– $8.48 in basic earnings per share or $204

million of net income from continuing operations for the quarter

–

– $0.67 in adjusted earnings per share or $15

million of adjusted net income for the quarter –

– Adjusted EBITDA for the quarter of $32

million –

Finance of America Companies Inc. (“Finance of America” or

the “Company”) (NYSE: FOA), a leading provider of home

equity-based financing solutions for a modern retirement, reported

financial results for the quarter ended September 30, 2024.

Third Quarter 2024 Highlights(1)

- Net income from continuing operations of $204 million or $8.48

basic earnings per share for the quarter.

- Adjusted net income(2) of $15 million or $0.67 adjusted

earnings per share for the quarter.

- The third quarter 2024 marks the fifth consecutive quarter of

improved operating performance on an adjusted net basis.

- Adjusted EBITDA(2) of $32 million for the quarter.

- Book equity increased to $456 million as of September 30, 2024,

or nearly $20 per fully diluted share.

- The Company completed its reverse stock split on July 25, 2024,

bringing it back into compliance with NYSE continued listing

standards.

- The Company successfully closed its exchange offer on October

31, 2024 with participation from holders of nearly 98% of senior

unsecured notes.

(1) The financial information

presented in the highlights is for the Company’s continuing

operations

(2) See the sections titled

“Reconciliation to GAAP” and “Non-GAAP Financial Measures” for

reconciliations to the most directly comparable GAAP measures and

other important disclosures.

Graham A. Fleming, Chief Executive Officer commented, “We’re

very pleased with this quarter’s results, which exceeded our volume

guidance and delivered strong GAAP earnings performance along with

a return to profitability in adjusted net income. We continue to

focus on our strategic initiatives, and now with a stronger balance

sheet, are well-positioned for continued growth.”

Third Quarter Financial Summary of Continuing

Operations

($ amounts in millions, except per share

data)

Variance (%)

Variance (%)

Variance (%)

Q3'24

Q2'24

Q3'24 vs Q2'24

Q3'23

Q3'24 vs Q3'23

YTD 2024

YTD 2023

2024 vs 2023

Funded volume

$

513

$

447

15

%

$

512

—

%

$

1,384

$

1,315

5

%

Total revenues

290

79

267

%

(70

)

514

%

444

(41

)

1183

%

Total expenses and other, net

82

83

(1

)%

102

(20

)%

255

296

(14

)%

Pre-tax income (loss) from continuing

operations

208

(4

)

5300

%

(173

)

220

%

189

(338

)

156

%

Net income (loss) from continuing

operations

204

(5

)

4180

%

(172

)

219

%

183

(338

)

154

%

Adjusted net income (loss)(1)

15

—

N/A

(24

)

163

%

9

(64

)

114

%

Adjusted EBITDA(1)

32

10

220

%

(23

)

239

%

42

(59

)

171

%

Basic earnings (loss) per share

$

8.48

$

(0.20

)

4340

%

$

(7.36

)

215

%

$

7.80

$

(15.72

)

150

%

Diluted earnings (loss) per share(2)

$

7.50

$

(0.29

)

2686

%

$

(7.36

)

202

%

$

6.65

$

(15.72

)

142

%

Adjusted earnings (loss) per share(1)

$

0.67

$

—

N/A

$

(1.03

)

165

%

$

0.38

$

(2.95

)

113

%

(1)

See the sections titled

“Reconciliation to GAAP” and “Non-GAAP Financial Measures” for

reconciliations to the most directly comparable GAAP measures and

other important disclosures.

(2)

Calculated on an if-converted

basis except when anti-dilutive.

