- TWYMEEG® sales continue to increase in Japan for the last

quarter (July-September) by 5% over the prior quarter and by 23%

over the 3rd quarter 2023

- Poxel expects TWYMEEG® net sales in Japan in the near term

to reach at least JPY 5 billion (EUR 30.6 million)1 entitling the

Company to receive 10% royalties on all TWYMEEG® net sales and a

sales-based payment of JPY 500 million (EUR 3.1 million)

1

- Continued discussions with potential partners in parallel of

reviewing the clinical development strategy for PXL770 and PXL065

for the treatment of multiple rare diseases

- As of September 30, 2024, cash and cash equivalents were EUR

13.1 million (USD 14.7 million)2

- Following the non-dilutive financing agreement with OrbiMed,

cash runway extension until end of 2025, including the full

residual drawdown of the equity-linked financing facility put in

place with IRIS

Regulatory News:

POXEL SA (Euronext : POXEL - FR0012432516), a clinical stage

biopharmaceutical company developing innovative treatments for

chronic serious diseases with metabolic pathophysiology, including

metabolic dysfunction-associated steatohepatitis (MASH) and rare

metabolic disorders, today provided a corporate update and

announced its cash position and revenue for the third quarter and

the nine months ended September 30, 2024.

“We are pleased to see the good sales trajectory for TWYMEEG® in

Japan, which should lead to the achievement of JPY 5 billion net

sales in the coming months, at which point, Poxel will be entitled

to 10% royalties on all TWYMEEG® net sales and a sales-based

payment of JPY 500 million (EUR 3.1 million)1 . These amounts,

based on our recent royalty monetization agreement, will serve to

start repayment of bonds to OrbiMed. Additionally, Poxel will

benefit from the residual amount of the reserve deposit made under

the terms of the agreement with OrbiMed, in addition to the USD

42.5 million proceeds received upon closing. This deposit amount

will be used to further reduce our debt obligations towards IPF

Partners,” stated Thomas Kuhn, Chief Executive Officer of

Poxel.

TWYMEEG® (Imeglimin)

- For the quarter ended September 2024, TWYMEEG® gross sales in

Japan increased by 5% to JPY 1.8 billion (EUR 11.4 million) 2 over

the prior quarter sales of JPY 1.7 billion (EUR 10.1 million)3 as

reported by Sumitomo Pharma.

- During Sumitomo Pharma FY 2024, Poxel expects TWYMEEG® net

sales in Japan to reach at least JPY 5 billion (EUR 30.6 million)1,

entitling Poxel to receive 10% royalties on all TWYMEEG® net sales

and a sales-based payment of JPY 500 million (EUR 3.1 million)1.

Based on the recent royalty monetization agreement with OrbiMed,

these proceeds for FY2024, net of Poxel's obligation to Merck

Serono, will be directed to the reimbursement of the bonds

issuance. Beyond 2024, Poxel expects to receive escalating

double-digit royalties as well as additional sales-based payments

upon achievement of contractually based sales thresholds.

- Sumitomo Pharma has announced an early retirement program in

Japan that could impact their organization, including Sales &

Marketing division. However, to support TWYMEEG® sales trajectory,

Sumitomo Pharma is implementing measures to minimize potential

impact from this program.

- As announced on August 7, 2024, topline results obtained from

the post-marketing clinical study, TWINKLE (TWYMEEG® in diabetic patients with renal impairment: A post-marketing long-term

study) conducted by Sumitomo Pharma in Japanese type 2 diabetic

patients with renal impairment confirmed TWYMEEG®’s safety and

tolerability profile, which is consistent with prior clinical

studies in the general type 2 diabetes population. Based on these

results, Sumitomo Pharma has initiated discussions with the

regulatory authorities in Japan for revising TWYMEEG® package

insert for patients with renal impairment with eGFR (estimated

glomerular filtration rate) less than 45 ml/min/1.73m2.

- In parallel of the non-dilutive financing agreement with

OrbiMed announced on September 30, 2024, Poxel recovered the

Imeglimin rights for Asian countries other than Japan4 from

Sumitomo Pharma. The Company has already initiated discussions to

develop and market Imeglimin in China, the world's second largest

type 2 diabetes market.

Third Quarter and Nine Months Ended September 30, 2024,

Revenue and Cash

Revenue

Poxel reported revenues of EUR 854 thousand for the third

quarter 2024, bringing the revenues for the nine months ended

September 30, 2024, to EUR 2,016 thousand as compared to EUR 1,619

thousand during the corresponding period in 2023.

Revenue for the first nine months of 2024 mostly reflects the

JPY 328 million (EUR 2,016 thousand)2 of royalty revenue from

Sumitomo Pharma which represents 8% of TWYMEEG® net sales in Japan.

Based on the current forecast, Poxel expects to receive 10%

royalties on TWYMEEG® net sales in Japan through the Sumitomo

Pharma fiscal year 2024 and a sales-based payment of JPY 500

million (EUR 3.1 million)1. As part of the Merck Serono licensing

agreement, Poxel will pay Merck Serono a fixed 8% royalty based on

the net sales of Imeglimin, independent of the level of sales.

According to the Royalty Monetization agreement with OrbiMed, the

positive net Royalties will be fully dedicated to the repayment of

the bonds.

