VF Corporation (NYSE: VFC) today reported financial results for

its first quarter (Q1'FY25) ended June 29, 2024, announcing a

quarterly per share dividend of $0.09.

Bracken Darrell, President and CEO, said: "As I complete

my first year at VF, I feel more energized than ever. While the

business is still down, the rate of decline moderated

quarter-over-quarter versus Q4 and across almost all our brands. We

advanced further on the Reinvent transformation plan. We are on

track to deliver our targeted cost savings and we have addressed

one of our top financial priorities to strengthen the balance sheet

with the announced sale of Supreme. Together with the first-class

leadership team I have built, we are confident we will continue to

make progress to return to growth and drive strong, sustainable

value creation at VF."

Q1'FY25 Financial Review

- Revenue $1.9 billion, down 9% (down 8% in constant dollars)

- The North Face® down 3% (down 2% in constant dollars), with

global brand DTC up 6% (up 8% in constant dollars), inclusive of

broad-based DTC growth in all regions, more than offset by US

wholesale

- Vans® down 21%, reflecting a modest improvement relative to the

previous quarter

- Gross margin 52.0%, down 80 basis points

- Gross margin contraction driven by 60 basis points of

unfavorable rate, which includes foreign currency headwinds, and 20

basis points from unfavorable mix

- Operating margin (12.6)%, down 1,220 basis points; adjusted

operating margin (4.0)%, down 360 basis points

- Adjusted operating margin reflects approximately 280 basis

points of deleverage and 80 basis points of unfavorable gross

margin

- Loss per share $(0.67) vs. Q1'FY24 $(0.15); adjusted loss per

share $(0.33) vs. Q1'FY24 $(0.15)

Balance Sheet Review

- Q1'FY25 ending inventories down 24% versus the prior year

- Net debt at the end of Q1'FY25 is $5.3 billion, down by

approximately $587 million relative to last year

FY25 Outlook

- The company reiterates guidance for free cash flow plus the

proceeds from non-core physical asset sales of approximately $600

million, excluding the impact of the divestiture of Supreme, which

is anticipated to be completed by the end of calendar year 2024.

Supreme is expected to be reported as discontinued operations

beginning in Q2'FY25.

Shareholder Returns

- Return of $35 million to shareholders through cash dividends in

Q1'FY25

- VF’s Board of Directors declared a quarterly dividend of $0.09

per share. This dividend will be payable on September 18, 2024, to

shareholders of record at the close of business on September 10,

2024. Subject to approval by its Board of Directors, VF intends to

continue to pay quarterly dividends.

Summary Revenue

Information

(Unaudited)

Three Months Ended

June

(Dollars in millions)

2024

2023

% Change

% Change (constant currency)

Brand:

The North Face®

$

524.2

$

538.2

(3

)%

(2

)%

Vans®

581.8

737.5

(21

)%

(21

)%

Timberland®

229.4

253.8

(10

)%

(9

)%

Dickies®

116.8

136.6

(15

)%

(14

)%

Other Brands

455.0

420.2

8

%

10

%

VF Revenue

$

1,907.3

$

2,086.3

(9

)%

(8

)%

Region:

Americas

$

1,044.8

$

1,183.8

(12

)%

(12

)%

EMEA

552.9

584.3

(5

)%

(5

)%

APAC

309.7

318.2

(3

)%

2

%

VF Revenue

$

1,907.3

$

2,086.3

(9

)%

(8

)%

International

$

978.9

$

1,026.7

(5

)%

(3

)%

Channel:

DTC

$

879.2

$

973.6

(10

)%

(9

)%

Wholesale (a)

1,028.1

1,112.7

(8

)%

(7

)%

VF Revenue

$

1,907.3

$

2,086.3

(9

)%

(8

)%

All references to the three months ended

June 2024 relate to the 13-week fiscal period ended June 29, 2024

and all references to the three months ended June 2023 relate to

the 13-week fiscal period ended July 1, 2023.

