CMC Metals Ltd. (TSX-V: CMB) (Frankfurt:ZM5P) (“CMC” or the

“Company”) is pleased to report that it has entered into

an option agreement (“Agreement”) with Coeur Silvertip Holdings,

Ltd. (“Coeur”), a subsidiary of Coeur Mining, Inc. (NYSE: CDE) on

its Silverknife Property (“Property”) in north-central British

Columbia.

The Agreement paves the way forward for Coeur to

undertake a significant, multi-year exploration program on the

Property. The Agreement provides Coeur with the ability to earn a

75% interest in the Property, following which Coeur has a right to

either purchase the property or enter a Joint Venture arrangement

with CMC. The total commitments to earn 75% amount to $4,050,000 in

the aggregate, of which $500,000 Cdn is cash payments to CMC and

$3,550,000 Cdn is exploration expenditures. Purchase of the

remaining 25% interest would require an additional buyout payment

that would take the aggregate commitment to $6.3M Cdn, and the

Property would remain subject to an existing NSR. The Agreement

contains the commitments as follows:

|

Item |

Date/Period |

Expenditures |

OptionPayments |

|

1 |

Within ten (10) business days of the Effective Date |

|

$ |

100,000 |

|

2 |

On or before December 31, 2024 |

$ |

150,000 |

|

-- |

|

3 |

On or before March 31, 2025 |

|

-- |

$ |

100,000 |

|

4 |

On or before December 31, 2025 |

$ |

550,000 |

|

-- |

|

5 |

On or before March 31, 2026 |

|

-- |

$ |

100,000 |

|

6 |

On or before December 31, 2026 |

$ |

800,000 |

|

-- |

|

7 |

On or before March 31, 2027 |

|

-- |

$ |

100,000 |

|

8 |

On or before December 31, 2027 |

$ |

950,000 |

|

-- |

|

9 |

On or before March 31, 2028 |

|

-- |

$ |

100,000 |

|

10 |

On or before December 31, 2028 |

$ |

1,100,000 |

|

-- |

|

Cumulative Total |

$ |

3,550,000 |

$ |

500,000 |

|

|

Once Coeur has completed the expenditure and

option payment commitments to earn at least a 75% interest in the

Property, it then also acquires:

- A right of first refusal to

purchase CMC’s Amy property, a high-grade Carbonate Replacement

Deposit (“CRD”) target located approximately 6 km west of the

Silverknife Property;

- Any expenditures made by Coeur in

excess of $3,550,000 up to December 31, 2028, will be credited

towards Coeur’s right to a Buyout or, if no Buyout is exercised, to

Coeur’s account to increase its interest in the Joint Venture;

- Two distinct buyout options for the

remaining 25% interest:

- Buyout Payment: Within 60 days of

earning its 75% interest, Coeur has the right to buy out CMCs’

remaining interest by paying $2,250,000 Cdn.

- Joint Venture: If Coeur does not

exercise the buyout payment option, then the parties will establish

a joint venture that will fund the ongoing operations according to

their proportionate interests. Coeur will have the right to

increase its interest in the joint venture, earning an additional

0.5% interest for every $100,000 spent on expenditures, up to a

maximum of 90% of CMCs remaining interest, provided these

additional expenditures occur before December 31, 2030. Coeur may,

at its discretion, purchase the remaining interest from CMC for

$3,000,000 Cdn subject to certain additional conditions.

CMC retained its right to purchase an existing

1% NSR on the Property.

The complete definitive agreement will be posted

on www.cmcmetals.ca

Mr. Kevin Brewer, President, CEO and Director of

CMC notes “This agreement is very significant and a game changer

for our Company. It confirms that we are on the right track towards

identifying high-grade CRD prospects of significant interest within

the Rancheria Silver District. We are extremely pleased to attract

Coeur, a top tier precious metals producer, to commit to a

significant program at Silverknife and also signal a potential

interest in the Amy Property. This agreement solidifies our

positive working relationship with Coeur Mining and we continue to

see a very bright future for further exploration and development in

the Rancheria Silver District.”

Ms. Aoife McGrath, Senior Vice President of

Exploration for Coeur notes “Coeur is very pleased with the signing

of this agreement that fills a gap in the current Silvertip land

package, ensuring we have a fully contiguous set of claims over

this highly-prospective belt. We believe mineralization styles are

similar to those found at Silvertip and expect to include an

exploration program over the property in our 2025 plans. We look

forward to continuing the exploration programs initiated by

CMC.”

Coeur will now be the project operator and is

currently compiling the data from previous programs and planning to

undertake additional airborne geophysical surveys in the

foreseeable future. Exploration efforts are expected to continue to

target identifying polymetallic mineralization that management

believes may be similar to that found at Coeur’s Silvertip Mine,

located within one kilometer east of the Silverknife Property.

Coeur’s mining claims and the Silverknife Property are contiguous.

