

|

Accumulated deficits |

|

(314,994,985 |

) |

|

|

(331,647,755 |

) |

|

Additional paid-in capital |

|

376,964,891 |

|

|

|

375,044,145 |

|

|

Total stockholders' equity |

|

61,971,197 |

|

|

|

43,397,504 |

|

|

Total redeemable common stock and stockholders' equity |

|

71,676,123 |

|

|

|

63,813,620 |

|

| TOTAL LIABILITIES,

REDEEMABLE COMMON STOCK AND STOCKHOLDERS' EQUITY |

$ |

166,190,292 |

|

|

$ |

174,337,184 |

|

| |

|

STRONGHOLD DIGITAL MINING, INC.CONDENSED

CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED) |

| |

| |

Three Months Ended |

| |

March 31,2024 |

|

March 31,2023 |

| OPERATING

REVENUES: |

|

|

|

|

Cryptocurrency mining |

$ |

21,291,058 |

|

|

$ |

11,297,298 |

|

|

Cryptocurrency hosting |

|

5,457,529 |

|

|

|

2,325,996 |

|

|

Energy |

|

700,067 |

|

|

|

2,730,986 |

|

|

Capacity |

|

— |

|

|

|

859,510 |

|

|

Other |

|

73,531 |

|

|

|

52,425 |

|

|

Total operating revenues |

|

27,522,185 |

|

|

|

17,266,215 |

|

| OPERATING

EXPENSES: |

|

|

|

|

Fuel |

|

7,410,828 |

|

|

|

7,414,014 |

|

|

Operations and maintenance |

|

8,241,725 |

|

|

|

8,440,923 |

|

|

General and administrative |

|

6,598,346 |

|

|

|

8,468,755 |

|

|

Depreciation and amortization |

|

9,514,654 |

|

|

|

7,722,841 |

|

|

Loss on disposal of fixed assets |

|

— |

|

|

|

91,086 |

|

|

Realized gain on sale of digital currencies |

|

(624,107 |

) |

|

|

(326,768 |

) |

|

Unrealized gain on digital currencies |

|

(1,227 |

) |

|

|

— |

|

|

Realized gain on sale of miner assets |

|

(36,012 |

) |

|

|

— |

|

|

Impairments on digital currencies |

|

— |

|

|

|

71,477 |

|

|

Total operating expenses |

|

31,104,207 |

|

|

|

31,882,328 |

|

| NET OPERATING

LOSS |

|

(3,582,022 |

) |

|

|

(14,616,113 |

) |

| OTHER INCOME

(EXPENSE): |

|

|

|

|

Interest expense |

|

(2,263,409 |

) |

|

|

(2,383,913 |

) |

|

Loss on debt extinguishment |

|

— |

|

|

|

(28,960,947 |

) |

|

Changes in fair value of warrant liabilities |

|

11,677,720 |

|

|

|

(714,589 |

) |

|

Other |

|

10,000 |

|

|

|

15,000 |

|

|

Total other income (expense) |

|

9,424,311 |

|

|

|

(32,044,449 |

) |

| NET INCOME

(LOSS) |

$ |

5,842,289 |

|

|

$ |

(46,660,562 |

) |

| NET INCOME (LOSS)

attributable to noncontrolling interest |

|

918,287 |

|

|

|

(18,119,131 |

) |

| NET INCOME (LOSS)

attributable to Stronghold Digital Mining, Inc. |

$ |

4,924,002 |

|

|

$ |

(28,541,431 |

) |

| NET INCOME (LOSS)

attributable to Class A common shareholders: |

|

|

|

|

Basic |

$ |

0.35 |

|

|

$ |

(6.52 |

) |

|

Diluted |

$ |

0.35 |

|

|

$ |

(6.52 |

) |

| Weighted average

number of Class A common shares outstanding: |

|

|

|

|

Basic |

|

13,989,820 |

|

|

|

4,375,614 |

|

|

Diluted |

|

13,989,820 |

|

|

|

4,375,614 |

|

| |

|

STRONGHOLD DIGITAL MINING, INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH

