Bloom Energy Corporation (NYSE: BE) reported today its total

revenue for the second quarter ended June 30, 2023 grew 24%

compared with the second quarter of 2022. The record revenue for

the quarter was driven by continued growth in Product and Service

revenue.

Second Quarter Highlights

- Revenue of $301.1 million in the second quarter of 2023, an

increase of 23.8% compared to $243.2 million in the second quarter

of 2022. Product and Service revenue of $257.0 million in the

second quarter of 2023, an increase of 21.2% compared to $212.1

million in the second quarter of 2022.

- Gross margin of 18.7% in the second quarter of 2023, an

increase of 19.5 percentage points compared to (0.8%) in the second

quarter of 2022.

- Non-GAAP gross margin of 20.4% in the second quarter of 2023,

an increase of 0.8 percentage points compared to 19.6% in the

second quarter of 2022.

- Operating loss of ($54.5) million in the second quarter of

2023, an improvement of $47.7 million compared to ($102.2) million

in the second quarter of 2022.

- Non-GAAP operating loss of ($25.9) million in the second

quarter of 2023, an increase of ($1.3) million compared to ($24.6)

million in the second quarter of 2022.

Commenting on second quarter results, KR Sridhar, founder,

Chairman and CEO of Bloom Energy, said, “Bloom continued to make

great progress in the second quarter. We grew revenues, reduced

costs, and strengthened our balance sheet. We are dedicated as ever

to building a great company that continues to innovate and offers

real solutions. As we look forward, we are excited about the recent

launch of Series 10 and our enhanced CHP product which we believe

will resonate strongly with customers.”

Greg Cameron, President and CFO of Bloom Energy, added, “We had

record second quarter revenue on strong product shipments. Our

product costs declined 13% over last year, significantly improving

our product margins. With total cash of over $900 million, we are

in a strong liquidity position. We are reaffirming our 2023 outlook

for revenues and profitability.”

Summary of Key Financial Metrics

Preliminary Summary of GAAP Profit and Loss

Statements

($000)

Q2’23

Q1’23

Q2’22

Revenue

301,095

275,191

243,236

Cost of Revenue

244,745

220,924

245,206

Gross Profit

56,350

54,267

(1,970)

Gross Margin

18.7%

19.7%

(0.8%)

Operating Expenses

110,806

117,948

100,203

Operating Loss

(54,456)

(63,681)

(102,173)

Operating Margin

(18.1%)

(23.1%)

(42.0%)

Non-operating Expenses

11,607

7,886

16,627

Net Loss to Common Stockholders

(66,061)

(71,567)

(118,800)

GAAP EPS

($0.32)

($0.35)

($0.67)

Preliminary Summary of Non-GAAP Financial

Information1

($000)

Q2’23

Q1’23

Q2’22

Revenue

301,095

275,191

243,236

Cost of Revenue

239,678

216,763

195,639

Gross Profit

61,418

58,428

47,597

Gross Margin

20.4%

21.2%

19.6%

Operating Expenses

87,357

92,520

72,223

Operating Income (Loss)

(25,939)

(34,092)

(24,626)

Operating Margin

(8.6%)

(12.4%)

(10.1%)

Adjusted EBITDA

(8,421)

(15,942)

(8,314)

Non-GAAP EPS

($0.17)

($0.22)

($0.20)

- A detailed reconciliation of GAAP to Non-GAAP financial

measures is provided at the end of this press release

Outlook

Bloom reaffirms outlook for the full-year 2023:

• Revenue:

$1.4 - $1.5 billion

• Product & Service Revenue:

$1.25 - $1.35 billion

• Non-GAAP Gross Margin:

~25%

• Non-GAAP Operating Margin:

Positive

Conference Call Details

Bloom will host a conference call today, Aug 3, 2023, at 2:00

p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss its financial

results. To participate in the live call, analysts and investors

may call toll-free dial-in number: +1 (888) 330-2443 and

toll-dial-in-number +1 (240) 789-2728. The conference ID is

4781037. A simultaneous live webcast will also be available under

the Investor Relations section on our website at

https://investor.bloomenergy.com/. Following the webcast, an

archived version will be available on Bloom’s website for one year.

