Company to present at ICR Conference 2023

Tuesday, January 10th at 1:30 p.m. EST

Build-A-Bear Workshop, Inc. (NYSE: BBW) updated its financial

guidance for the 2022 fiscal year in advance of its participation

at the ICR Conference 2023. The Company expects its fiscal 2022

results to deliver the highest profitability in its 25-year

history.

On a preliminary basis for the 2022 fiscal year (52 weeks ending

January 28, 2023 compared to the 52 weeks ended January 29, 2022),

the Company currently expects:

- Total revenues to be in the range of $460.0 million to $465.0

million, an increase from its previous expectation for total

revenues in the range of $455.0 million to $465.0 million. The

Company reported total revenues of $411.5 million in fiscal

2021;

- Pre-tax income to be in the range of $57.0 million to $63.0

million, an increase from its previous expectation for pre-tax

income in the range of $56.0 million to $63.0 million. The company

reported pre-tax income of $50.7 million in fiscal 2021;

- Earnings before interest, taxes, depreciation and amortization

(EBITDA) to be in the range of $69.5 million to $75.5 million, an

increase from its previous expectation for EBITDA in the range of

$69.0 million to $76.0 million. The Company reported EBITDA of

$63.0 million in fiscal 2021; and

- Capital expenditures to be in the range of $12.0 million to

$14.0 million and depreciation and amortization to be approximately

$12.5 million in fiscal 2022.

The Company’s guidance considers anticipated ongoing

inflationary pressures as well as its plans to mitigate the impact

on its margins. The Company noted that its outlook assumes no

further material changes in the operations of its supply chain

including the ability to receive and ship product on a timely

basis, the macro-economic environment or relevant foreign currency

exchange rates.

Sharon Price John, Build-A-Bear Workshop President and Chief

Executive Officer commented, “We have continued to see positive

momentum in our business throughout the current fourth quarter and

combined with our record-breaking profit in the first nine-month

period, we expect fiscal 2022 to deliver a double-digit increase in

profitability compared to the prior year which would be the most

profitable in our 25 years of operations, which comes on top of the

previous record set in fiscal 2021. Our company has evolved to

become a multi-channel, site-based experience and entertainment

entity with diverse categories that appeal to a broad addressable

demographic and market. Our disciplined execution of our strategic

model and key initiatives has allowed us to build a foundation that

we believe can be leveraged for further profitable growth in 2023

and beyond.”

The Company is scheduled to participate at the ICR Conference

2023 being held at the Grande Lakes Orlando on January 9, 2023

through January 11, 2023. The Company expects to conduct a fireside

chat presentation on Tuesday, January 10, 2023, at 1:30 p.m. EST.

The audio portion of the presentation will be broadcast over the

internet and can be accessed at the Company’s investor relations

website, http://IR.buildabear.com. A replay of the broadcast will

remain on the Company’s investor relations website for one

year.

The Company noted that it expects to report full results for the

fourth quarter and fiscal 2022 year in March 2023.

Note Regarding Non-GAAP Financial Measures:

In this press release, the Company’s financial results are

provided both in accordance with generally accepted accounting

principles (GAAP) and using certain non-GAAP financial measures. In

particular, the Company provides projected and historic EBITDA,

which is a non-GAAP financial measure. These projections and

results are included as a complement to results provided in

accordance with GAAP because management believes these non-GAAP

financial measures help identify underlying trends in the Company’s

business and provide useful information to both management and

investors by excluding certain items that may not be indicative of

the Company’s core operating results. These measures should not be

considered a substitute for or superior to GAAP results. These

non-GAAP financial measures are defined and reconciled to the most

comparable GAAP measure later in this document.

