Comparable Sales Declined 6.2%

GAAP Diluted EPS of $1.25

Non-GAAP Diluted EPS of $1.22

Best Buy Co., Inc. (NYSE: BBY) today announced results for the

13-week second quarter ended July 29, 2023 (“Q2 FY24”), as compared

to the 13-week second quarter ended July 30, 2022 (“Q2 FY23”).

Q2 FY24

Q2 FY23

Revenue ($ in millions)

Enterprise

$

9,583

$

10,329

Domestic segment

$

8,890

$

9,569

International segment

$

693

$

760

Enterprise comparable sales % change1

(6.2

)%

(12.1

)%

Domestic comparable sales % change1

(6.3

)%

(12.7

)%

Domestic comparable online sales %

change1

(7.1

)%

(14.7

)%

International comparable sales %

change1

(5.4

)%

(4.2

)%

Operating Income

GAAP operating income as a % of

revenue

3.6

%

3.6

%

Non-GAAP operating income as a % of

revenue

3.8

%

4.1

%

Diluted Earnings per Share

("EPS")

GAAP diluted EPS

$

1.25

$

1.35

Non-GAAP diluted EPS

$

1.22

$

1.54

For GAAP to non-GAAP reconciliations of the measures referred to

in the above table, please refer to the attached supporting

schedule.

“Today we are reporting second quarter sales results that are at

the high-end of the outlook we shared in May and profitability that

was better than expectations,” said Corie Barry, Best Buy CEO.

“These results continue to demonstrate our strong operational

execution as we balance our reaction to the current industry sales

pressure with our ongoing strategic investments.”

“Our financial results were better than expected, and they

reflect a consumer electronics industry that remains challenged due

to the pull-forward of demand in prior years and the various

macroeconomic factors that we are all too familiar with,” Barry

continued. “With that said, we continue to expect that this year

will be the low point in tech demand after two years of sales

declines. Next year the consumer electronics industry should see

stabilization and possibly growth driven by the natural upgrade and

replacement cycles and the normalization of tech innovation. I am

very proud of the way our teams are managing the business and

preparing for our future, and we remain incredibly excited about

our future opportunities.”

FY24 Financial Guidance

“In May, we noted that we were preparing for a number of

scenarios within our annual guidance range, and we believed our

sales were aligning closer to the midpoint of the annual comparable

sales guidance,” said Matt Bilunas, Best Buy CFO. “Today we are

lowering the high-end of our full year revenue outlook to our

previous midpoint, while keeping the low-end of our revenue

guidance unchanged. At the same time, we are narrowing our

profitability ranges, effectively raising the midpoint of our

previous annual guidance for non-GAAP operating income rate and

non-GAAP diluted EPS.”

Bilunas continued, “As it relates specifically to the third

quarter, we expect our comparable sales to be slightly better than

the negative 6.2% we reported for the second quarter and our

non-GAAP operating income rate to be approximately 3.4%.”

Best Buy’s guidance for FY24, which includes 53 weeks, is the

following:

- Revenue of $43.8 billion to $44.5 billion, which compares to

prior guidance of $43.8 billion to $45.2 billion

- Comparable sales decline of 4.5% to 6.0%, which compares to

prior guidance of a decline of 3.0% to 6.0%

- Enterprise non-GAAP operating income rate2 of 3.9% to 4.1%,

which compares to prior guidance of 3.7% to 4.1%

- Non-GAAP effective income tax rate2 of approximately 24.5%,

which remains unchanged

- Non-GAAP diluted EPS2 of $6.00 to $6.40, which compares to

prior guidance of $5.70 to $6.50

- Capital expenditures of approximately $850 million, which

remains unchanged

Note: Incorporated in the above guidance, the 53rd week is

expected to add approximately $700 million of revenue to Q4 FY24

and provide a benefit of approximately 10 basis points to the

company’s full year non-GAAP operating income rate.2

Domestic Segment Q2 FY24

Results

Domestic Revenue

Domestic revenue of $8.89 billion decreased 7.1% versus last

year primarily driven by a comparable sales decline of 6.3%.

From a merchandising perspective, the largest drivers of the

comparable sales decline on a weighted basis were appliances, home

theater, computing and mobile phones. These drivers were partially

offset by growth in gaming.

Domestic online revenue of $2.76 billion decreased 7.1% on a

comparable basis, and as a percentage of total Domestic revenue,

online revenue was flat to last year at 31.0%.