Balance Sheet Highlights

($ amounts in millions)

September 30,

June 30,

Variance (%)

2024

2024

Q3'24 vs Q2'24

Cash and cash equivalents

$

44

$

47

(6

)%

Securitized loans held for investment

(HMBS & nonrecourse)

27,619

26,614

4

%

Total assets

28,950

27,974

3

%

Total liabilities

28,494

27,723

3

%

Total equity

456

251

82

%

- Total equity increased from $251 million to $456 million,

reflecting enhanced operational performance and positive fair value

adjustments on the Company’s retained interests in securitizations

resulting from improving market inputs and model assumptions.

- Additionally, tangible net worth increased from $16 million as

of June 30, 2024 to $231 million as of September 30, 2024.

Segment Results

Retirement Solutions

The Retirement Solutions segment primarily generates revenue and

earnings in the form of net origination gains and origination fees

earned on the origination of reverse mortgage loans.

Variance (%)

Variance (%)

Variance (%)

($ amounts in millions)

Q3'24

Q2'24

Q3'24 vs Q2'24

Q3'23

Q3'24 vs Q3'23

YTD 2024

YTD 2023

2024 vs 2023

Funded volume

$

513

$

447

15

%

$

512

—

%

$

1,384

$

1,315

5

%

Total revenue

64

47

36

%

40

60

%

157

107

47

%

Pre-tax income (loss)

16

(2

)

900

%

(20

)

180

%

10

(47

)

121

%

Adjusted net income (loss)(1)

19

7

171

%

(6

)

417

%

30

(10

)

400

%

(1)

See the sections titled

“Reconciliation to GAAP” and “Non-GAAP Financial Measures” for

reconciliations to the most directly comparable GAAP measures and

other important disclosures.

- For the quarter, the segment recognized pre-tax income of $16

million and adjusted net income of $19 million as a result of

increased volumes and improved margins.

- Compared to the third quarter 2023, total revenue increased by

60% primarily due to an increase in revenue margin and funded

volume, which led to a 180% improvement in pre-tax income and a

417% improvement in adjusted net income.

- Total expenses decreased significantly from the third quarter

2023 from $60 million to $49 million as the business completed the

integration of the retail platform and streamlined business

operations.

Portfolio Management

The Portfolio Management segment primarily generates revenue and

earnings in the form of net interest income and fair value changes

on our portfolio assets, monetized through securitization, sale, or

other financing of those assets.

Variance (%)

Variance (%)

Variance (%)

($ amounts in millions)

Q3'24

Q2'24

Q3'24 vs Q2'24

Q3'23

Q3'24 vs Q3'23

YTD 2024

YTD 2023

2024 vs 2023

Assets under management

$

28,659

$

27,655

4

%

$

26,023

10

%

$

28,659

$

26,023

10

%

Assets excluding HMBS and nonrecourse

obligations

1,830

1,624

13

%

1,232

49

%

1,830

1,232

49

%

Total revenue

235

41

473

%

(103

)

328

%

313

(125

)

350

%

Pre-tax income (loss)

217

22

886

%

(124

)

275

%

253

(193

)

231

%

Adjusted net income(1)

12

12

—

%

1

1100

%

30

7

329

%

(1)

See the sections titled

“Reconciliation to GAAP” and “Non-GAAP Financial Measures” for

reconciliations to the most directly comparable GAAP measures and

other important disclosures.

- For the quarter, the segment recognized pre-tax income of $217

million, an improvement against the prior quarter and third quarter

2023 primarily due to positive fair value adjustments of retained

interests in securitizations, resulting from market inputs and

model assumptions.

- Adjusted net income during the third quarter totaled $12

million, flat to the prior quarter and an increase of $11 million

year over year, primarily driven by an increase in accreted yield

on the Company’s residual interests.

Finance of America Companies

Inc.