Note: Amounts may not sum due to

rounding

(a) Royalty revenues are included in the

wholesale channel for all periods.

Webcast Information

VF will host its first quarter fiscal 2025 conference call

beginning at 4:30 p.m. Eastern Time today. The conference call will

be broadcast live via the Internet, accessible at ir.vfc.com. For

those unable to listen to the live broadcast, an archived version

will be available at the same location.

About VF

Founded in 1899, VF Corporation is one of the world’s largest

apparel, footwear and accessories companies connecting people to

the lifestyles, activities and experiences they cherish most

through a family of iconic outdoor, active and workwear brands

including The North Face®, Vans®, Timberland® and Dickies®. Our

purpose is to power movements of sustainable and active lifestyles

for the betterment of people and our planet. We connect this

purpose with a relentless drive to succeed to create value for all

stakeholders and use our company as a force for good. For more

information, please visit vfc.com.

Financial Presentation Disclosure

All per share amounts are presented on a diluted basis. This

release refers to “reported” and “constant dollar” or "constant

currency" amounts, terms that are described under the heading below

“Constant Currency - Excluding the Impact of Foreign Currency.”

Unless otherwise noted, “reported” and “constant dollar” or

"constant currency" amounts are the same. This release also refers

to “adjusted” amounts, a term that is described under the heading

below “Adjusted Amounts - Excluding Reinvent, Noncash Impairment

Charges, and Transaction and Deal Related Activities.” Unless

otherwise noted, “reported” and “adjusted” amounts are the

same.

Constant Currency - Excluding the Impact of Foreign

Currency

This release refers to “reported” amounts in accordance with

U.S. generally accepted accounting principles (“GAAP”), which

include translation and transactional impacts from foreign currency

exchange rates. This release also refers to both “constant dollar”

and "constant currency" amounts, which exclude the impact of

translating foreign currencies into U.S. dollars. Reconciliations

of GAAP measures to constant currency amounts are presented in the

supplemental financial information included with this release,

which identifies and quantifies all excluded items, and provides

management’s view of why this information is useful to

investors.

Adjusted Amounts - Excluding Reinvent, Noncash Impairment

Charges, and Transaction and Deal Related Activities

The adjusted amounts in this release exclude costs related to

Reinvent, VF's transformation program. Costs, including exit costs

and project-related costs, were approximately $18 million in the

first quarter of fiscal 2025.

The adjusted amounts in this release exclude noncash impairment

charges related to the Supreme reporting unit goodwill and

indefinite-lived trademark intangible asset of approximately $145

million in the first quarter of fiscal 2025.

The adjusted amounts in this release exclude transaction and

deal related activities associated with the review of strategic

alternatives for the Global Packs business, consisting of the

Kipling®, Eastpak® and JanSport® brands. Total transaction and deal

related activities include costs of approximately $0.5 million in

the first quarter of fiscal 2025.

Combined, the above items negatively impacted loss per share by

$0.34 during the first quarter of fiscal 2025. All adjusted amounts

referenced herein exclude the effects of these amounts.

Reconciliations of measures calculated in accordance with GAAP

to adjusted amounts are presented in the supplemental financial

information included with this release, which identifies and

quantifies all excluded items, and provides management’s view of

why this information is useful to investors. The company also

provides guidance on a non-GAAP basis as we cannot predict certain

elements which are included in reported GAAP results. VF defines

free cash flow as cash flow from operations less capital

expenditures and software purchases and defines net debt as short

and long term borrowings less cash and cash equivalents.

Forward-looking Statements

Certain statements included in this release are "forward-looking

statements" within the meaning of the federal securities laws.