Domestic Gross Profit Rate

Domestic gross profit rate was 23.1% versus 22.0% last year. The

higher gross profit rate was primarily due to: (1) favorable

product margin rates; (2) improved financial performance from the

company’s membership offerings, which included higher services

margin rates and reduced costs associated with program changes made

to the company’s free membership offering; and (3) an improved

gross profit rate from the company’s Health initiatives.

Domestic Selling, General and Administrative Expenses

(“SG&A”)

Domestic GAAP SG&A was $1.73 billion, or 19.5% of revenue,

versus $1.73 billion, or 18.1% of revenue, last year. On a non-GAAP

basis, SG&A was $1.71 billion, or 19.2% of revenue, versus

$1.71 billion, or 17.9% of revenue, last year. Both GAAP and

non-GAAP SG&A were approximately flat to last year, as higher

incentive compensation was primarily offset by reduced store

payroll expense.

International Segment Q2 FY24

Results

International revenue of $693 million decreased 8.8% versus last

year. This decrease was primarily driven by a comparable sales

decline of 5.4% and the negative impact of approximately 340 basis

points from foreign currency exchange rates.

International operating income was $19 million, or 2.7% of

revenue, compared to $28 million, or 3.7% of revenue, last year.

The lower operating income rate was primarily driven by SG&A

deleverage on lower revenue, which was partially offset by an

improvement in the company’s gross profit rate of approximately 80

basis points compared to last year.

Income Taxes

The Q2 FY24 GAAP effective tax rate was 26.1% versus 15.6% last

year. On a non-GAAP basis, the effective tax rate was 26.6% versus

16.7% last year. The lower GAAP and non-GAAP effective tax rates

last year were primarily due to the resolution of certain discrete

tax matters.

Share Repurchases and

Dividends

In Q2 FY24, the company returned a total of $279 million to

shareholders through dividends of $200 million and share

repurchases of $79 million. On a year-to-date basis, the company

has returned a total of $560 million to shareholders through

dividends of $402 million and share repurchases of $158

million.

Today, the company announced that its board of directors has

authorized the payment of a regular quarterly cash dividend of

$0.92 per common share. The quarterly dividend is payable on

October 10, 2023, to shareholders of record as of the close of

business on September 19, 2023.

Conference Call

Best Buy is scheduled to conduct an earnings conference call at

8:00 a.m. Eastern Time (7:00 a.m. Central Time) on August 29, 2023.

A webcast of the call is expected to be available at

www.investors.bestbuy.com, both live and after the call.

Notes:

(1) The method of calculating comparable sales varies across the

retail industry. As a result, our method of calculating comparable

sales may not be the same as other retailers’ methods. For

additional information on comparable sales, please see our most

recent Annual Report on Form 10-K, and our subsequent Quarterly

Reports on Form 10-Q, filed with the Securities and Exchange

Commission (“SEC”), and available at www.investors.bestbuy.com.

(2) A reconciliation of the projected non-GAAP operating income

rate, non-GAAP effective income tax rate and non-GAAP diluted EPS,

which are forward-looking non-GAAP financial measures, to the most

directly comparable GAAP financial measures, is not provided

because the company is unable to provide such reconciliation

without unreasonable effort. The inability to provide a

reconciliation is due to the uncertainty and inherent difficulty

predicting the occurrence, the financial impact and the periods in

which the non-GAAP adjustments may be recognized. These GAAP

measures may include the impact of such items as restructuring

charges; price-fixing settlements; goodwill impairments; gains and

losses on sales of subsidiaries and certain investments; intangible

asset amortization; certain acquisition-related costs; and the tax

effect of all such items. Historically, the company has excluded

these items from non-GAAP financial measures. The company currently

expects to continue to exclude these items in future disclosures of

non-GAAP financial measures and may also exclude other items that

may arise (collectively, “non-GAAP adjustments”). The decisions and

events that typically lead to the recognition of non-GAAP

adjustments, such as a decision to exit part of the business or

reaching settlement of a legal dispute, are inherently

unpredictable as to if or when they may occur. For the same

reasons, the company is unable to address the probable significance

of the unavailable information, which could be material to future

results.