A telephonic replay of the conference call will be available for

one week following the call, by dialing +1 (800) 770-2030 or +1

(647) 362 9199 and entering passcode 4781037.

Use of Non-GAAP Financial Measures

This release includes certain non-GAAP financial measures as

defined by the rules and regulations of the Securities and Exchange

Commission (SEC). These non-GAAP financial measures are in addition

to, and not a substitute for or superior to, measures of financial

performance prepared in accordance with U.S. GAAP. There are a

number of limitations related to the use of these non-GAAP

financial measures versus their nearest GAAP equivalents. For

example, other companies may calculate non-GAAP financial measures

differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of our

non-GAAP financial measures as tools for comparison. Bloom urges

you to review the reconciliations of its non-GAAP financial

measures to the most directly comparable U.S. GAAP financial

measures set forth in this press release, and not to rely on any

single financial measure to evaluate our business. With respect to

Bloom’s expectations regarding its 2023 Outlook, Bloom is not able

to provide a quantitative reconciliation of non-GAAP gross margin

and non-GAAP operating margin measures to the corresponding GAAP

measures without unreasonable efforts due to the uncertainty

regarding, and the potential variability of, reconciling items such

as stock-based compensation expense. Material changes to

reconciling items could have a significant effect on future GAAP

results and, as such, we believe that any reconciliation provided

would imply a degree of precision that could be confusing or

misleading to investors.

About Bloom Energy

Bloom Energy empowers businesses and communities to responsibly

take charge of their energy. The company’s leading solid oxide

platform for distributed generation of electricity and hydrogen is

changing the future of energy. Fortune 100 companies turn to Bloom

Energy as a trusted partner to deliver lower carbon energy today

and a net-zero future. For more information, visit

www.bloomenergy.com.

Forward-Looking Statements

This press release contains certain forward-looking statements,

which are subject to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally relate to future events or our future

financial or operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “should,” “will” and “would” or the negative of these words

or similar terms or expressions that concern Bloom’s expectations,

strategy, priorities, plans or intentions. These forward-looking

statements include, but are not limited to, Bloom’s expectations

regarding: innovation and solutions; customer reaction to Bloom’s

products; Bloom’s liquidity position; Bloom’s 2023 outlook for

revenue and profitability. Readers are cautioned that these

forward-looking statements are only predictions and may differ

materially from actual future events or results due to a variety of

factors including, but not limited to: Bloom’s limited operating

history; the emerging nature of the distributed generation market

and rapidly evolving market trends; the significant losses Bloom

has incurred in the past; the significant upfront costs of Bloom’s

Energy Servers and Bloom’s ability to secure financing for its

products; Bloom’s ability to drive cost reductions and to

successfully mitigate against potential price increases; Bloom’s

ability to service its existing debt obligations; Bloom’s ability

to be successful in new markets; the ability of the Bloom Energy

Server to operate on the fuel source a customer will want; the

success of the strategic partnership with SK ecoplant in the United

States and international markets; timing and development of an

ecosystem for the hydrogen market, including in the South Korean

market; continued incentives in the South Korean market; the timing

and pace of adoption of hydrogen for stationary power; the risk of

manufacturing defects; the accuracy of Bloom’s estimates regarding

the useful life of its Energy Servers; delays in the development

and introduction of new products or updates to existing products;