Forward-looking statements are made based on our expectations and

beliefs concerning future events impacting VF and therefore involve

several risks and uncertainties. You can identify these statements

by the fact that they use words such as “will,” “anticipate,”

"believe," “estimate,” “expect,” “should,” and “may” and other

words and terms of similar meaning or use of future dates, however,

the absence of these words or similar expressions does not mean

that a statement is not forward-looking. All statements regarding

VF’s plans, objectives, projections and expectations relating to

VF’s operations or financial performance, and assumptions related

thereto are forward-looking statements. We caution that

forward-looking statements are not guarantees and that actual

results could differ materially from those expressed or implied in

the forward-looking statements. VF undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as required by law. Potential risks and uncertainties that could

cause the actual results of operations or financial condition of VF

to differ materially from those expressed or implied by

forward-looking statements include, but are not limited to: the

level of consumer demand for apparel and footwear; disruption to

VF’s distribution system; changes in global economic conditions and

the financial strength of VF’s consumers and customers, including

as a result of current inflationary pressures; fluctuations in the

price, availability and quality of raw materials and finished

products; disruption and volatility in the global capital and

credit markets; VF’s response to changing fashion trends, evolving

consumer preferences and changing patterns of consumer behavior;

VF's ability to maintain the image, health and equity of its

brands, including through investment in brand building and product

innovation; intense competition from online retailers and other

direct-to-consumer business risks; increasing pressure on margins;

retail industry changes and challenges; VF's ability to execute our

Reinvent transformation program and other business priorities,

including measures to streamline and right-size our cost base and

strengthen the balance sheet while reducing leverage, including any

sale of the Supreme® brand business; VF’s ability to successfully

establish a global commercial organization, and identify and

capture efficiencies in our business model; any inability of VF or

third parties on which we rely, to maintain the strength and

security of information technology systems; the fact that VF’s

facilities and systems, and those of third parties on which we

rely, are frequent targets of cyber-attacks of varying levels of

severity, and may in the future be vulnerable to such attacks, and

any inability or failure by us or such third parties to anticipate

or detect data or information security breaches or other

cyber-attacks, including the cyber incident that was reported by VF

in December 2023, could result in data or financial loss,

reputational harm, business disruption, damage to our relationships

with customers, consumers, employees and third parties on which we

rely, litigation, regulatory investigations, enforcement actions or

other negative impacts; any inability by VF or third parties on

which we rely to properly collect, use, manage and secure business,

consumer and employee data and comply with privacy and security

regulations; VF’s ability to adopt new technologies, including

artificial intelligence, in a competitive and responsible manner;

foreign currency fluctuations; stability of VF's vendors'

manufacturing facilities and VF's ability to establish and maintain

effective supply chain capabilities; continued use by VF’s

suppliers of ethical business practices; VF’s ability to accurately

forecast demand for products; actions of activist and other

shareholders; VF's ability to recruit, develop or retain key

executive or employee talent or successfully transition executives;