Forward-Looking and Cautionary Statements:

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 as

contained in Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. You can identify these

statements by the fact that they use words such as "anticipate,"

“appear,” “approximate,” "assume," "believe," “continue,” “could,”

"estimate," "expect," “foresee,” "guidance," "intend," “may,”

“might,” "outlook," "plan," “possible,” "project" “seek,” “should,”

“would,” and other words and terms of similar meaning or the

negatives thereof. Such statements reflect our current views and

estimates with respect to future market conditions, company

performance and financial results, operational investments,

business prospects, our operating model, new strategies and growth

initiatives, the competitive environment, consumer behavior and

other events. These statements involve a number of judgments and

are subject to certain risks and uncertainties, many of which are

outside the control of the Company, that could cause actual results

to differ materially from the potential results discussed in such

forward-looking statements. Readers should review Item 1A, Risk

Factors, of our most recent Annual Report on Form 10-K, and any

updated information in subsequent Quarterly Reports on Form 10-Q,

for a description of important factors that could cause our actual

results to differ materially from those contemplated by the

forward-looking statements made in this release. Among the factors

that could cause actual results and outcomes to differ materially

from those contained in such forward-looking statements are the

following: macroeconomic pressures in the markets in which we

operate (including but not limited to inflation rates, fluctuations

in foreign currency exchange rates, limitations on a government’s

ability to borrow and/or spend capital, fluctuations in housing

prices, energy markets, and jobless rates and effects related to

the conflict in Ukraine or other geopolitical events); catastrophic

events, health crises and pandemics; susceptibility of the products

we sell to technological advancements, product life cycle

fluctuations and changes in consumer preferences; competition

(including from multi-channel retailers, e-commerce business,

technology service providers, traditional store-based retailers,

vendors and mobile network carriers and in the provision of

delivery speed and options); our ability to attract and retain

qualified employees; changes in market compensation rates; our

expansion into health and new products, services and technologies;

our focus on services as a strategic priority; our reliance on key

vendors and mobile network carriers (including product

availability); our ability to maintain positive brand perception

and recognition; our ability to effectively manage strategic

ventures, alliances or acquisitions; our ability to effectively

manage our real estate portfolio; inability of vendors or service

providers to perform components our supply chain (impacting our

stores or other aspects of our operations) and other various

functions of our business; risks arising from and potentially

unique to our exclusive brands products; our reliance on our

information technology systems, internet and telecommunications

access and capabilities; our ability to prevent or effectively

respond to a cyber-attack, privacy or security breach; product

safety and quality concerns; changes to labor or employment laws or

regulations; risks arising from statutory, regulatory and legal

developments (including statutes and/or regulations related to tax

or privacy); evolving corporate governance and public disclosure

regulations and expectations (including, but not limited to,

cybersecurity and environmental, social and governance matters);

risks arising from our international activities (including those

related to the conflict in Ukraine or fluctuations in foreign

currency exchange rates) and those of our vendors; failure to

effectively manage our costs; our dependence on cash flows and net

earnings generated during the fourth fiscal quarter; pricing

investments and promotional activity; economic or regulatory

developments that might affect our ability to provide attractive

promotional financing; constraints in the capital markets; changes

to our vendor credit terms; changes in our credit ratings; failure

to meet financial-performance guidance or other forward-looking

statements; and general economic uncertainty in key global markets

and worsening of global economic conditions or low levels of

economic growth. We caution that the foregoing list of important

factors is not complete. Any forward-looking statements speak only

as of the date they are made and we assume no obligation to update

any forward-looking statement that we may make.

BEST BUY CO., INC.

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

($ and shares in millions, except

per share amounts)

(Unaudited and subject to

reclassification)

Three Months Ended

Six Months Ended

July 29, 2023

July 30, 2022

July 29, 2023

July 30, 2022

Revenue

$

9,583

$

10,329

$

19,050

$

20,976

Cost of sales

7,363

8,042

14,680

16,336

Gross profit

2,220

2,287

4,370

4,640

Gross profit %

23.2

%

22.1

%

22.9

%

22.1

%

Selling, general and administrative

expenses

1,879

1,882

3,727

3,772

SG&A %

19.6

%

18.2

%

19.6

%

18.0

%

Restructuring charges

(7

)

34

(16

)

35

Operating income

348

371

659

833

Operating income %

3.6

%

3.6

%

3.5

%

4.0

%

Other income (expense):

Gain on sale of subsidiary, net

21

-

21

-

Investment income (expense) and other

12

3

33

(2

)

Interest expense

(12

)

(7

)

(24

)

(13

)

