Baker Just Beats, Falls Y/Y - Analyst Blog

23 Janeiro 2013 - 9:50AM

Zacks

Baker Hughes Inc.

(BHI) reported fourth quarter 2012 adjusted earnings from

continuing operations of 62 cents a share, which beat the Zacks

Consensus Estimate by a penny on strong international results.

However, the quarterly figure fell 48.3% from the year-ago adjusted

profit level of $1.20 a share.

The year over year underperformance stemmed mainly from unfavorable

pricing conditions in the North American Pressure Pumping business.

Moreover, weak activity in several important markets of Baker

Hughes resulted in an unfavorable mix.

Total revenue of $5,221 million in the quarter declined almost 2%

from the year-ago level of $5,295 million. However, the top line

surpassed the Zacks Consensus Estimate of $5,193 million.

Full-year 2012 adjusted earnings from continuing operations came in

at $3.00 a share, missing our expectation of $3.20 by 6.3% and the

year-ago earnings of $4.14 by 27.5%.

Total revenue of $20,929 million in 2012 increased 7.7% year over

year but was below the Zacks Consensus Estimate of $21,036

million.

Fourth Quarter Segmental Highlights

Of Baker Hughes' total quarterly revenue, North America,

Europe/Africa/Russia/Caspian, Middle East/Asia-Pacific and Latin

America accounted for 49%, 18%, 17% and 12%, respectively. The

remainder was generated by the Industrial Services segment.

An improvement in before-tax profit was noticed in

Europe/Africa/Russia/Caspian, which recorded a profit before-tax

margin of 18% versus 11% in the year-ago quarter, and in Industrial

Services segment with 11% margin (versus 3% in the year-ago

quarter). All other segments registered lackluster pre-tax margins,

with North America coming in at 9% (compared with 15% in the

year-earlier quarter) and Latin America at 1% (versus 3%). Pre-tax

margins at Middle East/Asia-Pacific segment came in at 9% (at par

with the year-earlier quarter).

Liquidity

At the end of the fourth quarter, Baker Hughes had $1,015.0 million

in cash and cash equivalents, while long-term debt was $3,837.0

million, representing a debt-to-capitalization ratio of 18.2%. The

company's capital expenditures were $714.0 million in the

quarter.

Our Take

Baker Hughes, the world's third-largest oilfield services provider

following Schlumberger Ltd. (SLB) and

Halliburton Co. (HAL), holds a Zacks Rank #5

(Strong Sell).

Although Baker Hughes reregistered impressive international growth

and has strong positions in various offshore markets worldwide, its

earnings dropped on an annualized basis during Oct–Dec 2012.

The company’s significant improvement in its Integrated Operations

business in the Middle East and the Gulf of Mexico performance

(which generated 30% growth in 2012) remain overshadowed by the

ongoing pricing pressures, supply chain and raw material

constraints as well as implementation issues on its pressure

pumping business in North America. Its margins were hit

particularly by a fall in the North American pressure pumping

business.

Given these headwinds, we expect the shares of Baker Hughes to be

under pressure in the near future. However, one oilfield service

company, which is expected to perform well in the coming one to

three months, is Hornbeck Offshore Services, Inc

(HOS). It carries a Zacks Rank #2 (Buy).

BAKER-HUGHES (BHI): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

HORNBECK OFFSHR (HOS): Free Stock Analysis Report

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

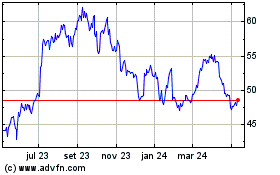

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Schlumberger (NYSE:SLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024