continuity of members of VF’s management; changes in the

availability and cost of labor; VF’s ability to protect trademarks

and other intellectual property rights; possible goodwill and other

asset impairment such as the impairment charges related to the

Supreme reporting unit goodwill and indefinite-lived trademark

intangible asset; maintenance by VF’s licensees and distributors of

the value of VF’s brands; VF’s ability to execute acquisitions and

dispositions, integrate acquisitions and manage its brand

portfolio, including the proposed sale of the Supreme® brand

business; whether and when the required regulatory approvals for

the proposed sale of the Supreme® brand business will be obtained,

whether and when the closing conditions will be satisfied and

whether and when the proposed sale of the Supreme® brand business

will close, if at all; our ability to execute, and realize

benefits, successfully, or at all, from the proposed sale of the

Supreme® brand business; business resiliency in response to natural

or man-made economic, public health, cyber, political or

environmental disruptions; changes in tax laws and additional tax

liabilities; legal, regulatory, political, economic, and

geopolitical risks, including those related to the current

conflicts in Ukraine and the Middle East and tensions between the

U.S. and China; changes to laws and regulations; adverse or

unexpected weather conditions, including any potential effects from

climate change; VF's indebtedness and its ability to obtain

financing on favorable terms, if needed, could prevent VF from

fulfilling its financial obligations; VF's ability to pay and

declare dividends or repurchase its stock in the future; climate

change and increased focus on environmental, social and governance

issues; VF's ability to execute on its sustainability strategy and

achieve its sustainability-related goals and targets; risks arising

from the widespread outbreak of an illness or any other

communicable disease, or any other public health crisis, including

the coronavirus (COVID-19) global pandemic; and tax risks

associated with the spin-off of our Jeanswear business completed in

2019. More information on potential factors that could affect VF’s

financial results is included from time to time in VF’s public

reports filed with the SEC, including VF’s Annual Report on Form

10-K, and Quarterly Reports on Form 10-Q, and Forms 8-K filed or

furnished with the SEC.

VF CORPORATION

Condensed Consolidated

Statements of Operations

(Unaudited)

(In thousands, except per

share amounts)

Three Months Ended

June

2024

2023

Net revenues

$

1,907,301

$

2,086,336

Costs and operating expenses

Cost of goods sold

915,643

985,269

Selling, general and administrative

expenses

1,086,551

1,110,059

Impairment of goodwill and intangible

assets

145,000

—

Total costs and operating expenses

2,147,194

2,095,328

Operating loss

(239,893

)

(8,992

)

Interest expense, net

(55,677

)

(49,719

)

Other income (expense), net

(1,950

)

(3,567

)

Loss before income taxes

(297,520

)

(62,278

)

Income tax benefit

(38,634

)

(4,853

)

Net loss

$

(258,886

)

$

(57,425

)

Net loss per common share (a)

Basic

$

(0.67

)

$

(0.15

)

Diluted

$

(0.67

)

$

(0.15

)

Weighted average shares

outstanding

Basic

388,741

388,160

Diluted

388,741

388,160

Cash dividends per common share

$

0.09

$

0.30

Basis of presentation of condensed

consolidated financial statements: VF operates and reports

using a 52/53 week fiscal year ending on the Saturday closest to

March 31 of each year. For presentation purposes herein, all

references to the three months ended June 2024 and June 2023 relate

to the 13-week fiscal period ended June 29, 2024 and the 13-week

fiscal period ended July 1, 2023, respectively. References to March

2024 relate to information as of March 30, 2024.

(a) Amounts have been calculated using

unrounded numbers.

VF CORPORATION

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

June

March

June

2024

2024

2023

ASSETS

Current assets

Cash and equivalents

$

637,420

$

674,605

$

806,529

Accounts receivable, net

1,055,571

1,273,965

1,214,223

Inventories

2,110,598

1,766,366

2,787,021

Other current assets

545,542

512,011

405,784

Total current assets

4,349,131

4,226,947

5,213,557

Property, plant and equipment,

net

794,212

823,886

943,163

Goodwill and intangible assets,

net

3,932,547

4,088,896

4,614,442

Operating lease right-of-use

assets

1,332,950

1,330,361

1,349,725

Other assets

1,132,523

1,142,873

1,923,011

Total assets

$

11,541,363

$

11,612,963

$

14,043,898

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

Short-term borrowings

$

263,709

$

263,938

$

58,520

Current portion of long-term debt

1,749,601

1,000,721

928,736

Accounts payable

1,157,755

817,128

1,282,313

Accrued liabilities

1,237,909

1,375,192

1,546,866

Total current liabilities

4,408,974

3,456,979

3,816,435

Long-term debt

3,940,668

4,702,284

5,722,448

Operating lease liabilities

1,167,415

1,156,858

1,155,852

Other liabilities

636,401

638,477

632,400

Total liabilities

10,153,458

9,954,598

11,327,135

Stockholders' equity

1,387,905

1,658,365

2,716,763

Total liabilities and stockholders'

equity

$

11,541,363

$

11,612,963

$

14,043,898

VF CORPORATION

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

(In thousands)

Three Months Ended

June

2024

2023

Operating activities

Net loss

$

(258,886

)