Earnings before income tax expense and

equity in income (loss) of affiliates

369

367

689

818

Income tax expense

96

58

171

168

Effective tax rate

26.1

%

15.6

%

24.8

%

20.5

%

Equity in income (loss) of affiliates

1

(3

)

-

(3

)

Net earnings

$

274

$

306

$

518

$

647

Basic earnings per share

$

1.25

$

1.36

$

2.37

$

2.86

Diluted earnings per share

$

1.25

$

1.35

$

2.36

$

2.85

Weighted-average common shares

outstanding:

Basic

218.6

225.4

218.7

226.1

Diluted

219.0

226.1

219.5

227.2

BEST BUY CO., INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

($ in millions)

(Unaudited and subject to

reclassification)

July 29, 2023

July 30, 2022

Assets

Current assets:

Cash and cash equivalents

$

1,093

$

840

Receivables, net

856

840

Merchandise inventories

5,651

6,043

Other current assets

704

621

Total current assets

8,304

8,344

Property and equipment, net

2,305

2,319

Operating lease assets

2,813

2,796

Goodwill

1,383

1,385

Other assets

513

575

Total assets

$

15,318

$

15,419

Liabilities and equity

Current liabilities:

Accounts payable

$

5,471

$

5,406

Unredeemed gift card liabilities

250

273

Deferred revenue

996

1,133

Accrued compensation and related

expenses

377

374

Accrued liabilities

709

820

Current portion of operating lease

liabilities

615

629

Current portion of long-term debt

15

15

Total current liabilities

8,433

8,650

Long-term operating lease liabilities

2,254

2,221

Long-term liabilities

651

472

Long-term debt

1,145

1,184

Equity

2,835

2,892

Total liabilities and equity

$

15,318

$

15,419

BEST BUY CO., INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

($ in millions)

(Unaudited and subject to

reclassification)

Six Months Ended

July 29, 2023

July 30, 2022

Operating activities

Net earnings

$

518

$

647

Adjustments to reconcile net earnings to

total cash provided by (used in) operating activities:

Depreciation and amortization

473

453

Restructuring charges

(16

)

35

Stock-based compensation

75

65

Gain on sale of subsidiary, net

(21

)

-

Other, net

2

19

Changes in operating assets and

liabilities:

Receivables

289

201

Merchandise inventories

(508

)

(79

)

Other assets

(32

)

(13

)

Accounts payable

(206

)

(1,434

)

Income taxes

(148

)

42

Other liabilities

(245

)

(645

)

Total cash provided by (used in) operating

activities

181

(709

)

Investing activities

Additions to property and equipment

(395

)

(441

)

Purchases of investments

(2

)

(46

)

Net proceeds from sale of subsidiary

14

-

Other, net

2

3

Total cash used in investing

activities

(381

)

(484

)

Financing activities

Repurchase of common stock

(158

)

(465

)

Dividends paid

(402

)

(397

)

Other, net

-

1

Total cash used in financing

activities

(560

)

(861

)

Effect of exchange rate changes on cash

and cash equivalents

(2

)

1

Decrease in cash, cash equivalents and

restricted cash

(762

)

(2,053

)

Cash, cash equivalents and restricted

cash at beginning of period

2,253

3,205

Cash, cash equivalents and restricted

cash at end of period

$

1,491

$

1,152

BEST BUY CO., INC.

SEGMENT INFORMATION

($ in millions)

(Unaudited and subject to

reclassification)