Bloom’s ability to secure partners in order to commercialize its

electrolyzer and carbon capture products; supply constraints; the

availability of rebates, tax credits and other tax benefits;

changes in the regulatory landscape; Bloom’s reliance on tax equity

financing arrangements; Bloom’s reliance upon a limited number of

customers; Bloom’s lengthy sales and installation cycle,

construction, utility interconnection and other delays and cost

overruns related to the installation of its Energy Servers;

business and economic conditions and growth trends in commercial

and industrial energy markets; global macroeconomic conditions,

including rising interest rates, recession fears and inflationary

pressures, or geopolitical events or conflicts; overall electricity

generation market; Bloom’s ability to protect its intellectual

property; and other risks and uncertainties detailed in Bloom’s SEC

filings from time to time. More information on potential factors

that may impact Bloom’s business are set forth in Bloom’s periodic

reports filed with the SEC, including our Annual Report on Form

10-K for the year ended December 31, 2022 as filed with the SEC on

February 21, 2023 and our Quarterly Report on Form 10-Q for the

quarter ended May 31, 2023, as filed with the SEC on May 9, 2023,

as well as subsequent reports filed with or furnished to the SEC

from time to time. These reports are available on Bloom’s website

at www.bloomenergy.com and the SEC’s website at www.sec.gov. Bloom

assumes no obligation to, and does not currently intend to, update

any such forward-looking statements.

The Investor Relations section of Bloom’s website at

investor.bloomenergy.com contains a significant amount of

information about Bloom Energy, including financial and other

information for investors. Bloom encourages investors to visit this

website from time to time, as information is updated and new

information is posted.

Condensed Consolidated Balance Sheets

(preliminary & unaudited)

(in thousands)

June 30,

December 31,

2023

2022

Assets

Current assets:

Cash and cash equivalents1

$

767,055

$

348,498

Restricted cash1

45,811

51,515

Accounts receivable less allowance for

doubtful accounts of $119 as of June 30, 2023 and December 31,

20221

351,021

250,995

Contract assets

35,182

46,727

Inventories1

468,266

268,394

Deferred cost of revenue

53,982

46,191

Loan commitment asset

5,259

—

Prepaid expenses and other current

assets1

49,823

43,643

Total current assets

1,776,399

1,055,963

Property, plant and equipment, net1

606,007

600,414

Operating lease right-of-use assets1

132,452

126,955

Restricted cash1

109,678

118,353

Deferred cost of revenue

4,407

4,737

Loan commitment asset

47,533

—

Other long-term assets1

43,426

40,205

Total assets

$

2,719,902

$

1,946,627

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable1

$

194,503

$

161,770

Accrued warranty

14,906

17,332

Accrued expenses and other current

liabilities1

113,848

144,183

Deferred revenue and customer

deposits1

137,704

159,048

Operating lease liabilities1

17,168

16,227

Financing obligations

29,097

17,363

Recourse debt

—

12,716

Non-recourse debt1

10,814

13,307

Redeemable convertible preferred stock,

Series B

310,508

—

Total current liabilities

828,548

541,946

Deferred revenue and customer

deposits1

26,226

56,392

Operating lease liabilities1

137,667

132,363

Financing obligations

424,811

442,063

Recourse debt1

839,223

273,076

Non-recourse debt1

107,793

112,480

Other long-term liabilities

9,399

9,491

Total liabilities

2,373,667

1,567,811

Commitments and contingencies (Note

12)

Stockholders’ equity:

Common stock: $0.0001 par value; Class A

shares - 600,000,000 shares authorized and 193,506,252 shares and

189,864,722 shares issued and outstanding and Class B shares -

600,000,000 shares authorized and 15,675,130 shares and 15,799,968

shares issued and outstanding at June 30, 2023 and December 31,

2022, respectively

20

20

Additional paid-in capital

4,011,900

3,906,491

Accumulated other comprehensive loss

(2,053

)

(1,251

)

Accumulated deficit

(3,702,111

)

(3,564,483

)

Total equity attributable to Class A and

Class B common stockholders

307,756

340,777

Noncontrolling interest

38,479

38,039

Total stockholders’ equity

$

346,235

$

378,816

Total liabilities and stockholders’

equity

$

2,719,902

$

1,946,627

1We have a variable interest entity

related to PPA V and a joint venture in the Republic of Korea which

represent a portion of the consolidated balances recorded within

these financial statement line items.