EUR

(in thousands)

Sept. 2024

9 months

Q3 2024

3 months

H1

2024

6 months

Sept. 2023

9 months

Q3

2023

3 months

H1

2023

6 months

Sumitomo Pharma Agreement

2,016

854

1,162

1,619

664

955

Other

-

-

-

-

-

-

Total revenues

2,016

854

1,162

1,619

664

955

Unaudited data

Cash and cash equivalents

As of September 30, 2024, total cash and cash equivalents were

EUR 13.1 million (USD 14.7 million)2, as compared to EUR 2.8

million as of June 30, 2024.

EUR (in thousands)

Q3 2024

Q2 2024

Q1 2024

Q4 2023

Cash

13,149

2,812

2,460

2,341

Cash equivalents

-

-

-

-

Total cash and cash equivalents

13,149

2,812

2,460

2,341

Unaudited data

Following the non-dilutive financing agreement with OrbiMed, and

according to Poxel's current forecasts, including in

particular:

(i) The Company’s cash position as of

September 30, 2024, at EUR 13.1 million; (ii) the partial

redemption of the PGE loans for a total amount of EUR 2.8 million;

(iii) the advisory fees linked to the transaction; (iv) the full

residual drawdown of the equity-linked financing facility put in

place with IRIS5; and (v) the anticipated business plan including

strict control of its operating expenses;

the Company expects that its resources will be sufficient to

finance its operations and capital expenditures until the end of

2025.

Next Financial Press Releases:

- First Half Results, on December 9, 2024

- Fourth Quarter 2024 Cash and Revenue update, on February 12,

2025

About Poxel SA

Poxel is a clinical stage biopharmaceutical company

developing innovative treatments for chronic serious diseases

with metabolic pathophysiology, including metabolic

dysfunction-associated steatohepatitis (MASH) and rare

disorders. For the treatment of MASH, PXL065

(deuterium-stabilized R-pioglitazone) met its primary endpoint in a

streamlined Phase 2 trial (DESTINY-1). In rare diseases,

development of PXL770, a first-in-class direct adenosine

monophosphate-activated protein kinase (AMPK) activator, is focused

on the treatment of adrenoleukodystrophy (ALD) and autosomal

dominant polycystic kidney disease (ADPKD). TWYMEEG®

(Imeglimin), Poxel’s first-in-class product that targets

mitochondrial dysfunction, is now marketed for the treatment of

type 2 diabetes in Japan by Sumitomo Pharma and Poxel expects to

receive royalties and sales-based payments. Poxel has a strategic

partnership with Sumitomo Pharma for Imeglimin in Japan. Listed on

Euronext Paris, Poxel is headquartered in Lyon, France, and has

subsidiaries in Boston, MA, and Tokyo, Japan. For more information,

please visit: www.poxelpharma.com

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control. These

statements may include, without limitation, any statements preceded

by, followed by or including words such as “target,” “believe,”

“expect,” “aim,” “intend,” “may,” “anticipate,” “estimate,” “plan,”

“project,” “will,” “can have,” “likely,” “should,” “would,” “could”

and other words and terms of similar meaning or the negative

thereof. Forward-looking statements are subject to inherent risks

and uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements. The Company does not endorse or is

not otherwise responsible for the content of external hyperlinks

referred to in this press release.

Glossary

You will find below a list of words and/or expressions that are

used in this press release or in Poxel’s communication, with the

aim to bring clarification and transparency:

- Sumitomo Pharma fiscal year runs April to March. As an

example, Fiscal Year 2024 is April 1, 2024, through March 31,

2025.

- TWYMEEG royalties: As per the Sumitomo Pharma’s

agreement, Poxel is entitled to receive royalties from the sales of

TWYMEEG (Imeglimin) in Japan

- Sumitomo Pharma communicates gross

sales of TWYMEEG, while TWYMEEG royalties are calculated on

net sales.

- Net sales represent the amount of gross sales to which are

deducted potential rebates, allowances, and costs such as prepaid

freight, postage, shipping, customs duties and insurance

charges.

- Poxel is entitled to receive escalating royalties of 8-18% on

TWYMEEG net sales from Sumitomo

Pharma.

Positive net royalties: as part of the Merck Serono

licensing agreement, Poxel will pay Merck Serono a fixed 8% royalty

based on the net sales of TWYMEEG, independent of the level of

sales. All royalties that Poxel receives from TWYMEEG net sales

above that 8% level are considered as positive net royalties. Net

royalties will therefore be positive for Poxel when TWYMEEG net

sales exceed JPY 5 billion in a fiscal year and royalties reach 10%

and above.

1 Converted at the exchange rate as of March 31, 2024 2

Converted at the exchange rate as of September 30, 2024. 3

Converted at the exchange rate as of June 30, 2024. 4 China, South

Korea, Taiwan, Indonesia, Vietnam, Thailand, Malaysia, The

Philippines, Singapore, Republic of the Union of Myanmar, Kingdom

of Cambodia and Lao People's Democratic Republic. 5 Since March 31,

2023, 15 additional tranches have been drawn down for a total of

EUR 7.8 million. 5 tranches are currently secured for a total of

EUR 2.5 million. and an additional amount of 1.2 million euros

could be drawn down by the Company depending on the liquidity and

exposure conditions under the contract.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106155932/en/

Contacts - Investor relations / Media

NewCap Nicolas Fossiez, Aurélie Manavarere / Arthur Rouillé

investors@poxelpharma.com +33 1 44 71 94 94

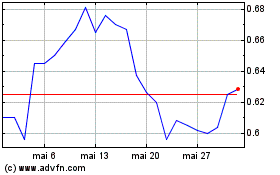

Poxel (EU:POXEL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Poxel (EU:POXEL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024