Increases Long-Term Store Target and Plans

to Open 200 Net New Stores Over the Next Three Years

Announces New $3 Billion Share Repurchase

Authorization

Reaffirms Fiscal 2024 Guidance

Ulta Beauty, Inc. (NASDAQ: ULTA) will host its 2024 Investor Day

today, where the management team will outline Ulta Beauty’s

strategic priorities to drive profitable growth and announce new

long-term financial targets.

“Ulta Beauty is a leader in a growing category with a proven

model and substantial financial strength to invest and power our

long-term growth,” said Dave Kimbell, chief executive officer.

“More than 30 years ago, Ulta Beauty was the original disruptor in

beauty bringing All Things Beauty. All In One Place®. While beauty

has continued to expand and evolve, we remain true to our core

purpose - we champion beauty for everyone, helping every guest

discover their own possibilities through the power of beauty. The

strategic priorities announced today are designed to amplify our

differentiated model and drive relevant innovation to meet evolving

guest needs, positioning Ulta Beauty as the destination for beauty

enthusiasts for a lifetime. This plan will enable us to drive

strong growth and capture greater market share in beauty and

wellness. We have consistently delivered exceptional results over

time, and we are well positioned to build on this record of

profitable growth and shareholder value creation. We remain

confident in and excited about the future of Ulta Beauty.”

Strategic Framework

Ulta Beauty intends to drive profitable growth and market share

leadership in beauty and wellness through four foundational focus

areas:

- Assortment: Curating the best of all things beauty and wellness

for all beauty enthusiasts;

- Experience: Fostering authentic, empowering human connections

that inspire, delight and engage guests at every touchpoint;

- Access: Engaging our guests wherever they want to shop by

expanding our reach through seamless and immersive omnichannel

experiences; and

- Loyalty: Building lifelong loyalty and brand love through

member growth and personalization.

Actioning against these focus areas, Ulta Beauty plans to:

- Accelerate new store openings, targeting 1,800+ stores over the

long-term;

- Drive loyalty program growth to 50 million members by 2028 by

reaching new segments of beauty enthusiasts;

- Establish a leadership position in wellness with an expanded

assortment and elevated experience;

- Deepen guest engagement through community building and advanced

personalization;

- Drive product newness through a differentiated portfolio of

exclusive, emerging and established brands, including Ulta Beauty

Collection;

- Enhance the immersive in-store experience by investing in key

differentiators including its best-in-class store associates and

stylists, distinct service offerings, and signature events;

- Elevate digital engagement by fueling discovery through

continued innovation and streamlining the shopping experience;

and

- Heighten omnichannel satisfaction, meeting every guest where

they are with a robust suite of offerings and increased speed to

guest.

New Share Repurchase Authorization

Ulta Beauty has long returned excess capital to shareholders

through an active share repurchase program. Since launching its

stock repurchase program in 2014, Ulta Beauty has returned more

than $6 billion to shareholders, while continuing to make strategic

growth investments.

On October 15, 2024, the Company’s board of directors approved a

new share repurchase authorization of $3.0 billion, which replaces

the prior authorization implemented in March 2024. Under the new

program, as under the previous program, the Company may repurchase

outstanding shares of the Company's common stock from time to time

through privately negotiated transactions or open market

transactions, including under plans complying with Rule 10b5-1

under the Securities Exchange Act of 1934. The new program has no

expiration date but may be terminated by the Board at any time.

2024 Guidance

The Company’s previously announced expectations for fiscal 2024

have not changed. The Company plans to deliver:

Net sales

$11.0 billion to $11.2

billion

Comparable sales

-2% to 0%

New stores, net

60-65

Remodel and relocation projects

40-45

Operating margin

12.7% to 13.0%

Diluted earnings per share

$22.60 to $23.50

Share repurchases

approximately $1 billion

Interest income

approximately $13 million

Effective tax rate

approximately 24%

Capital expenditures

$400 million to $450 million

Depreciation and amortization expense

$265 million to $270 million

Long-Term Financial Targets

“Ulta Beauty is a market leader in a robust, healthy consumer

category, and we have delivered strong and consistent profitable

growth and shareholder value over time,” said Paula Oyibo, chief

financial officer. “While we expect 2024 and 2025 will be

transitional years as we manage through near-term category

dynamics, over the long-term, we see additional opportunity to

expand our leadership position, delivering both profitable growth

and compelling shareholder value.”

Ulta Beauty’s new long-term financial targets for 2026 and

beyond are:

- 4% to 6% net sales growth;

- Mid‐single‐digit operating profit growth, while targeting

operating margins around 12% of net sales; and

- Low double‐digit diluted EPS growth.