Selected Financial

Information

Condensed Consolidated

Statements of Financial Condition

(in thousands, except share

data)

(unaudited)

September 30, 2024

June 30, 2024

ASSETS

Cash and cash equivalents

$

44,258

$

46,509

Restricted cash

176,105

200,104

Loans held for investment, subject to HMBS

related obligations, at fair value

18,521,337

18,196,092

Loans held for investment, subject to

nonrecourse debt, at fair value

9,097,369

8,418,195

Loans held for investment, at fair

value

703,356

677,726

Intangible assets, net

225,639

234,936

Other assets, net

178,493

196,134

Assets of discontinued operations

3,827

4,658

TOTAL ASSETS

$

28,950,384

$

27,974,354

LIABILITIES AND EQUITY

HMBS related obligations, at fair

value

$

18,292,043

$

17,980,232

Nonrecourse debt, at fair value

8,537,119

8,050,708

Other financing lines of credit

1,054,568

1,073,844

Notes payable, net (includes amounts due

to related parties of $84,630 and $84,630, respectively)

435,744

442,971

Payables and other liabilities

160,869

157,273

Liabilities of discontinued operations

13,585

18,029

TOTAL LIABILITIES

28,493,928

27,723,057

EQUITY

Class A Common Stock, $0.0001 par value;

6,000,000,000 shares authorized; 10,351,652 and 10,344,043 shares

issued, respectively, and 9,925,802 and 9,918,193 shares

outstanding, respectively

1

1

Class B Common Stock, $0.0001 par value;

1,000,000 shares authorized; 15 shares issued and outstanding,

respectively

—

—

Additional paid-in capital

953,023

951,535

Accumulated deficit

(639,807

)

(724,010

)

Accumulated other comprehensive loss

(273

)

(296

)

Noncontrolling interest

143,512

24,067

TOTAL EQUITY

456,456

251,297

TOTAL LIABILITIES AND EQUITY

$

28,950,384

$

27,974,354

Finance of America Companies

Inc.

Selected Financial

Information

Condensed Consolidated

Statements of Operations

(in thousands, except share

data)

(unaudited)

Q3'24

Q2'24

Q3'23

YTD 2024

YTD 2023

PORTFOLIO INTEREST INCOME

Interest income

$

489,900

$

478,091

$

443,999

$

1,431,970

$

1,169,624

Interest expense

(426,839

)

(412,618

)

(372,459

)

(1,233,261

)

(970,428

)

NET PORTFOLIO INTEREST INCOME

63,061

65,473

71,540

198,709

199,196

OTHER INCOME (EXPENSE)

Net origination gains

57,216

40,260

31,376

137,133

88,777

Gain on securitization of HECM tails,

net

10,560

11,031

7,100

32,317

17,095

Fair value changes from model

amortization

(43,753

)

(47,813

)

(56,882

)

(149,174

)

(162,386

)

Fair value changes from market inputs or

model assumptions

204,154

11,260

(122,449

)

228,976

(172,168

)

Net fair value changes on loans and

related obligations

228,177

14,738

(140,855

)

249,252

(228,682

)

Fee income

8,054

7,880

13,201

22,170

33,377

Gain (loss) on sale and other income from

loans held for sale, net

—

216

(6,984

)

302

(23,464

)

Non-funding interest expense, net

(9,219

)

(9,268

)

(7,342

)

(26,639

)

(21,909

)

NET OTHER INCOME (EXPENSE)

227,012

13,566

(141,980

)

245,085

(240,678

)

TOTAL REVENUES

290,073

79,039

(70,440

)

443,794

(41,482

)

EXPENSES

Salaries, benefits, and related

expenses

31,083

35,053

48,557

105,159

140,469

Loan production and portfolio related

expenses

6,946

5,662

6,370

21,221

21,296

Loan servicing expenses

7,772

7,632

8,000

23,622

23,274

Marketing and advertising expenses

10,325

10,706

11,491

29,543

22,166

Depreciation and amortization

9,777

9,753

9,954

29,208

32,431

General and administrative expenses

14,405

16,241

21,054

47,917

59,572

TOTAL EXPENSES

80,308

85,047

105,426

256,670

299,208

IMPAIRMENT OF OTHER ASSETS

—

—

(558

)

(600

)

(558

)