Three Months Ended

Six Months Ended

Domestic Segment Results

July 29, 2023

July 30, 2022

July 29, 2023

July 30, 2022

Revenue

$

8,890

$

9,569

$

17,691

$

19,463

Comparable sales % change

(6.3

)%

(12.7

)%

(8.4

)%

(10.6

)%

Comparable online sales % change

(7.1

)%

(14.7

)%

(9.7

)%

(14.8

)%

Gross profit

$

2,052

$

2,109

$

4,044

$

4,279

Gross profit as a % of revenue

23.1

%

22.0

%

22.9

%

22.0

%

SG&A

$

1,730

$

1,732

$

3,440

$

3,473

SG&A as a % of revenue

19.5

%

18.1

%

19.4

%

17.8

%

Operating income

$

329

$

343

$

619

$

772

Operating income as a % of revenue

3.7

%

3.6

%

3.5

%

4.0

%

Domestic Segment Non-GAAP

Results1

Gross profit

$

2,052

$

2,109

$

4,044

$

4,279

Gross profit as a % of revenue

23.1

%

22.0

%

22.9

%

22.0

%

SG&A

$

1,709

$

1,710

$

3,399

$

3,429

SG&A as a % of revenue

19.2

%

17.9

%

19.2

%

17.6

%

Operating income

$

343

$

399

$

645

$

850

Operating income as a % of revenue

3.9

%

4.2

%

3.6

%

4.4

%

Three Months Ended

Six Months Ended

International Segment Results

July 29, 2023

July 30, 2022

July 29, 2023

July 30, 2022

Revenue

$

693

$

760

$

1,359

$

1,513

Comparable sales % change

(5.4

)%

(4.2

)%

(5.5

)%

(2.8

)%

Gross profit

$

168

$

178

$

326

$

361

Gross profit as a % of revenue

24.2

%

23.4

%

24.0

%

23.9

%

SG&A

$

149

$

150

$

287

$

299

SG&A as a % of revenue

21.5

%

19.7

%

21.1

%

19.8

%

Operating income

$

19

$

28

$

40

$

61

Operating income as a % of revenue

2.7

%

3.7

%

2.9

%

4.0

%

International Segment Non-GAAP

Results1

Gross profit

$

168

$

178

$

326

$

361

Gross profit as a % of revenue

24.2

%

23.4

%

24.0

%

23.9

%

SG&A

$

149

$

150

$

287

$

299

SG&A as a % of revenue

21.5

%

19.7

%

21.1

%

19.8

%

Operating income

$

19

$

28

$

39

$

62

Operating income as a % of revenue

2.7

%

3.7

%

2.9

%

4.1

%

(1)

For GAAP to non-GAAP reconciliations,

please refer to the attached supporting schedule titled

Reconciliation of Non-GAAP Financial Measures.

BEST BUY CO., INC.

REVENUE CATEGORY

SUMMARY

(Unaudited and subject to

reclassification)

Revenue Mix

Comparable Sales

Three Months Ended

Three Months Ended

Domestic Segment

July 29, 2023

July 30, 2022

July 29, 2023

July 30, 2022

Computing and Mobile Phones

41

%

42

%

(6.4

)%

(16.6

)%

Consumer Electronics

30

%

30

%

(5.7

)%

(14.7

)%

Appliances

16

%

17

%

(16.1

)%

(1.2

)%

Entertainment

6

%

5

%

9.0

%

(9.2

)%

Services

6

%

5

%

7.6

%

(8.5

)%

Other

1

%

1

%

2.4

%

15.6

%

Total

100

%

100

%

(6.3

)%

(12.7

)%

Revenue Mix

Comparable Sales

Three Months Ended

Three Months Ended

International Segment

July 29, 2023

July 30, 2022

July 29, 2023

July 30, 2022

Computing and Mobile Phones

45

%

43

%

(2.4

)%

(7.6

)%

Consumer Electronics

28

%

29

%

(10.4

)%

(4.8

)%

Appliances

13

%

14

%

(6.1

)%

6.8

%

Entertainment

7

%

7

%

2.5

%

(5.8

)%

Services

5

%

5

%

4.6

%

(0.4

)%

Other

2

%

2

%

(38.1

)%

12.6

%

Total

100

%

100

%

(5.4

)%

(4.2

)%

BEST BUY CO., INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

($ in millions, except per share

amounts)

(Unaudited and subject to

reclassification)

The following information provides

reconciliations of the most comparable financial measures presented

in accordance with accounting principles generally accepted in the

U.S. (GAAP financial measures) to presented non-GAAP financial

measures. The company believes that non-GAAP financial measures,

when reviewed in conjunction with GAAP financial measures, can

provide more information to assist investors in evaluating current

period performance and in assessing future performance. For these

reasons, internal management reporting also includes non-GAAP

financial measures. Generally, presented non-GAAP financial

measures include adjustments for items such as restructuring

charges, goodwill and intangible asset impairments, price-fixing

settlements, gains and losses on subsidiaries and certain

investments, intangible asset amortization, certain

acquisition-related costs and the tax effect of all such items. In

addition, certain other items may be excluded from non-GAAP

financial measures when the company believes this provides greater

clarity to management and investors. These non-GAAP financial

measures should be considered in addition to, and not superior to

or as a substitute for, the GAAP financial measures presented in

this earnings release and the company’s financial statements and

other publicly filed reports. Non-GAAP financial measures as

presented herein may not be comparable to similarly titled measures

used by other companies.

