Stronghold Provides May 2024 Bitcoin Mining and Operational Update

07 Junho 2024 - 5:30PM

Stronghold Digital Mining, Inc. (NASDAQ: SDIG) (“Stronghold” or the

“Company”) today provided the following updates regarding its

operations and financial performance:

Bitcoin Mining Update

Stronghold mined 82 Bitcoin in May 2024 and the

Company generated an estimated $5.2 million of revenue during May,

a decrease of 46% compared to April 2024. The primary driver of the

decline was due to the first full month of post-halving operations.

Average hash price in May was $0.052 per TH/s per day compared to

$0.095 in April, largely due to the halving of Bitcoin block awards

from 6.250 to 3.125, a slight decline in Bitcoin price of 0.8%,

lower transaction fees averaging 7.4% in May compared to 25.3% in

April, and partially offset by a decline in network hash rate of

1.2%.

About Stronghold Digital Mining, Inc.

Stronghold is a vertically integrated Bitcoin

mining company with an emphasis on environmentally beneficial

operations. Stronghold houses its miners at its wholly owned and

operated Scrubgrass Plant and Panther Creek Plant, both of which

are low-cost, environmentally beneficial coal refuse power

generation facilities in Pennsylvania.

Forward-Looking Statements of

Stronghold:

Certain statements contained in this press

release, including guidance, constitute “forward-looking

statements.” within the meaning of the Private Securities

Litigation Reform Act of 1995. You can identify forward-looking

statements because they contain words such as “believes,”

“expects,” “may,” “will,” “should,” “seeks,” “approximately,”

“intends,” “plans,” “estimates” or “anticipates” or the negative of

these words and phrases or similar words or phrases which are

predictions of or indicate future events or trends and which do not

relate solely to historical matters. Forward-looking statements and

the business prospects of Stronghold are subject to a number of

risks and uncertainties that may cause Stronghold’s actual results

in future periods to differ materially from the forward-looking

statements. These risks and uncertainties include, among other

things: the hybrid nature of our business model, which is highly

dependent on the price of Bitcoin; our dependence on the level of

demand and financial performance of the crypto asset industry; our

ability to manage growth, business, financial results and results

of operations; uncertainty regarding our evolving business model;

our ability to retain management and key personnel and the

integration of new management; our ability to raise capital to fund

business growth; our ability to maintain sufficient liquidity to

fund operations, growth and acquisitions; our substantial

indebtedness and its effect on our results of operations and our

financial condition; uncertainty regarding the outcomes of any

investigations or proceedings; our ability to enter into purchase

agreements, acquisitions and financing transactions; public health

crises, epidemics, and pandemics such as the coronavirus pandemic;

our ability to procure crypto asset mining equipment, including

from foreign-based suppliers; our ability to maintain our

relationships with our third party brokers and our dependence on

their performance; our ability to procure crypto asset mining

equipment; developments and changes in laws and regulations,

including increased regulation of the crypto asset industry through

legislative action and revised rules and standards applied by The

Financial Crimes Enforcement Network under the authority of the

U.S. Bank Secrecy Act and the Investment Company Act; the future

acceptance and/or widespread use of, and demand for, Bitcoin and

other crypto assets; our ability to respond to price fluctuations

and rapidly changing technology; our ability to operate our coal

refuse power generation facilities as planned; our ability to

develop and monetize our carbon capture project to generate

meaningful revenue, on a timely basis or at all; our ability to

remain listed on a stock exchange and maintain an active trading

market; our ability to avail ourselves of tax credits for the

clean-up of coal refuse piles; and legislative or regulatory

changes, and liability under, or any future inability to comply

with, existing or future energy regulations or requirements. More

information on these risks and other potential factors that could

affect our financial results is included in our filings with the

Securities and Exchange Commission, including in the “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” sections of our Annual Report on Form

10-K filed on March 8, 2024 and in our subsequently filed Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. Any

forward-looking statement or guidance speaks only as of the date as

of which such statement is made, and, except as required by law, we

undertake no obligation to update or revise publicly any

forward-looking statements or guidance, whether because of new

information, future events, or otherwise.

Contacts:

Stronghold Digital Mining, Inc. Investor

Contact:Matt Glover or Alec WilsonGateway Group, Inc.

SDIG@gateway-grp.com1-949-574-3860

Media Contact:contact@strongholddigitalmining.com

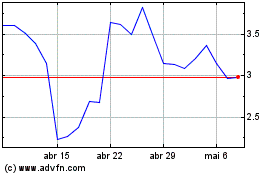

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025