OTHER, NET

(1,592

)

2,240

3,853

2,101

2,852

NET INCOME (LOSS) FROM CONTINUING

OPERATIONS BEFORE INCOME TAXES

208,173

(3,768

)

(172,571

)

188,625

(338,396

)

Provision (benefit) for income taxes from

continuing operations

4,425

1,153

(103

)

5,578

(786

)

NET INCOME (LOSS) FROM CONTINUING

OPERATIONS

203,748

(4,921

)

(172,468

)

183,047

(337,610

)

NET LOSS FROM DISCONTINUED

OPERATIONS

—

(203

)

(2,464

)

(4,727

)

(45,211

)

NET INCOME (LOSS)

203,748

(5,124

)

(174,932

)

178,320

(382,821

)

Noncontrolling interest

119,545

(3,035

)

(109,569

)

103,744

(241,372

)

NET INCOME (LOSS) ATTRIBUTABLE TO

CONTROLLING INTEREST

$

84,203

$

(2,089

)

$

(65,363

)

$

74,576

$

(141,449

)

EARNINGS (LOSS) PER SHARE

Basic weighted average shares

outstanding

9,924,671

9,898,182

8,772,623

9,824,171

7,980,449

Basic earnings (loss) per share from

continuing operations

$

8.48

$

(0.20

)

$

(7.36

)

$

7.80

$

(15.72

)

Basic earnings (loss) per share

$

8.48

$

(0.21

)

$

(7.45

)

$

7.59

$

(17.72

)

Diluted weighted average shares

outstanding

23,159,304

23,084,189

8,772,623

23,062,616

7,980,449

Diluted earnings (loss) per share from

continuing operations

$

7.50

$

(0.29

)

$

(7.36

)

$

6.65

$

(15.72

)

Diluted earnings (loss) per share

$

7.50

$

(0.30

)

$

(7.45

)

$

6.47

$

(17.72

)

(unaudited)

Reconciliation to GAAP

($ amounts in millions)(1)

Q3'24

Q2'24

Q3'23

YTD 2024

YTD 2023

Reconciliation of net income (loss)

from continuing operations to adjusted net income (loss) and

adjusted EBITDA

Net income (loss) from continuing

operations

$

204

$

(5

)

$

(172

)

$

183

$

(338

)

Add back: (Provision) benefit for income

taxes

(4

)

(1

)

1

(6

)

1

Net income (loss) from continuing

operations before taxes

208

(4

)

(173

)

189

(338

)

Adjustments for:

Changes in fair value(2)

(198

)

(8

)

120

(216

)

197

Amortization or impairment of intangibles

and impairment of other assets(3)

9

9

9

28

28

Equity-based compensation(4)

2

1

5

7

14

Certain non-recurring costs(5)

—

2

6

4

12

Adjusted net income (loss) before

taxes

21

—

(32

)

12

(86

)

Benefit (provision) for income

taxes(6)

(6

)

—

8

(4

)

23

Adjusted net income (loss)

15

—

(24

)

9

(64

)

Provision (benefit) for income

taxes(6)

6

—

(8

)

4

(23

)

Depreciation

—

—

1

1

5

Interest expense on non-funding debt

10

10

8

28

23

Adjusted EBITDA

$

32

$

10

$

(23

)

$

42

$

(59

)

($ amounts in millions except shares and $

per share)

Q3'24

Q2'24

Q3'23

YTD 2024

YTD 2023

GAAP PER SHARE MEASURES

Net income (loss) from continuing

operations attributable to controlling interest

$

84

$

(2

)

$

(65

)

$

77

$

(125

)

Weighted average outstanding share

count

9,924,671

9,898,182

8,772,623

9,824,171

7,980,449

Basic earnings (loss) per share from

continuing operations

$

8.48

$

(0.20

)

$

(7.36

)

$

7.80

$

(15.72

)

If-converted method net income (loss) from

continuing operations

$

174

$

(7

)