Coeur has indicated they will undertake a detailed review of all

historical and current data and from that determine future

exploration activities on the Property. Once this program has been

defined, relevant details will be communicated to investors and

shareholders. A five-year exploration permit is in place for the

Property, expiring on March 31, 2028.

Since 2022, CMC has completed a SkyTEM

geophysical survey, two ground gravity geophysical surveys, and a

2,146.3m drill program. Key intersections include Hole SKP 23-06:

0.5m of 881 g/t silver, 5,060 g/t lead, 1,500 g/t zinc and 1,335

g/t copper; and Hole SKP 2P 23-07 with 3.91m grading 0.73 g/t Gold,

and 17.63 g/t Silver; and another 1.6m interval grading 9,079.7 g/t

zinc. This work served to identify four primary CRD targets on the

property (see Press Releases of March 20, 2024 and April 15,

2024).

Exploration at Silverknife is targeting

high-grade silver-lead-zinc CRDs, which management believes may be

similar to that found at Coeur’s Silvertip Mine. At Silverknife,

CRD mineralization was identified in drilling campaigns (47 diamond

drill holes, 4,167.1 meters) during the mid-1980’s at the

Silverknife Prospect which extends west by less than one kilometer

from the Silvertip mine. Key intersections included hole 85-4:

7.25m of 5.04 oz Ag/t, 2.65%Pb and 3.09% Zn; Hole 85-6 – 0.2m of

4.43 oxz/t Ag, 1.9% Pb and 3.42% Zn, 85-21: 4.3m of 29.02 oz/t Ag,

10.14% Pb and 7.02% Zn. Other work included extensive ground

geophysical programs (i.e., VLF-EM, Induced Polarization – 30.3

line km), over 2,000 soils, prospecting and mapping.

Qualified Person

Qualified Person Kevin Brewer, a registered

professional geoscientist, is the Company’s President and CEO, and

Qualified Person (as defined by National Instrument 43-101). He has

given his approval of the technical information pertaining reported

herein. The Company is committed to meeting the highest standards

of integrity, transparency and consistency in reporting technical

content, including geological reporting, geophysical

investigations, environmental and baseline studies, engineering

studies, metallurgical testing, assaying and all other technical

data.

About CMC Metals Ltd.

CMC Metals Ltd. is a growth stage exploration

company focused on opportunities for high grade polymetallic

deposits in British Columbia, Yukon and Newfoundland. Our flagship

project is the Amy Property in the emerging Rancheria Silver

District. Other projects in this District include the Silverknife

project (British Columbia) and the Silver Hart Deposit/Blue Heaven

claims (Yukon). Our polymetallic projects with potential for

copper-silver-gold and other metals include Bridal Veil

(Newfoundland) and Logjam (Yukon), both of which are available for

option.

On behalf of the Board: “Kevin Brewer”President,

CEO and DirectorCMC Metals Ltd.

For Further Information and Investor

Inquiries:

Kevin Brewer, P. Geo., MBA, B.Sc. (Hons), Dip.

Mine Eng.President, CEO and Director Tel: (709)

327-8013kbrewer80@hotmail.comSuite 1000-409 Granville St.,

Vancouver, BC, V6C 1T2

To be added to CMC's news distribution list,

please send an email to info@cmcmetals.ca or contact Mr. Kevin

Brewer directly.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

“This news release may contain certain

statements that constitute “forward-looking information” within the

meaning of applicable securities law, including without limitation,

statements that address the timing and content of upcoming work

programs, geological interpretations, receipt of property titles

and exploitation activities and developments. In this release

disclosure regarding the potential to undertake future exploration

work comprise forward-looking statements. Forward-looking

statements address future events and conditions and are necessarily

based upon a number of estimates and assumptions. While such

estimates and assumptions are considered reasonable by the

management of the Company, they are inherently subject to

significant business, economic, competitive and regulatory

uncertainties and risks, including the ability of the Company to

raise the funds necessary to fund its projects, to carry out the

work and, accordingly, may not occur as described herein or at all.

Actual results may differ materially from those currently

anticipated in such statements. Factors that could cause actual

results to differ materially from those in forward-looking

statements include market prices, exploitation and exploration

successes, the timing and receipt of government and regulatory

approvals, the impact of the constantly evolving COVID-19 pandemic

crisis and continued availability of capital and financing and

general economic, market or business conditions. Readers are

referred to the Company’s filings with the Canadian securities

regulators for information on these and other risk factors,

available at www.sedar.com. Investors are cautioned that

forward-looking statements are not guarantees of future performance

or events and, accordingly are cautioned not to put undue reliance

on forward-looking statements due to the inherent uncertainty of

such statements. The forward-looking statements included in this

news release are made as of the date hereof and the Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as expressly required by

applicable securities legislation.”

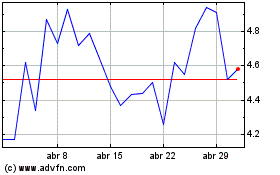

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024