Details the Need for Further Change at Bitfarms

in Order to Fix Broken Governance and Enhance Value for All

Shareholders

Reduces Proposed Slate of New Directors From

Three to Two in Light of Bitfarms’ Recent Moves in Response to

Public Pressure from Riot

Warns Bitfarms Not to Take Any Additional

Actions to Entrench the Existing Board Prior to the October 29

Special Meeting

Additional Information Available at

www.ABetterBitfarms.com

Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot”) today issued an

open letter to Bitfarms Ltd. (NASDAQ/TSX: BITF) (“Bitfarms” or the

“Company”) shareholders. The full text of the letter is below:

Dear Fellow Bitfarms Shareholders,

Riot currently owns approximately 19.9% of Bitfarms, making us

Bitfarms’ largest shareholder. As we approach the October 29

special meeting of Bitfarms’ shareholders (the “Special Meeting”),

we want to share our perspectives on the recent actions taken by

Bitfarms, including changes to its Board of Directors (the

“Bitfarms Board”) and the proposed acquisition of Stronghold

Digital Mining, Inc. (“Stronghold”). We also want to provide an

update on our campaign to bring urgently needed change to the

Bitfarms Board.

Further Board Change Is

Needed

Our focus remains on fixing Bitfarms’ broken governance to

enhance value for all shareholders. In order to achieve this

objective, additional fresh perspectives are required in Bitfarms’

boardroom.

Since we initiated our campaign, two of Bitfarms’ three

co-founders – Emiliano Grodzki and Nicolas Bonta – have resigned

from the Bitfarms Board. Notably, Mr. Grodzki only resigned after

shareholders voted not to re-elect him by a significant margin at

Bitfarms’ May 31, 2024 annual and special meeting of shareholders.

Bitfarms subsequently appointed Fanny Philip to replace Mr.

Grodzki, appointed Ben Gagnon as Chief Executive Officer and a

member of the Bitfarms Board to replace Mr. Bonta, and made other

executive leadership changes.

While these changes represent a step in the right direction,

they have been reactive and insufficient to address Bitfarms’

broken governance. These actions followed Riot’s sustained public

pressure and would not have occurred had Riot not challenged the

entrenchment of the Bitfarms Board. The evidence is clear: Bitfarms

needs additional truly independent directors with the experience

and expertise to ensure that decisions about the Company’s strategy

moving forward reflect what is best for all shareholders – not just

what is best for legacy directors whose focus is maintaining their

own positions.

Consider the following examples of the Bitfarms Board’s

defensive posture and prioritizing entrenchment over

engagement:

- Bitfarms’ failed off-market poison pill: The unilateral

adoption of a shareholder rights plan (the “Poison Pill”) with a

15% threshold ran counter to established legal and governance

standards. This entrenching Poison Pill was rightfully invalidated

and cease traded by the Ontario Capital Markets Tribunal in

response to Riot’s application. Had Riot not acted, the Poison Pill

would have prejudiced all Bitfarms’ shareholders and set a damaging

precedent for the Canadian capital markets. The Bitfarms Board knew

better but disregarded these concerns.

- A unilateral Board refresh: On June 27, 2024, Bitfarms

announced the addition of Fanny Philip to the Bitfarms Board.

Bitfarms chose to make this appointment without consulting Riot,

its largest shareholder, even though the Bitfarms Board knew that

we had proposed a slate of highly qualified director nominees and

specifically asked that we be consulted before any board changes

were made.

- The concerning Stronghold acquisition announcement:

Shareholders should seriously question the timing of Bitfarms’

announcement of its agreement to acquire Stronghold,

notwithstanding the pending Special Meeting, and the price that it

was willing to pay. The US$175 million transaction (including US$50

million of assumed debt) represents a greater than 100% premium to

Stronghold’s closing share price on the day prior to the

announcement, which greatly exceeds the premiums of precedent

all-stock transactions in which sellers participate in any

potential upside. Moreover, while announced as a “highly accretive”

transaction with “compelling economics,” shareholders have not yet

been provided an estimate of capital expenditures that will be

required to fund the development of Stronghold’s sites. These

points are especially troubling given that Stronghold was

effectively “for sale” for a significant period of time, with its

strategic review process publicly announced earlier this year, and

clearly no other participant in the sector was willing to pay such

an inflated price. As Bitfarms’ largest shareholder, we are

concerned that the Bitfarms Board did not enter into this

transaction with the best interests of Bitfarms’ shareholders in

mind. Based on the transaction terms, the Stronghold acquisition

appears to be yet another action designed to entrench the Bitfarms

Board.

- A continued lack of engagement with Riot: We have still

seen no change in posture from the Bitfarms Board regarding its

willingness to work constructively with Riot to consider beneficial

changes to the Bitfarms Board and/or a mutually beneficial

combination that could maximize value for all Bitfarms

shareholders.

The Path Forward – Electing Riot’s

Nominees

Previously, we announced that we would nominate three

independent and highly qualified nominees for election to the

Bitfarms Board at the Special Meeting. With the resignations of

Messrs. Bonta and Grodzki, our campaign to fix Bitfarms’ broken

governance has already resulted in progress towards addressing the

founder-led culture that we believe has been harmful to the

Bitfarms Board.

