Report of Foreign Issuer (6-k)

13 Novembro 2019 - 2:42PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2019

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA PARANAENSE DE ENERGIA - COPEL

Corporate Taxpayer’s ID (CNPJ): 76.483.817/0001-20

PUBLICLY HELD COMPANY

CVM Registration no. 1431-1

SUMMARY OF THE ONE HUNDRED AND NINETY-SIXTH

ORDINARY BOARD OF DIRECTORS’ MEETING

1. VENUE: Rua Coronel Dulcídio no. 800, city of Curitiba, state of Paraná. 2. DATE: 11/12/2019 - 8:30 a.m. 3. PRESIDING: MARCEL MARTINS MALCZEWSKI - Chairman; and DENISE TEIXEIRA GOMES - Secretary. 4. MATTERS DISCUSSED AND RESOLUTIONS TAKEN:

I. After hearing the Statutory Audit Committee, the Board of Directors unanimously resolved to approve the interim financial statements for the third quarter of 2019 of Copel (Holding).

II. The Board of Directors unanimously resolved to approve the 2020 budget proposal and the limits for budget commitment for future fiscal years, with recommended efforts to reduce PMSO.

III. The Board of Directors unanimously resolved to approve the financial plans and respective targets related to the 2020-2024 Strategic Plan, with suggestions for adjustments by the Board members to be made by the end of 2019.

IV. The Board of Directors unanimously resolved to approve the corporate strategic goals and projects of the 2020-2024 Strategic Plan, with suggestions for adjustments by the Board members to be made by the end of 2019.

V. The Board of Directors unanimously resolved to approve the capital contribution to UEG Araucária Ltda. – UEGA by Copel (Holding) and Copel Geração e Transmissão S.A.

VI. After hearing the Statutory Audit Committee, the Board of Directors unanimously resolved to approve the granting of corporate guarantee, as provided for in the gas purchase contract to be entered into between UEG Araucária Ltda. - UEGA and Petróleo Brasileiro S.A. - Petrobras, subject to a condition subsequent that the contract will be ended if UEGA does not win the Auction A-2/2019.

VII. The Board of Directors unanimously approved the project for the creation of SPE F.D.A. Geração de Energia S.A.

VIII. After hearing the Statutory Audit Committee, the Board of Directors unanimously resolved to approve the revision of the Company’s Risk Management Policy.

IX. After hearing the Statutory Audit Committee, the Board of Directors unanimously resolved to approve the revision of the Company’s strategic risks.

X. The Board of Directors received an information report on the Remediation, Repair and Collaboration Plan within the scope of UEG Araucária Ltda. – UEGA.

XI. The Board of Directors received information on the organizational restructuring of Copel Geração e Transmissão S.A.

XII. After hearing the Statutory Audit Committee, the Board of Directors unanimously approved the extension of the corporate financial guarantee limit for energy purchase contracts entered into by Copel Comercialização S.A.

XIII. The Board of Directors unanimously approved: i. the re-ratification of the minutes of the 195th Ordinary Board of Directors’ Meeting, of October 16, 2019, in order to change, within the scope of fifth (5th) issue of simple unsecured non-convertible debentures, in up to two (2) series, with additional personal guarantee, of Copel Distribuição S.A., a) the maturity term of second series debentures (as established in the 195th Meeting); b) the remuneration of first series debentures (as established in the 195th Meeting); c) the remuneration of second series debentures (as established in the 195th Meeting); and d) the amortization of the nominal unit value of second series debentures (as established in the 195th Meeting); and ii. the

ratification of all other resolutions taken at the 195th Ordinary Board of Directors’ Meeting, as well as all the acts already taken by the Company, represented by its officers and/or proxies, related to the above resolutions.

XIV. The Board of Directors received a report from the Statutory Audit Committee on various matters, discussed the issues and made its recommendations.

XV. The Board of Directors received a report from the CEO regarding various corporate matters.

XVI. The Board of Directors held an executive session.

5. SIGNATURES: MARCEL MARTINS MALCZEWSKI - Chairman; DANIEL PIMENTEL SLAVIERO - Executive Secretary; ADRIANA ANGELA ANTONIOLLI; CARLOS BIEDERMANN; GUSTAVO BONINI GUEDES; LEILA ABRAHAM LORIA; LUIZ CLAUDIO MAIA VIEIRA; MARCO ANTÔNIO BARBOSA CÂNDIDO; OLGA STANKEVICIUS COLPO; and DENISE TEIXEIRA GOMES - Secretary.

The full text of the minutes of the 196th Ordinary Board of Directors’ Meeting was drawn up in the Company’s book no. 11.

DENISE TEIXEIRA GOMES

Secretary

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

COMPANHIA PARANAENSE DE ENERGIA – COPEL

|

|

|

|

|

|

By:

|

/S/ Daniel Pimentel Slaviero

|

|

|

|

Daniel Pimentel Slaviero

Chief Executive Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

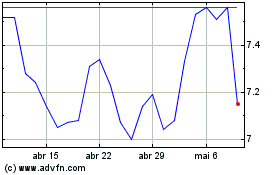

Companhia Parana De Energ (NYSE:ELP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

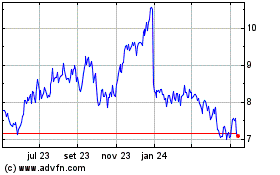

Companhia Parana De Energ (NYSE:ELP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024