Three Months Ended

Three Months Ended

July 29, 2023

July 30, 2022

Domestic

International

Consolidated

Domestic

International

Consolidated

SG&A

$

1,730

$

149

$

1,879

$

1,732

$

150

$

1,882

% of revenue

19.5

%

21.5

%

19.6

%

18.1

%

19.7

%

18.2

%

Intangible asset amortization1

(21

)

-

(21

)

(22

)

-

(22

)

Non-GAAP SG&A

$

1,709

$

149

$

1,858

$

1,710

$

150

$

1,860

% of revenue

19.2

%

21.5

%

19.4

%

17.9

%

19.7

%

18.0

%

Operating income

$

329

$

19

$

348

$

343

$

28

$

371

% of revenue

3.7

%

2.7

%

3.6

%

3.6

%

3.7

%

3.6

%

Intangible asset amortization1

21

-

21

22

-

22

Restructuring charges2

(7

)

-

(7

)

34

-

34

Non-GAAP operating income

$

343

$

19

$

362

$

399

$

28

$

427

% of revenue

3.9

%

2.7

%

3.8

%

4.2

%

3.7

%

4.1

%

Effective tax rate

26.1

%

15.6

%

Intangible asset amortization1

(0.4

)%

0.4

%

Restructuring charges2

0.4

%

0.7

%

Loss on investments

0.5

%

-

%

Non-GAAP effective tax rate

26.6

%

16.7

%

Three Months Ended

Three Months Ended

July 29, 2023

July 30, 2022

Pretax Earnings

Net of Tax4

Per Share

Pretax Earnings

Net of Tax4

Per Share

Diluted EPS

$

1.25

$

1.35

Intangible asset amortization1

$

21

$

21

0.10

$

22

$

17

0.07

Restructuring charges2

(7

)

(7

)

(0.03

)

34

26

0.12

Loss on investments

2

2

-

-

-

-

Gain on sale of subsidiary, net3

(21

)

(21

)

(0.10

)

-

-

-

Non-GAAP diluted EPS

$

1.22

$

1.54

Six Months Ended

Six Months Ended

July 29, 2023

July 30, 2022

Domestic

International

Consolidated

Domestic

International

Consolidated

SG&A

$

3,440

$

287

$

3,727

$

3,473

$

299

$

3,772

% of revenue

19.4

%

21.1

%

19.6

%

17.8

%

19.8

%

18.0

%

Intangible asset amortization1

(41

)

-

(41

)

(44

)

-

(44

)

Non-GAAP SG&A

$

3,399

$

287

$

3,686

$

3,429

$

299

$

3,728

% of revenue

19.2

%

21.1

%

19.3

%

17.6

%

19.8

%

17.8

%

Operating income

$

619

$

40

$

659

$

772

$

61

$

833

% of revenue

3.5

%

2.9

%

3.5

%

4.0

%

4.0

%

4.0

%

Intangible asset amortization1

41

-

41

44

-

44

Restructuring charges2

(15

)

(1

)

(16

)

34

1

35

Non-GAAP operating income

$

645

$

39

$

684

$

850

$

62

$

912

% of revenue

3.6

%

2.9

%

3.6

%

4.4

%

4.1

%

4.3

%

Effective tax rate

24.8

%

20.5

%

Intangible asset amortization1

0.4

%

0.2

%

Restructuring charges2

(0.1

)%

0.1

%

Non-GAAP effective tax rate

25.1

%

20.8

%

Six Months Ended

Six Months Ended

July 29, 2023

July 30, 2022

Pretax Earnings

Net of Tax4

Per Share

Pretax Earnings

Net of Tax4

Per Share

Diluted EPS

$

2.36

$

2.85

Intangible asset amortization1

$

41

$

36

0.16

$

44

$

34

0.14

Restructuring charges2

(16

)

(14

)

(0.06

)

35

27

0.12

Loss on investments

2

2

0.01

-

-

-

Gain on sale of subsidiary, net3

(21

)

(21

)

(0.10

)

-

-

-

Non-GAAP diluted EPS

$

2.37

$

3.11

(1)

Represents the non-cash amortization of

definite-lived intangible assets associated with acquisitions,

including customer relationships, tradenames and developed

technology assets.