$

(57,425

)

Impairment of goodwill and intangible

assets

145,000

—

Depreciation and amortization

67,781

67,075

Reduction in the carrying amount of

right-of-use assets

92,495

95,728

Other adjustments, including changes in

operating assets and liabilities

(26,560

)

58,197

Cash provided by operating activities

19,830

163,575

Investing activities

Proceeds from sale of assets

45,596

1,170

Capital expenditures

(25,187

)

(61,763

)

Software purchases

(16,106

)

(22,827

)

Other, net

(15,364

)

(7,142

)

Cash used by investing activities

(11,061

)

(90,562

)

Financing activities

Net increase (decrease) from short-term

borrowings and long-term debt

(505

)

46,415

Cash dividends paid

(35,015

)

(116,575

)

Proceeds from issuance of Common Stock,

net of payments for tax withholdings

(1,924

)

(1,725

)

Cash used by financing activities

(37,444

)

(71,885

)

Effect of foreign currency rate changes

on cash, cash equivalents and restricted cash

(8,340

)

(9,326

)

Net change in cash, cash equivalents

and restricted cash

(37,015

)

(8,198

)

Cash, cash equivalents and restricted

cash – beginning of year

676,957

816,319

Cash, cash equivalents and restricted

cash – end of period

$

639,942

$

808,121

VF CORPORATION

Supplemental Financial

Information

Reportable Segment

Information

(Unaudited)

(In thousands)

Three Months Ended

June

% Change

% Change Constant Currency

(a)

2024

2023

Segment revenues

Outdoor

$

790,199

$

829,697

(5)%

(4)%

Active

942,139

1,066,009

(12)%

(11)%

Work

174,963

190,630

(8)%

(8)%

Total segment revenues

$

1,907,301

$

2,086,336

(9)%

(8)%

Segment profit (loss)

Outdoor

$

(83,415

)

$

(43,661

)

Active

98,549

123,782

Work

5,328

6,831

Total segment profit

20,462

86,952

Impairment of goodwill and intangible

assets

(145,000

)

—

Corporate and other expenses

(117,305

)

(99,511

)

Interest expense, net

(55,677

)

(49,719

)

Loss before income taxes

$

(297,520

)

$

(62,278

)

(a) Refer to constant currency definition

on the following pages.

VF CORPORATION

Supplemental Financial

Information

Reportable Segment Information

– Constant Currency Basis

(Unaudited)

(In thousands)

Three Months Ended June

2024

As Reported

Adjust for Foreign

under GAAP

Currency Exchange

Constant Currency

Segment revenues

Outdoor

$

790,199

$

6,688

$

796,887

Active

942,139

8,682

950,821

Work

174,963

883

175,846

Total segment revenues

$

1,907,301

$

16,253

$

1,923,554

Segment profit (loss)

Outdoor

$

(83,415

)

$

788

$

(82,627

)

Active

98,549

2,918

101,467

Work

5,328

(30

)

5,298

Total segment profit

20,462

3,676

24,138

Impairment of goodwill and intangible

assets

(145,000

)

—

(145,000

)

Corporate and other expenses

(117,305

)

(711

)

(118,016

)

Interest expense, net

(55,677

)

—

(55,677

)

Loss before income taxes

$

(297,520

)

$

2,965

$

(294,555

)

Diluted net loss per share

growth

(350

)%

4

%

(346

)%

Constant Currency Financial

Information

VF is a global company that reports

financial information in U.S. dollars in accordance with GAAP.

Foreign currency exchange rate fluctuations affect the amounts

reported by VF from translating its foreign revenues and expenses

into U.S. dollars. These rate fluctuations can have a significant

effect on reported operating results. As a supplement to our

reported operating results, we present constant currency financial

information, which is a non-GAAP financial measure that excludes

the impact of translating foreign currencies into U.S. dollars. We

use constant currency information to provide a framework to assess

how our business performed excluding the effects of changes in the

rates used to calculate foreign currency translation. Management

believes this information is useful to investors to facilitate

comparison of operating results and better identify trends in our

businesses.