FLOWS(UNAUDITED) |

| |

| |

Three Months Ended |

| |

March 31,2024 |

|

March 31,2023 |

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

Net income (loss) |

$ |

5,842,289 |

|

|

$ |

(46,660,562 |

) |

|

Adjustments to reconcile net income (loss) to cash flows from

operating activities: |

|

|

|

|

Depreciation and amortization |

|

9,514,654 |

|

|

|

7,722,841 |

|

|

Accretion of asset retirement obligation |

|

13,743 |

|

|

|

13,051 |

|

|

Loss on disposal of fixed assets |

|

— |

|

|

|

91,086 |

|

|

Realized gain on sale of miner assets |

|

(36,012 |

) |

|

|

— |

|

|

Change in value of accounts receivable |

|

213,040 |

|

|

|

1,002,750 |

|

|

Amortization of debt issuance costs |

|

51,473 |

|

|

|

34,517 |

|

|

Stock-based compensation |

|

1,939,120 |

|

|

|

2,449,324 |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

28,960,947 |

|

|

Changes in fair value of warrant liabilities |

|

(11,677,720 |

) |

|

|

714,589 |

|

|

Other |

|

199,844 |

|

|

|

(12,139 |

) |

|

(Increase) decrease in digital currencies: |

|

|

|

|

Mining revenue |

|

(25,114,221 |

) |

|

|

(12,921,075 |

) |

|

Net proceeds from sale of digital currencies |

|

28,387,631 |

|

|

|

12,286,573 |

|

|

Unrealized gain on digital currencies |

|

(1,227 |

) |

|

|

— |

|

|

Impairments on digital currencies |

|

— |

|

|

|

71,477 |

|

|

(Increase) decrease in assets: |

|

|

|

|

Accounts receivable |

|

(1,445,198 |

) |

|

|

4,959,865 |

|

|

Prepaid insurance |

|

1,395,842 |

|

|

|

1,336,037 |

|

|

Due from related parties |

|

— |

|

|

|

(68,436 |

) |

|

Inventory |

|

110,889 |

|

|

|

(229,175 |

) |

|

Other assets |

|

(1,092,745 |

) |

|

|

(296,265 |

) |

|

Increase (decrease) in liabilities: |

|

|

|

|

Accounts payable |

|

(400,907 |

) |

|

|

(1,390,895 |

) |

|

Due to related parties |

|

(98,891 |

) |

|

|

237,466 |

|

|

Accrued liabilities |

|

(1,637,806 |

) |

|

|

(1,518,296 |

) |

|

Other liabilities, including contract liabilities |

|

(302,388 |

) |

|

|

(125,146 |

) |

| NET CASH FLOWS

PROVIDED BY (USED IN) OPERATING ACTIVITIES |

|

5,861,410 |

|

|

|

(3,341,466 |

) |

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

Purchases of property, plant and equipment |

|

(244,605 |

) |

|

|

(13,738 |

) |

|

Proceeds from sale of property, plant and equipment, including

CIP |

|

180,000 |

|

|

|

— |

|

| NET CASH FLOWS USED IN

INVESTING ACTIVITIES |

|

(64,605 |

) |

|

|

(13,738 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

Repayments of debt |

|

(1,060,008 |

) |

|

|

(1,836,925 |

) |

|

Repayments of financed insurance premiums |

|

(1,413,803 |

) |

|

|

(1,750,874 |

) |

|

Proceeds from exercise of warrants |

|

— |

|

|

|

273 |

|

| NET CASH FLOWS USED IN

FINANCING ACTIVITIES |

|

(2,473,811 |

) |

|

|

(3,587,526 |

) |

| NET INCREASE

(DECREASE) IN CASH AND CASH EQUIVALENTS |

|

3,322,994 |

|

|

|

(6,942,730 |

) |

| CASH AND CASH

EQUIVALENTS - BEGINNING OF PERIOD |

|

4,214,613 |

|

|

|

13,296,703 |

|

| CASH AND CASH

EQUIVALENTS - END OF PERIOD |

$ |

7,537,607 |

|

|

$ |

6,353,973 |

|

Use and Reconciliation of Non-GAAP

Financial Measures

This press release contains certain non-GAAP

financial measures, including Adjusted EBITDA, as a measure of our

operating performance. Adjusted EBITDA is a non-GAAP financial

measure. We define Adjusted EBITDA as net income (loss) before

interest, taxes, depreciation and amortization, further adjusted by

the removal of one-time transaction costs, non-recurring expenses,

realized gains and losses on the sale of long-term assets, expenses

related to stock-based compensation, gains or losses on derivative

contracts, gain or losses on extinguishment of debt, commissions on

the sale of ash, or changes in the fair value of warrant

liabilities in the period presented. See reconciliation below.