As a result, we will be reducing our proposed slate of new

directors from three to two – Amy Freedman and John Delaney (the

“Nominees”). Both Nominees are fully independent of Riot and

Bitfarms and will bring much needed public company board

experience, corporate governance oversight, transaction experience

and business expertise to the Bitfarms Board. We will be running

the Nominees to replace two Bitfarms directors: co-founder Andres

Finkielsztain and Fanny Philip. In particular, Mr. Finkielsztain,

as one of the three co-founders, bears responsibility for, among

other things, Bitfarms’ botched CEO succession process that led to

it having five CEOs in five years.

Bitfarms Needs to Halt its Defensive

Tactics and Let Shareholders Be Heard

With the Special Meeting less than two months away, we sincerely

hope that Bitfarms will allow its shareholders to have their say,

and will not seek to take any steps that adversely affect investors

or that are intended to gain an unfair advantage in the director

election. Specifically, the Bitfarms Board

should not enter into any financing transaction prior to the

completion of the Special Meeting. Riot is deeply concerned that

any transaction the current Bitfarms Board will pursue will be

punitively dilutive to all Bitfarms’ shareholders when there are

other more attractive financing options available. If the

Bitfarms Board insists on taking any such action to further

entrench itself at the expense of shareholders, Riot will not

hesitate to hold the incumbent directors personally

accountable.

***

We look forward to mailing our solicitation materials and giving

shareholders a chance to vote for our two Nominees in the near

future. We are confident that, together, we can help ensure a

Better Bitfarms moving forward.

Yours sincerely, Benjamin Yi, Executive Chairman Jason Les,

Chief Executive Officer

***

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading

Bitcoin-driven infrastructure platform. Our mission is to

positively impact the sectors, networks and communities that we

touch. We believe that the combination of an innovative spirit and

strong community partnership allows Riot to achieve best-in-class

execution and create successful outcomes.

Riot, a Nevada corporation, is a Bitcoin mining and digital

infrastructure company focused on a vertically integrated strategy.

Riot has Bitcoin mining operations in central Texas and electrical

switchgear engineering and fabrication operations in Denver,

Colorado.

For more information, visit www.riotplatforms.com.

Cautionary Note Regarding Forward Looking Statements

Statements contained herein that are not historical facts

constitute “forward-looking statements” and “forward-looking

information” (together, “forward-looking statements”) within the

meaning of applicable U.S. and Canadian securities laws that

reflect management’s current expectations, assumptions, and

estimates of future events, performance and economic conditions.

Such forward-looking statements rely on the safe harbor provisions

of Section 27A of the U.S. Securities Act of 1933 and Section 21E

of the U.S. Securities Exchange Act of 1934 and the safe harbor

provisions of applicable Canadian securities laws. Because such

statements are subject to risks and uncertainties, actual results

may differ materially from those expressed or implied by such

forward-looking statements. Words and phrases such as “anticipate,”

“believe,” “combined company,” “create,” “drive,” “expect,”

“forecast,” “future,” “growth,” “intend,” “hope,” “opportunity,”

“plan,” “potential,” “proposal,” “synergies,” “unlock,” “upside,”

“will,” “would,” and similar words and phrases are intended to

identify forward-looking statements. These forward-looking

statements may include, but are not limited to, statements

concerning: uncertainties as to whether Bitfarms will enter into

discussions with Riot regarding a proposed combination of Riot and

Bitfarms; the outcome of any such discussions, including the terms

and conditions of any such potential combination; and uncertainties

as to the outcome of the Special Meeting. Such forward-looking

statements are not guarantees of future performance or actual

results, and readers should not place undue reliance on any

forward-looking statement as actual results may differ materially

and adversely from forward-looking statements. Detailed information

regarding the factors identified by the management of Riot, which

they believe may cause actual results to differ materially from

those expressed or implied by such forward-looking statements in

this press release, may be found in Riot’s filings with the U.S.

Securities and Exchange Commission (the “SEC”), including the

risks, uncertainties and other factors discussed under the sections

entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” of Riot’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, filed with the SEC on

February 23, 2024, and the other filings Riot has made or will make

with the SEC after such date, copies of which may be obtained from

the SEC’s website at www.sec.gov. All forward-looking statements

contained herein are made only as of the date hereof, and Riot

disclaims any intention or obligation to update or revise any such

forward-looking statements to reflect events or circumstances that

subsequently occur, or of which Riot hereafter becomes aware,

except as required by applicable law.