To calculate foreign currency translation

on a constant currency basis, operating results for the current

year period for entities reporting in currencies other than the

U.S. dollar are translated into U.S. dollars at the average

exchange rates in effect during the comparable period of the prior

year (rather than the actual exchange rates in effect during the

current year period).

These constant currency performance

measures should be viewed in addition to, and not in lieu of or

superior to, our operating performance measures calculated in

accordance with GAAP. The constant currency information presented

may not be comparable to similarly titled measures reported by

other companies.

VF CORPORATION

Supplemental Financial

Information

Reconciliation of Select GAAP

Measures to Non-GAAP Measures - Three Months Ended June

2024

(Unaudited)

(In thousands, except per

share amounts)

Three Months Ended June 2024

As Reported

under GAAP

Reinvent (a)

Impairment Charges (b)

Transaction and Deal Related

Activities (c)

Adjusted

Revenues

$

1,907,301

$

—

$

—

$

—

$

1,907,301

Gross profit

991,658

412

—

—

992,070

Percent

52.0

%

52.0

%

Operating loss

(239,893

)

17,849

145,000

490

(76,554

)

Percent

(12.6

)%

(4.0

)%

Diluted loss per share (d)

(0.67

)

0.04

0.30

—

(0.33

)

(a) Costs related to Reinvent, VF's

transformation program, including exit costs and project-related

costs, were $17.8 million in the three months ended June 2024.

These costs related primarily to severance and employee-related

benefits. Reinvent resulted in a net tax benefit of $4.1 million in

the three months ended June 2024.

(b) VF recognized noncash impairment

charges related to the Supreme reporting unit goodwill and

indefinite-lived trademark intangible asset of $145.0 million

during the three months ended June 2024. The goodwill impairment

charge related to the estimates of fair value subsequently

confirmed by the transaction price in the definitive agreement for

EssilorLuxottica to acquire the Supreme® brand business signed on

July 16, 2024, and the indefinite-lived trademark intangible asset

impairment charge related to an increase in the market-based

discount rate applied. The impairment charges resulted in a net tax

benefit of $27.9 million in the three months ended June 2024.

(c) Transaction and deal related

activities reflect activities associated with the review of

strategic alternatives for the Global Packs business, consisting of

the Kipling®, Eastpak® and JanSport® brands,

which totaled $0.5 million for the three months ended June 2024.

The transaction and deal related activities resulted in a net tax

benefit of $0.1 million in the three months ended June 2024.

(d) Amounts shown in the table have been

calculated using unrounded numbers. The diluted loss per share

impacts were calculated using 388,741,000 weighted average common

shares for the three months ended June 2024.

Non-GAAP Financial Information

The financial information above has been

presented on a GAAP basis and on an adjusted basis, which excludes

the impact of Reinvent, impairment charges and transaction and deal

related activities. The adjusted presentation provides non-GAAP

measures. Management believes these measures provide investors with

useful supplemental information regarding VF's underlying business

trends and the performance of VF's ongoing operations and are

useful for period-over-period comparisons of such operations.

Management uses the above financial

measures internally in its budgeting and review process and, in

some cases, as a factor in determining compensation. While

management believes that these non-GAAP financial measures are

useful in evaluating the business, this information should be

considered as supplemental in nature and should be viewed in

addition to, and not in lieu of or superior to, VF's operating

performance measures calculated in accordance with GAAP. In

addition, these non-GAAP financial measures may not be the same as

similarly titled measures presented by other companies.

