U.S. Bank offers Paze℠ for cardholders and merchants

10 Setembro 2024 - 11:00AM

Business Wire

Delivers the new online checkout solution to

anyone looking to check out with Paze

All U.S. Bank clients with eligible credit and debit cards now

have access to Paze℠, a new online checkout solution that makes

online shopping more convenient. Paze is an easy checkout

experience with no manual card entry, no new Paze password to

remember* and no need to download third-party applications.

U.S. Bank is offering special promotions to cardholders to

encourage them to use Paze. The company also offers a variety of

options for businesses to easily accept Paze transactions through a

seamless integration with Elavon's Converge Payment Gateway for

e-commerce.

“Paze is a great example of how U.S. Bank is delivering

innovative payment capabilities to our clients that are simple,

convenient and easy to use,” said Shailesh Kotwal, vice chair of

Payment Services at U.S. Bank. “Making an online purchase without

entering card data and trusting that the payment will process

quickly is what clients expect, and what is delivered with

Paze.”

Paze provides cardholders with added security by tokenizing

credit and debit card numbers, so the actual 16-digit card number

is not shared with the online merchant. Eligible U.S. Bank clients

can activate Paze by signing in through the U.S. Bank app, online

at usbank.com or by checking out at a participating retailer’s

website.

To use Paze, online shoppers should look for the Paze button at

the online checkout of participating merchants and follow the easy

steps to complete their purchase.

Paze is a great addition to a business’ e-commerce capabilities

because there are no additional transaction fees for merchants to

add Paze as a checkout option and it offers added security because

the actual card number stays hidden.

“We’re excited to work with a partner such as U.S. Bank, which

through Elavon is helping us to provide our customers and our

nationwide network of florists convenient and consumer-friendly

checkout options, like Paze,” said Matt Faulk, vice president of

finance operations at Teleflora.

To learn more about Paze, visit www.paze.com. Paze is operated

by Early Warning Services, LLC, an innovator in financial and risk

management solutions.

About U.S. Bank

U.S. Bancorp, with more than 70,000 employees and $680 billion

in assets as of June 30, 2024, is the parent company of U.S. Bank

National Association. Headquartered in Minneapolis, the company

serves millions of customers locally, nationally and globally

through a diversified mix of businesses including consumer banking,

business banking, commercial banking, institutional banking,

payments and wealth management. U.S. Bancorp has been recognized

for its approach to digital innovation, community partnerships and

customer service, including being named one of the 2024 World’s

Most Ethical Companies and Fortune’s most admired superregional

bank. Learn more at usbank.com/about.

About Paze

Paze is a reimagined online checkout solution that banks and

credit unions offer to consumers and merchants, combining all

eligible debit and credit cards into a single wallet and

eliminating manual card entry. Solving long-standing challenges in

e-commerce, Paze provides an easy experience for consumers and

merchants alike. At general availability, more than 150 million

debit and credit cards will be available to consumers for making

online purchases. To learn more about Paze, visit www.paze.com.

Paze is operated by Early Warning Services, LLC, an innovator in

financial and risk management solutions.

Paze and the Paze related marks are wholly owned by Early

Warning Services, LLC and are used herein under license.

*Some merchants may require account setup to make purchases.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240910474977/en/

Todd Deutsch, U.S. Bank Public Affairs and Communications,

todd.deutsch@usbank.com Teri Charest, U.S. Bank Public Affairs and

Communications, teri.charest@usbank.com

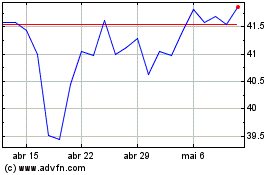

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Out 2024 até Out 2024

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024