Condensed Consolidated Statements

of Operations (preliminary & unaudited)

(in thousands, except per share

data)

Three Months Ended

June 30,

2023

2022

Revenue:

Product

$

214,706

$

173,625

Installation

24,321

12,729

Service

42,298

38,426

Electricity

19,770

18,456

Total revenue

301,095

243,236

Cost of revenue:

Product

145,146

129,419

Installation

26,879

16,730

Service

57,263

41,028

Electricity

15,457

58,029

Total cost of revenue

244,745

245,206

Gross profit (loss)

56,350

(1,970

)

Operating expenses:

Research and development

41,493

41,614

Sales and marketing

26,822

20,475

General and administrative

42,491

38,114

Total operating expenses

110,806

100,203

Loss from operations

(54,456

)

(102,173

)

Interest income

4,357

196

Interest expense

(13,953

)

(13,814

)

Other expense, net

(740

)

(1,191

)

Loss on extinguishment of debt

(2,873

)

(4,233

)

(Loss) gain on revaluation of embedded

derivatives

(1,216

)

38

Loss before income taxes

(68,881

)

(121,177

)

Income tax provision (benefit)

178

(12

)

Net loss

(69,059

)

(121,165

)

Less: Net loss attributable to

noncontrolling interest

(2,998

)

(2,365

)

Net loss attributable to Class A and Class

B common stockholders

(66,061

)

(118,800

)

Less: Net loss attributable to redeemable

noncontrolling interest

—

—

Net loss before portion attributable to

redeemable noncontrolling interest and noncontrolling interest

$

(66,061

)

$

(118,800

)

Net loss per share available to Class A

and Class B common stockholders, basic and diluted

$

(0.32

)

$

(0.67

)

Weighted average shares used to compute

net loss per share available to Class A and Class B common

stockholders, basic and diluted

208,692

178,507

Condensed Consolidated Statement of Cash

Flows (preliminary & unaudited)

(in thousands)

Six Months Ended

June 30,

2023

2022

Cash flows from operating

activities:

Net loss

$

(143,976

)

$

(203,912

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

35,668

30,697

Non-cash lease expense

16,184

8,800

Loss (gain) on disposal of property, plant

and equipment

196

(523

)

Revaluation of derivative contracts

1,099

1,680

Write-off of assets related to PPA

IIIa

—

44,800

Stock-based compensation

55,845

57,774

Amortization of warrants and debt issuance

costs

1,786

1,651

Loss on extinguishment of debt

2,873

4,233

Unrealized foreign currency exchange

loss

1,512

2,276

Other

—

3,487

Changes in operating assets and

liabilities:

Accounts receivable

(99,951

)

8,938

Contract assets

11,544

(8,173

)

Inventories

(197,346

)

(62,824

)

Deferred cost of revenue

(7,544

)

(8,995

)

Customer financing receivable

—

2,510

Prepaid expenses and other current

assets

1,958

(5,813

)

Other long-term assets

3,415

—

Operating lease right-of-use assets and

operating lease liabilities

(15,447

)

2,422

Finance lease liabilities

736

48

Accounts payable

35,894

50,585

Accrued warranty

(2,426

)

—

Accrued expenses and other current

liabilities

(35,719

)

(18,017

)

Deferred revenue and customer deposits

(26,766

)

(10,158

)

Other long-term liabilities

(730

)

—

Net cash used in operating activities

(361,195

)

(98,514

)

Cash flows from investing

activities:

Purchase of property, plant and

equipment

(46,150

)

(44,728

)

Proceeds from sale of property, plant and

equipment

25

—

Net cash used in investing activities

(46,125

)

(44,728

)

Cash flows from financing

activities:

Proceeds from issuance of debt

634,018

—

Payment of debt issuance costs

(15,828

)

—

Repayment of debt of PPA IIIa

—

(30,212

)

Debt make-whole payment related to PPA

IIIa debt

—

(2,413

)

Repayment of recourse debt

(72,852

)

(10,729

)

Proceeds from financing obligations

2,702

—

Repayment of financing obligations

(8,728

)

(16,475

)

Distributions and payments to

noncontrolling interests

—

(4,415

)