Ulta Beauty’s disciplined capital allocation priorities will

continue to emphasize:

- Efficiently funding ongoing operations;

- Reinvesting in the business to drive growth, with capital

expenditures remaining between 4% and 5% of net sales; and

- Returning excess cash to shareholders through share

repurchases.

Webcast Information

Today’s investor meeting will be webcast live from 8:30 a.m. to

12:00 p.m. Central Time at https://www.ulta.com/investor. A replay

will be made available online approximately three hours following

the live event for a period of six months.

About Ulta Beauty

At Ulta Beauty (NASDAQ: ULTA), the possibilities are beautiful.

Ulta Beauty is the largest specialty U.S. beauty retailer and the

premier beauty destination for cosmetics, fragrance, skin care

products, hair care products and salon services. In 1990, the

Company reinvented the beauty retail experience by offering a new

way to shop for beauty – bringing together All Things Beauty. All

in One Place®. Ulta Beauty operates 1,411 retail stores across 50

states and also distributes its products through its website, which

includes a collection of tips, tutorials, and social content. For

more information, visit www.ulta.com.

Forward‑Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, which reflect the

Company’s current views with respect to, among other things, future

events and financial performance. These statements can be

identified by the use of forward-looking words such as “outlook,”

“believes,” “expects,” “plans,” “estimates,” “targets,”

“strategies” or other comparable words. Any forward-looking

statements contained in this press release are based upon the

Company’s historical performance and on current plans, estimates

and expectations. The inclusion of this forward-looking information

should not be regarded as a representation by the Company or any

other person that the future plans, estimates, targets, strategies

or expectations contemplated by the Company will be achieved. Such

forward-looking statements are subject to various risks and

uncertainties, which include, without limitation:

- macroeconomic conditions, including inflation, elevated

interest rates and recessionary concerns, as well as continuing

labor cost pressures, and transportation and shipping cost

pressures, have had, and may continue to have, a negative impact on

our business, financial condition, profitability, and cash flows

(including future uncertain impacts);

- changes in the overall level of consumer spending and

volatility in the economy, including as a result of macroeconomic

conditions and geopolitical events;

- our ability to sustain our growth plans and successfully

implement our long-range strategic and financial plan;

- the ability to execute our operational excellence priorities,

including continuous improvement, Project SOAR (the replacement of

our enterprise resource planning platform), and supply chain

optimization;

- our ability to gauge beauty trends and react to changing

consumer preferences in a timely manner;

- the possibility that we may be unable to compete effectively in

our highly competitive markets;

- the possibility of significant interruptions in the operations

of our distribution centers, fast fulfillment centers, and market

fulfillment centers;

- the possibility that cybersecurity or information security

breaches and other disruptions could compromise our information or

result in the unauthorized disclosure of confidential

information;

- the possibility of material disruptions to our information

systems, including our Ulta.com website and mobile

applications;

- the failure to maintain satisfactory compliance with applicable

privacy and data protection laws and regulations;

- changes in the good relationships we have with our brand

partners, our ability to continue to obtain sufficient merchandise

from our brand partners, and/or our ability to continue to offer

permanent or temporary exclusive products of our brand

partners;

- our ability to effectively manage our inventory and protect

against inventory shrink;

- changes in the wholesale cost of our products and/or

interruptions at our brand partners’ or third-party vendors’

operations;

- epidemics, pandemics or natural disasters, which could

negatively impact sales;

- the possibility that new store openings and existing locations

may be impacted by developer or co-tenant issues;

- our ability to attract and retain key executive personnel;

- the impact of climate change on our business operations and/or

supply chain;

- our ability to successfully execute our common stock repurchase

program or implement future common stock repurchase programs;

- a decline in operating results which could lead to asset

impairment and store closure charges; and

- other risk factors detailed in the Company’s public filings

with the Securities and Exchange Commission (the SEC), including

risk factors contained in its Annual Report on Form 10‑K for the

fiscal year ended February 3, 2024, as such may be amended or

supplemented in its subsequently filed Quarterly Reports on Form

10-Q.

The Company’s filings with the SEC are available at www.sec.gov.

Except to the extent required by the federal securities laws, the

Company does not undertake to publicly update or revise its

forward-looking statements, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016298072/en/

Investor Contact: Kiley Rawlins, CFA Vice President, Investor

Relations krawlins@ulta.com Media Contact: Crystal Carroll Senior

Director, Public Relations ccarroll@ulta.com

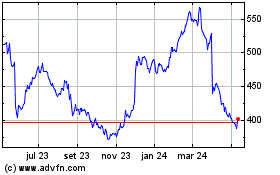

Ulta Beauty (NASDAQ:ULTA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

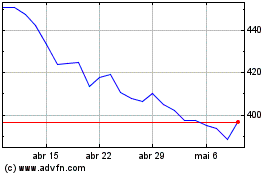

Ulta Beauty (NASDAQ:ULTA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024