(2)

Represents charges related to employee

termination benefits and subsequent adjustments from

higher-than-expected employee retention related to previously

planned organizational changes.

(3)

Represents the gain on sale of a Mexico

subsidiary subsequent to our exit from operations in Mexico.

(4)

The non-GAAP adjustments primarily relate

to the U.S. and Mexico. As such, the forecasted annual income tax

charge on the U.S. non-GAAP adjustments is calculated using the

statutory tax rate of 24.5%. There is no forecasted annual income

tax benefit for Mexico non-GAAP items, as there is no forecasted

annual tax expense on the income in the calculation of GAAP income

tax expense.

Return

on Assets and Non-GAAP Return on Investment

The tables below provide calculations of

return on assets ("ROA") (GAAP financial measure) and non-GAAP

return on investment (“ROI”) (non-GAAP financial measure) for the

periods presented. The company believes ROA is the most directly

comparable financial measure to ROI. Non-GAAP ROI is defined as

non-GAAP adjusted operating income after tax divided by average

invested operating assets. All periods presented below apply this

methodology consistently. The company believes non-GAAP ROI is a

meaningful metric for investors to evaluate capital efficiency

because it measures how key assets are deployed by adjusting

operating income and total assets for the items noted below. This

method of determining non-GAAP ROI may differ from other companies'

methods and therefore may not be comparable to those used by other

companies.

Return on Assets ("ROA")

July 29, 20231

July 30, 20221

Net earnings

$

1,290

$

1,772

Total assets

16,130

17,702

ROA

8.0

%

10.0

%

Non-GAAP Return on Investment

("ROI")

July 29, 20231

July 30, 20221

Numerator

Operating income

$

1,621

$

2,306

Add: Non-GAAP operating income

adjustments2

179

136

Add: Operating lease interest3

113

110

Less: Income taxes4

(469

)

(625

)

Add: Depreciation

855

806

Add: Operating lease amortization5

666

653

Adjusted operating income after

tax

$

2,965

$

3,386

Denominator

Total assets

$

16,130

$

17,702

Less: Excess cash6

(346

)

(1,374

)

Add: Accumulated depreciation and

amortization7

5,071

6,212

Less: Adjusted current liabilities8

(8,706

)

(9,866

)

Average invested operating

assets

$

12,149

$

12,674

Non-GAAP ROI

24.4

%

26.7

%

(1)

Income statement accounts represent the

activity for the trailing 12 months ended as of each of the balance

sheet dates. Balance sheet accounts represent the average account

balances for the trailing 12 months ended as of each of the balance

sheet dates.

(2)

Non-GAAP operating income adjustments

include continuing operations adjustments for intangible asset

amortization and restructuring charges. Additional details

regarding these adjustments are included in the Reconciliation of

Non-GAAP Financial Measures schedule within the company’s earnings

releases.

(3)

Operating lease interest represents the

add-back to operating income to approximate the total interest

expense that the company would incur if its operating leases were

owned and financed by debt. The add-back is approximated by

multiplying average operating lease assets by 4%, which

approximates the interest rate on the company’s operating lease

liabilities.

(4)

Income taxes are approximated by using a

blended statutory rate at the Enterprise level based on statutory

rates from the countries in which the company does business, which

primarily consists of the U.S. with a statutory rate of 24.5% for

the periods presented.

(5)

Operating lease amortization represents

operating lease cost less operating lease interest. Operating lease

cost includes short-term leases, which are immaterial, and excludes

variable lease costs as these costs are not included in the

operating lease asset balance.

(6)

Excess cash represents the amount of cash,

cash equivalents and short-term investments greater than $1

billion, which approximates the amount of cash the company believes

is necessary to run the business and may fluctuate over time.

(7)

Accumulated depreciation and amortization

represents accumulated depreciation related to property and

equipment and accumulated amortization related to definite-lived

intangible assets.

(8)

Adjusted current liabilities represent

total current liabilities less short-term debt and the current

portions of operating lease liabilities and long-term debt.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230828127131/en/

Investor Contact: Mollie O'Brien

mollie.obrien@bestbuy.com

Media Contact: Carly Charlson

carly.charlson@bestbuy.com

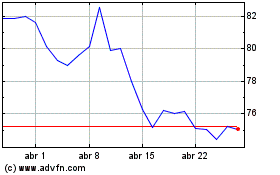

Best Buy (NYSE:BBY)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Best Buy (NYSE:BBY)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024