Proceeds from issuance of common stock

9,258

5,981

Proceeds from exercise of options

—

1,317

Proceeds from issuance of redeemable

convertible preferred stock

310,957

—

Contributions from noncontrolling

interest

6,979

—

Purchase of capped call related to

convertible notes

(54,522

)

—

Other

(158

)

—

Net cash provided by (used in) financing

activities

811,826

(56,946

)

Effect of exchange rate changes on cash,

cash equivalent and restricted cash

(328

)

(747

)

Net decrease in cash, cash equivalents and

restricted cash

404,178

(200,935

)

Cash, cash equivalents and restricted

cash:

Beginning of period

518,366

615,114

End of period

$

922,544

$

414,179

Reconciliation of GAAP to Non-GAAP

Financial Measures (preliminary & unaudited) (in thousands,

except percentages)

Q223

Q123

Q222

GAAP revenue

301,095

275,191

243,236

GAAP cost of sales

244,745

220,924

245,206

GAAP gross profit (loss)

56,350

54,267

(1,970)

Non-GAAP adjustments:

Stock-based compensation expense

5,067

4,161

4,767

PPA IIIa repowering-related

impairment charges

-

-

44,800

Non-GAAP gross profit

61,417

58,428

47,597

GAAP gross margin %

18.7%

19.7%

(0.8%)

Non-GAAP adjustments

1.7%

1.5%

20.4%

Non-GAAP gross margin %

20.4%

21.2%

19.6%

Q223

Q123

Q222

GAAP loss from operations

(54,456)

(63,681)

(102,173)

Non-GAAP adjustments:

Stock-based compensation expense

28,479

29,553

32,599

PPA IIIa repowering-related

impairment charges

-

-

44,800

Amortization of acquired intangible

assets

37

37

148

Non-GAAP loss from operations

(25,940)

(34,092)

(24,626)

GAAP operating margin %

(18.1%)

(23.1%)

(42.0%)

Non-GAAP adjustments

9.5%

10.8%

31.9%

Non-GAAP operating margin %

(8.6%)

(12.4%)

(10.1%)

Reconciliation of GAAP Net Loss to

non-GAAP Net Loss and Computation of non-GAAP Net Loss per Share

(EPS) (preliminary & unaudited) (in thousands, except per share

data)

Q223

Q123

Q222

Net loss to Common Stockholders

(66,061)

(71,567)

(118,800)

Non-GAAP adjustments:

Add back:

Loss for non-controlling interests

(2,998)

(3,350)

(2,365)

Loss (gain) on derivative liabilities

1,216

(117)

(38)

Goodwill Impairment

-

-

1,957

JV investment loss

-

-

1,446

PPA IIIa repowering-related impairment

charges

-

-

44,800

Loss on extinguishment of debt

2,873

-

4,233

Amortization of acquired intangible

assets

37

37

148

Stock-based compensation expense

28,479

29,553

32,599

Adjusted Net Loss

(36,454)

(45,445)

(36,020)

Net loss to Common Stockholders per

share

($0.32)

($0.35)

($0.67)

Adjusted net loss per share

(EPS)

($0.17)

($0.22)

($0.20)

GAAP weighted average shares outstanding

attributable to common, Basic and Diluted

208,692

206,724

178,507

Reconciliation of GAAP Net Loss to

Adjusted EBITDA (preliminary & unaudited) (in thousands)

Q223

Q123

Q222

Net loss to Common Stockholders

(66,061)

(71,567)

(118,800)

Add back:

Loss for non-controlling interests

(2,998)

(3,350)

(2,365)

Loss (gain) on derivative liabilities

1,216

(117)

(38)

Goodwill Impairment

-

-

1,957

JV investment loss

-

-

1,446

PPA IIIa repowering-related impairment

charges

-

-

44,800

Loss on extinguishment of debt

2,873

-

4,233

Amortization of acquired intangible

assets

37

37

148

Stock-based compensation expense

28,479

29,553

32,599

Adjusted Net Loss

(36,454)

(45,445)

(36,020)

Depreciation & amortization

17,519

18,150

16,313

Income tax provision (benefit)