$

(65

)

$

153

$

(125

)

Weighted average diluted share count

23,159,304

23,084,189

8,772,623

23,062,616

7,980,449

Diluted earnings (loss) per share from

continuing operations(7)

$

7.50

$

(0.29

)

$

(7.36

)

$

6.65

$

(15.72

)

NON-GAAP PER SHARE MEASURES

Adjusted net income (loss)

$

15

$

—

$

(24

)

$

9

$

(64

)

Weighted average share count

23,159,304

23,084,189

22,916,628

23,062,616

21,559,717

Adjusted earnings (loss) per

share

$

0.67

$

—

$

(1.03

)

$

0.38

$

(2.95

)

(1)

Totals may not foot due to

rounding.

(2)

Changes in fair value include

changes in fair value of loans and securities held for investment

and related obligations due to market inputs or model assumptions,

deferred purchase price obligations, contingent earnout, warrant

liability, and minority investments.

(3)

Includes amortization or

impairment of intangibles and impairment of certain other

long-lived assets.

(4)

Beginning with the third quarter

of 2024, the Company revised our definitions of adjusted net income

(loss), adjusted EBITDA, and adjusted earnings (loss) per share to

now adjust for all non-cash equity-based compensation in this line

item, excluding forfeitures and accelerations associated with

restructuring activities, which are included in certain

non-recurring costs. Prior to the third quarter of 2024, only

equity-based compensation for Replacement Restricted Stock Units

(“RSUs”) and Earnout Right RSUs were included in our adjustments.

As a result of this change, prior period amounts have been recast

to reflect the updated presentation. Adjusted net loss decreased $1

million for the three months ended June 30, 2024 and $1 million and

$2 million for the three and nine months ended September 30, 2023,

respectively, from what was previously reported. The change also

resulted in a decrease to adjusted loss per share of $0.05 for the

three months ended June 30, 2024 and $0.05 and $0.13 for the three

and nine months ended September 30, 2023, respectively, from what

was previously reported.

(5)

Reflects certain non-recurring

costs and adjustments that management believes should be excluded

as these do not relate to a recurring part of the core business

operations. These items include amounts recognized for settlement

of legal and regulatory matters, acquisition or divestiture-related

expenses, and other one-time charges.

(6)

Pro-forma income tax provision

(benefit) adjustments to apply an effective combined corporate tax

rate to adjusted net income (loss) before taxes.

(7)

Calculated on an if-converted

basis except when anti-dilutive.

(unaudited)

Adjusted Net Income by Segment

(Continuing Operations)

For the three months ended September

30, 2024

($ amounts in millions except shares and $

per share)(1)

Retirement

Solutions

Portfolio

Management

Corporate

& Other

FOA

Pre-tax income (loss)

$

16

$

217

$

(24

)

$

208

Adjustments for:

Changes in fair value(2)

—

(200

)

2

(198

)

Amortization or impairment of intangibles

and impairment of other assets(3)

9

—

—

9

Equity-based compensation(4)

—

—

1

2

Adjusted net income (loss) before

taxes

$

25

$

17

$

(21

)

$

21

Provision (benefit) for income

taxes(6)

7

4

(5

)

6

Adjusted net income (loss)

$

19

$

12

$

(16

)

$

15

Weighted average share count

23,159,304

23,159,304

23,159,304

23,159,304

Adjusted earnings (loss) per

share

$

0.81

$

0.53

$

(0.67

)

$

0.67

For the three months ended June 30,

2024

($ amounts in millions except shares and $

per share)(1)

Retirement

Solutions

Portfolio

Management

Corporate

& Other

FOA

Pre-tax income (loss)

$

(2

)

$

22

$

(24

)

$

(4

)

Adjustments for:

Changes in fair value(2)

—

(6

)

(2

)

(8

)

Amortization or impairment of intangibles

and impairment of other assets(3)

9

—

—

9

Equity-based compensation(4)