Our board of directors and management team use

Adjusted EBITDA to assess our financial performance because they

believe it allows them to compare our operating performance on a

consistent basis across periods by removing the effects of our

capital structure (such as varying levels of interest expense and

income), asset base (such as depreciation, amortization,

impairments, realized gains and losses on the sale of long-term

assets) and other items (such as one-time transaction costs,

expenses related to stock-based compensation, and gains and losses

on derivative contracts) that impact the comparability of financial

results from period to period. We present Adjusted EBITDA because

we believe it provides useful information regarding the factors and

trends affecting our business in addition to measures calculated

under GAAP. Adjusted EBITDA is not a financial measure presented in

accordance with GAAP. We believe that the presentation of this

non-GAAP financial measure will provide useful information to

investors and analysts in assessing our financial performance and

results of operations across reporting periods by excluding items

we do not believe are indicative of our core operating performance.

Net income (loss) is the GAAP measure most directly comparable to

Adjusted EBITDA. Our non-GAAP financial measure should not be

considered as an alternative to the most directly comparable GAAP

financial measure. You are encouraged to evaluate each of these

adjustments and the reasons we consider them appropriate for

supplemental analysis. In evaluating Adjusted EBITDA, you should be

aware that in the future we may incur expenses that are the same as

or similar to some of the adjustments in such presentation. Our

presentation of Adjusted EBITDA should not be construed as an

inference that our future results will be unaffected by unusual or

non-recurring items. There can be no assurance that we will not

modify the presentation of Adjusted EBITDA in the future, and any

such modification may be material. Adjusted EBITDA has important

limitations as an analytical tool, and you should not consider

Adjusted EBITDA in isolation or as a substitute for analysis of our

results as reported under GAAP. Our presentation of Adjusted EBITDA

should be read in conjunction with the financial statements

furnished in our Form 10-Q for the first quarter ended March 31,

2024, that the Company expects to file on or around May 3, 2024.

Because Adjusted EBITDA may be defined differently by other

companies in our industry, our definition of this non-GAAP

financial measure may not be comparable to similarly titled

measures of other companies, thereby diminishing its utility.

|

STRONGHOLD DIGITAL MINING,

INC.RECONCILIATION OF ADJUSTED

EBITDA |

| |

| |

Three Months Ended |

|

(in thousands) |

March 31,2024 |

|

March 31,2023 |

|

Net Income (Loss)—GAAP |

$ |

5,842 |

|

|

$ |

(46,661 |

) |

| Plus: |

|

|

|

|

Interest expense |

|

2,263 |

|

|

|

2,384 |

|

|

Depreciation and amortization |

|

9,515 |

|

|

|

7,723 |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

28,961 |

|

|

Impairments on digital currencies |

|

— |

|

|

|

71 |

|

|

Non-recurring expenses1 |

|

837 |

|

|

|

682 |

|

|

Stock-based compensation |

|

1,939 |

|

|

|

2,449 |

|

|

Loss on disposal of fixed assets |

|

— |

|

|

|

91 |

|

|

Realized gain on sale of miner assets |

|

(36 |

) |

|

|

— |

|

|

Realized gain on sale of digital currencies2 |

|

— |

|

|

|

(327 |

) |

|

Changes in fair value of warrant liabilities |

|

(11,678 |

) |

|

|

715 |

|

|

Accretion of asset retirement obligation |

|

14 |

|

|

|

13 |

|

|

Adjusted EBITDA—Non-GAAP |

$ |

8,696 |

|

|

$ |

(3,898 |

) |

1 Includes the following non-recurring expenses: One-time legal

fees, out-of-the-ordinary major repairs and upgrades to the power

plant, and other one-time items.2 As previously disclosed, the

Company adopted ASU 2023-08 effective January 1, 2024, using a

modified retrospective transition method, with a cumulative-effect

adjustment of approximately $0.1 million recorded to the opening

balance of retained earnings. For 2024 and beyond, in conjunction

with this accounting change, realized gains and losses on the sale

of digital currencies will no longer be excluded from Adjusted

EBITDA. Following the adoption of ASU 2023-08, realized gains (net

of realized losses) on the sale of digital currencies were

approximately $0.6 million and unrealized gains (net of unrealized

losses) on digital currencies were insignificant for the three

months ended March 31, 2024.

Investor Contact:

Matt Glover or Alex KovtunGateway Group, Inc.

SDIG@gateway-grp.com 1-949-574-3860

Media Contact:

contact@strongholddigitalmining.com

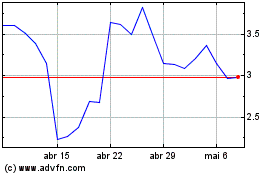

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025