178

259

(12)

Interest expense (income), Other expense

(income), net

10,336

11,094

11,405

Adjusted EBITDA

(8,421)

(15,942)

(8,314)

Use of non-GAAP financial measures

To supplement Bloom Energy condensed consolidated financial

statement information presented on GAAP basis, Bloom Energy

provides financial measures including non-GAAP gross profit (loss),

non-GAAP gross margin, non-GAAP operating profit (loss), (non-GAAP

earnings from operations), non-GAAP operating profit (loss) margin,

non-GAAP net earnings, non-GAAP basic, diluted net earnings per

share and Adjusted EBITDA. Bloom Energy also provides forecasts of

non-GAAP gross margin and non-GAAP operating margin.

These non-GAAP financial measures are not computed in accordance

with, or as an alternative to, GAAP in the United States.

- The GAAP measure most directly comparable to non-GAAP gross

profit (loss) is gross profit (loss).

- The GAAP measure most directly comparable to non-GAAP gross

margin is gross margin.

- The GAAP measure most directly comparable to non-GAAP operating

profit (loss) (non-GAAP earnings from operations) is operating

profit (loss) (earnings from operations).

- The GAAP measure most directly comparable to non-GAAP operating

margin is operating margin.

- The GAAP measure most directly comparable to non-GAAP net

earnings is net earnings.

- The GAAP measure most directly comparable to non-GAAP diluted

net earnings per share is diluted net earnings per share.

- The GAAP measure most directly comparable to Adjusted EBITDA is

net earnings.

Reconciliations of each of these non-GAAP financial measures to

GAAP information are included in the tables above or elsewhere in

the materials accompanying this news release.

Use and economic substance of non-GAAP financial measures

used by Bloom Energy

Non-GAAP gross profit (loss) and non-GAAP gross margin are

defined to exclude charges relating to stock-based compensation

expense. Non-GAAP operating profit (loss) (non-GAAP earnings from

operations) and non-GAAP operating margin are defined to exclude

any charges relating to stock-based compensation expense and the

amortization of acquired intangible assets. Non-GAAP net earnings

and non-GAAP diluted net earnings per share consist of net earnings

or diluted net earnings per share excluding stock-based

compensation, loss for non-controlling interest, loss on

derivatives liabilities, loss on extinguishment of debt related to

redemption of 10.25% senior secured notes due March 2027, and the

amortization of acquired intangible assets. Adjusted EBITDA is

defined as net loss before interest expense, provision for income

tax, depreciation and amortization expense, stock-based

compensation, amortization of acquired intangible assets, loss for

non-controlling interest, loss on derivatives liabilities and loss

on extinguishment of debt related to redemption of 10.25% senior

secured notes due March 2027.

Bloom Energy management uses these non-GAAP financial measures

for purposes of evaluating Bloom Energy’s historical and

prospective financial performance, as well as Bloom Energy’s

performance relative to its competitors. Bloom Energy believes that

excluding the items mentioned above from these non-GAAP financial

measures allows Bloom Energy management to better understand Bloom

Energy’s consolidated financial performance as management does not

believe that the excluded items are reflective of ongoing operating

results. More specifically, Bloom Energy management excludes each

of those items mentioned above for the following reasons:

- Stock-based compensation expense consists of equity awards

granted based on the estimated fair value of those awards at grant

date. Although stock-based compensation is a key incentive offered

to our employees, Bloom Energy excludes these charges for the

purpose of calculating these non-GAAP measures, primarily because

they are non-cash expenses and such an exclusion facilitates a more

meaningful evaluation of Bloom Energy current operating performance

and comparisons to Bloom Energy operating performance in other

periods.

- Loss for non-controlling interest represents allocation to the

non-controlling interests under the hypothetical liquidation at

book value (HLBV) method and are associated with our Bloom Energy

legacy PPA entities.

- Loss (gain) on derivatives liabilities represents non-cash

adjustments to the fair value of the embedded derivatives.