Information in Support of Public Broadcast Exemption under

Canadian Law

The information contained in this press release does not and is

not meant to constitute a solicitation of a proxy within the

meaning of applicable corporate and securities laws. Shareholders

of the Company are not being asked at this time to execute a proxy

in favour of the Nominees or in respect of any other matter to be

acted upon at the Special Meeting. In connection with the Special

Meeting, Riot intends to file a dissident information circular in

due course in compliance with applicable corporate and securities

laws. Notwithstanding the foregoing, Riot has voluntarily provided

in, or incorporated by reference into, this press release the

disclosure required under section 9.2(4) of National Instrument

51-102 – Continuous Disclosure Obligations (“NI 51-102”) and has

filed a document (the “Document”) containing disclosure prescribed

by applicable corporate law and disclosure required under section

9.2(6) of NI 51-102 in respect of the Nominees, in accordance with

corporate and securities laws applicable to public broadcast

solicitations. The Document is hereby incorporated by reference

into this press release and is available under the Company’s

profile on SEDAR+ at www.sedarplus.ca. The registered office of the

Company is 110 Yonge Street, Suite 1601, Toronto, ON M5C 1T4

Canada.

Neither Riot nor any director or officer of Riot is requesting

that Company shareholders submit a proxy at this time. Once formal

solicitation of proxies in connection with the Special Meeting has

commenced, proxies may be revoked by a registered holder of Company

shares: (a) by completing and signing a valid proxy bearing a later

date and returning it in accordance with the instructions contained

in the accompanying form of proxy; (b) by depositing an instrument

in writing that is signed by the shareholder or an attorney who is

authorized by a document that is signed in writing or by electronic

signature; (c) by transmitting by telephonic or electronic means a

revocation that is signed by electronic signature in accordance

with applicable law, as the case may be: (i) at the registered

office of the Company at any time up to and including the last

business day preceding the day the Special Meeting or any

adjournment or postponement of the Special Meeting is to be held,

or (ii) with the chair of the Special Meeting on the day of the

Special Meeting or any adjournment or postponement of the Special

Meeting; or (d) in any other manner permitted by law. In addition,

proxies may be revoked by a non-registered holder of Company shares

at any time by written notice to the intermediary in accordance

with the instructions given to the non-registered holder by its

intermediary.

This press release and any solicitation made by Riot in advance

of the Special Meeting is, or will be, as applicable, made by Riot,

and not by or on behalf of the management of the Company. Proxies

may be solicited by proxy circular, mail, telephone, email or other

electronic means, as well as by newspaper or other media

advertising and in person by managers, directors, officers and

employees of Riot who will not be specifically remunerated

therefor. In addition, Riot may solicit proxies by way of public

broadcast, including press release, speech or publication and any

other manner permitted under applicable Canadian laws, and may

engage the services of one or more agents and authorize other

persons to assist it in soliciting proxies on their behalf.

Riot has entered into agreements with Okapi Partners LLC

(“Okapi”) and Shorecrest Group Ltd. (“Shorecrest”) in connection

with solicitation and advisory services in respect of the

requisitioned meeting, for which Okapi will receive a fee not to

exceed US$1,200,000 and Shorecrest will receive a fee not to exceed

US$110,000, in each case together with reimbursement for reasonable

and out-of-pocket expenses, and under which each of Okapi and

Shorecrest will be indemnified against certain liabilities and

expenses, including certain liabilities under securities laws.

The costs incurred in the preparation and mailing of any

circular or proxy solicitation by Riot will be borne directly and

indirectly by Riot. However, to the extent permitted under

applicable law, Riot intends to seek reimbursement from Bitfarms of

all expenses it incurs in connection with the solicitation of

proxies for the election of the Nominees at the Special

Meeting.

None of Riot, any director or officer of Riot nor any associate

or affiliate of the foregoing (i) has any material interest, direct

or indirect, by way of beneficial ownership of securities of the

Company or otherwise, in any matter to be acted upon at the Special

Meeting, other than the election of directors, or (ii) has or has

had any material interest, direct or indirect, in any transaction

since the beginning of the Company’s last completed financial year

or, other than the proposal submitted by Riot to Bitfarms on April

22, 2024 and referred to in Riot’s press release dated May 28, 2024

(which proposal has since been withdrawn by Riot), in any proposed

transaction that has materially affected or will materially affect

the Company or any of the Company’s affiliates.

No Offer to Purchase or Sell Securities

This press release is for informational purposes only and is not

intended to and does not constitute an offer to sell or the

solicitation of an offer, or an intention to offer, to subscribe

for or buy or an invitation to purchase or subscribe for any

securities, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.

Such an offer to purchase securities would only be made pursuant to

a registration statement, prospectus, tender offer, takeover bid

circular, management information circular or other regulatory

filing filed by Riot with the SEC and available at www.sec.gov or

filed with applicable Canadian securities regulatory authorities on

SEDAR+ and available at www.sedarplus.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240903058824/en/

Investors: Phil McPherson 303-794-2000 ext. 110

IR@Riot.Inc

Okapi Partners Bruce Goldfarb / Chuck Garske, (877) 285-5990

info@okapipartners.com

Shorecrest Group 1-888-637-5789 (North American Toll-Free)

contact@shorecrestgroup.com

Media: Longacre Square Partners Joe Germani / Dan Zacchei

jgermani@longacresquare.com / dzacchei@longacresquare.com

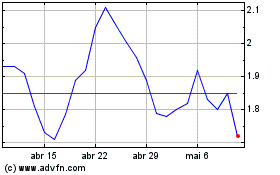

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bitfarms (NASDAQ:BITF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024