Coeur Announces Achievement of Key Milestones at Expanded Rochester Mine

12 Setembro 2024 - 8:00AM

Business Wire

Mining and placement rates remain on-track

Confirming full-year silver and gold production

ranges

Average crushing size trending toward year-end

target

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today

provided an operational update at the expanded Rochester

silver-gold mine in Nevada, including positive throughput trends

and significant progress on reducing overall crushing size.

The new three-stage crushing circuit continues to deliver

greatly enhanced levels of flexibility to accommodate the full

range of mined ore at Rochester. For the month of August,

approximately 2.7 million tons were placed on the new Stage VI

leach pad, representing a 39% increase over July placement levels.

Rochester remains on-track to place 7.0 – 8.0 million tons per

quarter during the second half of 2024 and to achieve its full-year

2024 production guidance of 4.8 – 6.6 million ounces of silver and

37,000 – 50,000 ounces of gold.

With the three-stage crusher fully ramped-up, the focus during

the second half of the year has shifted to particle sizing

optimization efforts, which are already exceeding expectations. The

Company aims to end 2024 with reaching design particle size

distribution (PSD) of approximately 80% passing 5/8 inch. Recent

particle size distribution is reaching an average PSD of

approximately 80% passing 3/4 inch, giving the Company confidence

of achieving the year-end target.

“In just six months since first processing ore through the

newly-expanded operation, the Rochester team continues to meet or

exceed expectations across a number of key performance metrics,

which is expected to be a key catalyst for generating Companywide

positive free cash flow during the second half of the year,” said

Mitchell J. Krebs, Chairman, President and Chief Executive Officer.

“With crushing and placement rates consistently achieving nameplate

capacity, the focus over the remainder of 2024 is on continuing to

reduce the material crush size to achieve optimum recovery rates as

we head into 2025. Additionally, recent exploration success within

the current mining footprint continues to provide higher-grade

upside potential to the current mine plan and positions Rochester

for sustained success over a long expected mine life.”

About Coeur Coeur Mining, Inc. is a U.S.-based,

well-diversified, growing precious metals producer with four

wholly-owned operations: the Palmarejo gold-silver complex in

Mexico, the Rochester silver-gold mine in Nevada, the Kensington

gold mine in Alaska and the Wharf gold mine in South Dakota. In

addition, the Company wholly-owns the Silvertip polymetallic

critical minerals exploration project in British Columbia.

Cautionary Statements This news release contains

forward-looking statements within the meaning of securities

legislation in the United States and Canada, including statements

regarding the Company’s anticipated production, cash flow,

operations, expectations and initiatives at Rochester. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause Coeur’s actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements. Such factors include,

among others, the risk that anticipated production levels are not

attained, the risks and hazards inherent in the mining business

(including risks inherent in developing large-scale mining

projects, environmental hazards, industrial accidents, weather or

geologically-related conditions), the uncertainties inherent in

Coeur’s production, exploratory and developmental activities,

including risks relating ground conditions and, grade and recovery

variability, any future labor disputes or work stoppages (involving

the Company and its subsidiaries or third parties), the loss of

access or insolvency of any third-party refiner or smelter to which

Coeur markets its production, the potential effects of future

pandemics, including impacts to the availability of our workforce,

government orders that may require temporary suspension of

operations at one or more of our sites and effects on our suppliers

or the refiners and smelters to whom the Company markets its

production and on the communities where we operate, the effects of

environmental and other governmental regulations and government

shut-downs, as well as other uncertainties and risk factors set out

in filings made from time to time with the United States Securities

and Exchange Commission, and the Canadian securities regulators,

including, without limitation, Coeur’s most recent reports on Form

10-K and Form 10-Q. Actual results, developments and timetables

could vary significantly from the estimates presented. Readers are

cautioned not to put undue reliance on forward-looking statements.

Coeur disclaims any intent or obligation to update publicly such

forward-looking statements, whether as a result of new information,

future events or otherwise. Additionally, Coeur undertakes no

obligation to comment on analyses, expectations or statements made

by third parties in respect of Coeur, its financial or operating

results or its securities. This does not constitute an offer of any

securities for sale.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912656570/en/

Coeur Mining, Inc. 200 S. Wacker Drive, Suite 2100 Chicago,

Illinois 60606 Attention: Jeff Wilhoit, Senior Director, Investor

Relations Phone: (312) 489-5800 www.coeur.com

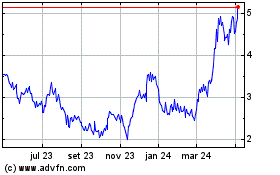

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

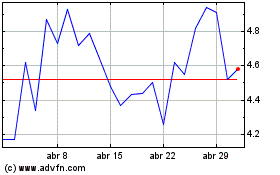

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025