VF CORPORATION

Supplemental Financial

Information

Reconciliation of Select GAAP

Measures to Non-GAAP Measures - Three Months Ended June

2023

(Unaudited)

(In thousands, except per

share amounts)

Three Months Ended June 2023

As Reported

under GAAP

Transaction and Deal Related

Activities (a)

Adjusted

Revenues

$

2,086,336

$

—

$

2,086,336

Gross profit

1,101,067

—

1,101,067

Percent

52.8

%

52.8

%

Operating loss

(8,992

)

1,118

(7,874

)

Percent

(0.4

)%

(0.4

)%

Diluted loss per share (b)

(0.15

)

—

(0.15

)

(a) Transaction and deal related

activities reflect activities associated with the review of

strategic alternatives for the Global Packs business, consisting of

the Kipling®, Eastpak® and JanSport® brands,

which totaled $1.1 million for the three months ended June 2023.

The transaction and deal related activities resulted in a net tax

benefit of $0.3 million in the three months ended June 2023.

(b) Amounts shown in the table have been

calculated using unrounded numbers. The diluted loss per share

impacts were calculated using 388,160,000 weighted average common

shares for the three months ended June 2023.

Non-GAAP Financial Information

The financial information above has been

presented on a GAAP basis and on an adjusted basis, which excludes

the impact of transaction and deal related activities. The adjusted

presentation provides non-GAAP measures. Management believes these

measures provide investors with useful supplemental information

regarding VF's underlying business trends and the performance of

VF's ongoing operations and are useful for period-over-period

comparisons of such operations.

Management uses the above financial

measures internally in its budgeting and review process and, in

some cases, as a factor in determining compensation. While

management believes that these non-GAAP financial measures are

useful in evaluating the business, this information should be

considered as supplemental in nature and should be viewed in

addition to, and not in lieu of or superior to, VF's operating

performance measures calculated in accordance with GAAP. In

addition, these non-GAAP financial measures may not be the same as

similarly titled measures presented by other companies.

VF CORPORATION

Supplemental Financial

Information

Top 4 Brand Revenue

Information

(Unaudited)

Three Months Ended June

2024

Top 4 Brand Revenue Growth

Americas

EMEA

APAC

Global

The North Face®

% change

(10)%

(6)%

30%

(3)%

% change constant currency*

(10)%

(6)%

35%

(2)%

Vans®

% change

(25)%

(3)%

(29)%

(21)%

% change constant currency*

(25)%

(3)%

(27)%

(21)%

Timberland®

% change

2%

(16)%

(25)%

(10)%

% change constant currency*

2%

(15)%

(21)%

(9)%

Dickies®

% change

(13)%

(3)%

(35)%

(15)%

% change constant currency*

(13)%

(2)%

(32)%

(14)%

*Refer to constant currency definition on

previous pages.

VF CORPORATION

Supplemental Financial

Information

Geographic and Channel Revenue

Information

(Unaudited)

Three Months Ended June

2024

% Change

% Change Constant

Currency*

Geographic

Revenue Growth

Americas

(12)%

(12)%

EMEA

(5)%

(5)%

APAC

(3)%

2%

Greater China

0%

4%

International

(5)%

(3)%

Global

(9)%

(8)%

Three Months Ended June

2024

% Change

% Change Constant

Currency*

Channel Revenue

Growth

Wholesale (a)

(8)%

(7)%

Direct-to-consumer

(10)%

(9)%

Digital

(5)%

(4)%

As of June

2024

2023

DTC Store

Count

Total

1,175

1,250

*Refer to constant currency definition on

previous pages.

(a) Royalty revenues are included in the

wholesale channel for all periods.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806789054/en/

Investor Contact: Allegra

Perry ir@vfc.com

Media Contact: Colin Wheeler

corporate_communications@vfc.com

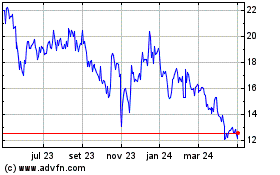

VF (NYSE:VFC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

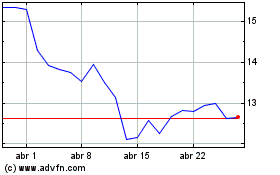

VF (NYSE:VFC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024