About Build-A-Bear Build-A-Bear is a multi-generational

global brand focused on its mission to “add a little more heart to

life” appealing to a wide array of consumer groups who enjoy the

personal expression in making their own “furry friends” to

celebrate and commemorate life moments. Nearly 500 interactive

brick-and-mortar retail locations operated through a variety of

formats provide guests of all ages a hands-on entertaining

experience, which often fosters a lasting and emotional brand

connection. The company also offers engaging e-commerce/digital

purchasing experiences on www.buildabear.com including its online

“Bear-Builder” as well as the new “Bear Builder 3D Workshop”. In

addition, extending its brand power beyond retail, Build-A-Bear

Entertainment, a subsidiary of Build-A-Bear Workshop, Inc., is

dedicated to creating engaging content for kids and adults that

fulfills the company’s mission, while the company also offers

products at wholesale and in non-plush consumer categories via

licensing agreements with leading manufacturers. Build-A-Bear

Workshop, Inc. (NYSE: BBW) posted total revenue of $411.5 million

in fiscal 2021. For more information, visit the Investor Relations

section of buildabear.com.

Forward-Looking Statements: This press release contains

certain statements that are, or may be considered to be,

“forward-looking statements” for the purpose of federal securities

laws, including, but not limited to, statements that reflect our

current views with respect to future events and financial

performance. We generally identify these statements by words or

phrases such as “may,” “might,” “should,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “intend,” “predict,” “future,”

“potential” or “continue,” the negative or any derivative of these

terms and other comparable terminology. All of the information

concerning our future liquidity, future revenues, margins and other

future financial performance and results, achievement of operating

of financial plans or forecasts for future periods, sources and

availability of credit and liquidity, future cash flows and cash

needs, success and results of strategic initiatives and other

future financial performance or financial position, as well as our

assumptions underlying such information, constitute forward-looking

information.

These statements are based only on our current expectations and

projections about future events. Because these forward-looking

statements involve risks and uncertainties, there are important

factors that could cause our actual results, level of activity,

performance or achievements to differ materially from the results,

level of activity, performance or achievements expressed or implied

by these forward-looking statements, including those factors

discussed under the caption entitled “Risks Related to Our

Business” and “Forward-Looking Statements” in our Annual Report on

Form 10-K filed with the Securities and Exchange Commission (“SEC”)

on April 15, 2021 and other periodic reports filed with the SEC

which are incorporated herein.

All of our forward-looking statements are as of the date of this

Press Release only. In each case, actual results may differ

materially from such forward-looking information. We can give no

assurance that such expectations or forward-looking statements will

prove to be correct. An occurrence of or any material adverse

change in one or more of the risk factors or other risks and

uncertainties referred to in this Press Release or included in our

other public disclosures or our other periodic reports or other

documents or filings filed with or furnished to the SEC could

materially and adversely affect our continuing operations and our

future financial results, cash flows, available credit, prospects

and liquidity. Except as required by law, the Company does not

undertake to publicly update or revise its forward-looking

statements, whether as a result of new information, future events

or otherwise.

All other brand names, product names, or trademarks belong to

their respective holders.

* Non-GAAP Financial Measures

BUILD-A-BEAR WORKSHOP, INC. AND SUBSIDIARIES

Reconciliation of GAAP to Non-GAAP Results (dollars in

millions)

New Previous

Projected Projected Actual

2022

2022

2021

Income (loss) before income taxes (pre-tax)

$57.0 - $63.0

$56.0 - $63.0

$50.7

Interest expense (income), net

-

-

-

Depreciation & Amortization

12.5

13

12.3

Earnings before interest, taxes, depreciation and amortization

(EBITDA)

$69.5 - $75.5

$69.0 - $76.0

$63.0

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230109005257/en/

Investors: Voin Todorovic Build-A-Bear Workshop 314.423.8000

x5221

Media: Public Relations PR@buildabear.com

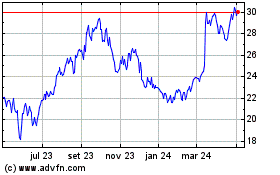

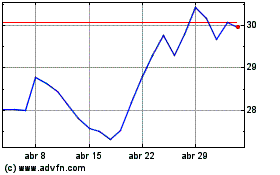

Build A Bear Workshop (NYSE:BBW)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Build A Bear Workshop (NYSE:BBW)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024