- Loss on debt extinguishment related to the redemption on July

1, 2023 of 10.25% senior secured notes due March 2027 and comprises

of 4% premium upon redemption of $2.3 million and $0.6 million of

debt issuance cost write off.

- Amortization of acquired intangible assets.

- Adjusted EBITDA is defined as Adjusted Net Income (Loss) before

depreciation and amortization expense, provision for income tax,

interest expense (income), other expense (income), net. We use

Adjusted EBITDA to measure the operating performance of our

business, excluding specifically identified items that we do not

believe directly reflect our core operations and may not be

indicative of our recurring operations.

Material limitations associated with use of non-GAAP

financial measures

These non-GAAP financial measures have limitations as analytical

tools, and these measures should not be considered in isolation or

as a substitute for analysis of Bloom Energy results as reported

under GAAP. Some of the limitations in relying on these non-GAAP

financial measures are:

- Items such as stock-based compensation expense that is excluded

from non-GAAP gross profit (loss), non-GAAP gross margin, non-GAAP

operating expenses, non-GAAP operating profit (loss) (non-GAAP

earnings from operations), non-GAAP operating margin, non-GAAP net

earnings, and non-GAAP diluted net earnings per share can have a

material impact on the equivalent GAAP earnings measure.

- Loss for non-controlling interest, loss (gain) on derivatives

liabilities, though not directly affecting Bloom Energy cash

position, represents the loss (gain) in value of certain assets and

liabilities. The expense associated with this loss (gain) in value

is excluded from non-GAAP net earnings, and non-GAAP diluted net

earnings per share and can have a material impact on the equivalent

GAAP earnings measure.

- Other companies may calculate non-GAAP gross profit, non-GAAP

gross profit margin, non-GAAP operating profit (non-GAAP earnings

from operations), non-GAAP operating profit margin, non-GAAP net

earnings, non-GAAP diluted net earnings per share and Adjusted

EBITDA differently than Bloom Energy does, limiting the usefulness

of those measures for comparative purposes.

Compensation for limitations associated with use of non-GAAP

financial measures

Bloom Energy compensates for the limitations on its use of

non-GAAP financial measures by relying primarily on its GAAP

results and using non-GAAP financial measures only as a supplement.

Bloom Energy also provides a reconciliation of each non-GAAP

financial measure to its most directly comparable GAAP measure

within this news release and in other written materials that

include these non-GAAP financial measures, and Bloom Energy

encourages investors to review those reconciliations carefully.

Usefulness of non-GAAP financial measures to

investors

Bloom Energy believes that providing financial measures

including non-GAAP gross profit (loss), non-GAAP gross margin,

non-GAAP operating profit (non-GAAP earnings from operations),

non-GAAP operating profit (loss) margin, non-GAAP net earnings,

non-GAAP diluted net earnings per share in addition to the related

GAAP measures provides investors with greater transparency to the

information used by Bloom Energy management in its financial and

operational decision making and allows investors to see Bloom

Energy’s results “through the eyes” of management. Bloom Energy

further believes that providing this information better enables

Bloom Energy investors to understand Bloom Energy’s operating

performance and to evaluate the efficacy of the methodology and

information used by Bloom Energy management to evaluate and measure

such performance. Disclosure of these non-GAAP financial measures

also facilitates comparisons of Bloom Energy’s operating

performance with the performance of other companies in Bloom

Energy’s industry that supplement their GAAP results with non-GAAP

financial measures that may be calculated in a similar manner.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230803198038/en/

Investor Relations: Ed Vallejo Bloom Energy +1 (267)

370-9717

Media: Virginia Citrano Bloom Energy

press@bloomenergy.com

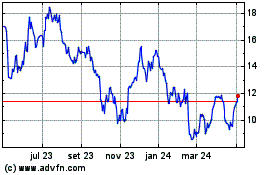

Bloom Energy (NYSE:BE)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

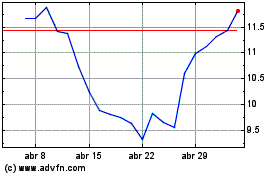

Bloom Energy (NYSE:BE)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024