—

—

1

1

Certain non-recurring costs(5)

1

—

1

2

Adjusted net income (loss) before

taxes

$

9

$

16

$

(24

)

$

—

Provision (benefit) for income

taxes(6)

2

4

(6

)

—

Adjusted net income (loss)

$

7

$

12

$

(18

)

$

—

Weighted average share count

23,084,189

23,084,189

23,084,189

23,084,189

Adjusted earnings (loss) per

share

$

0.27

$

0.52

$

(0.77

)

$

—

For the three months ended September

30, 2023

($ amounts in millions except shares and $

per share)(1)

Retirement

Solutions

Portfolio

Management

Corporate

& Other

FOA

Pre-tax loss

$

(20

)

$

(124

)

$

(28

)

$

(173

)

Adjustments for:

Changes in fair value(2)

—

124

(4

)

120

Amortization or impairment of intangibles

and impairment of other assets(3)

9

—

—

9

Equity-based compensation(4)

1

1

3

5

Certain non-recurring costs(5)

1

—

4

6

Adjusted net income (loss) before

taxes

$

(8

)

$

1

$

(24

)

$

(32

)

Benefit for income taxes(6)

(2

)

—

(6

)

(8

)

Adjusted net income (loss)

$

(6

)

$

1

$

(18

)

$

(24

)

Weighted average share count

22,916,628

22,916,628

22,916,628

22,916,628

Adjusted earnings (loss) per

share

$

(0.26

)

$

0.04

$

(0.80

)

$

(1.03

)

For the nine months ended September 30,

2024

($ amounts in millions except shares and $

per share)(1)

Retirement

Solutions

Portfolio

Management

Corporate

& Other

FOA

Pre-tax income (loss)

$

10

$

253

$

(74

)

$

189

Adjustments for:

Changes in fair value(2)

—

(214

)

(2

)

(216

)

Amortization or impairment of intangibles

and impairment of other assets(3)

28

—

1

28

Equity-based compensation(4)

1

1

6

7

Certain non-recurring costs(5)

1

—

2

4

Adjusted net income (loss) before

taxes

$

41

$

40

$

(68

)

$

12

Provision (benefit) for income

taxes(6)

11

11

(18

)

4

Adjusted net income (loss)

$

30

$

30

$

(51

)

$

9

Weighted average share count

23,062,616

23,062,616

23,062,616

23,062,616

Adjusted earnings (loss) per

share

$

1.30

$

1.28

$

(2.20

)

$

0.38

For the nine months ended September 30,

2023

($ amounts in millions except shares and $

per share)(1)

Retirement

Solutions

Portfolio

Management

Corporate

& Other

FOA

Pre-tax loss

$

(47

)

$

(193

)

$

(98

)

$

(338

)

Adjustments for:

Changes in fair value(2)

—

200

(3

)

197

Amortization or impairment of intangibles

and impairment of other assets(3)

28

—

—

28

Equity-based compensation(4)

3

1

10

14

Certain non-recurring costs(5)

3

1

8

12

Adjusted net income (loss) before

taxes

$

(13

)

$

9

$

(83

)

$

(86

)

Provision (benefit) for income

taxes(6)

(3

)

2

(22

)

(23

)

Adjusted net income (loss)

$

(10

)

$

7

$

(61

)

$

(64

)

Weighted average share count

21,559,717

21,559,717

21,559,717

21,559,717

Adjusted earnings (loss) per

share

$

(0.43

)

$

0.30

$

(2.82

)

$

(2.95

)

(1)

Totals may not foot due to

rounding.

(2)

Changes in fair value include

changes in fair value of loans and securities held for investment

and related obligations due to market inputs or model assumptions,

deferred purchase price obligations, contingent earnout, warrant

liability, and minority investments.

(3)

Includes amortization or

impairment of intangibles and impairment of certain other

long-lived assets.

(4)

Beginning with the third quarter

of 2024, the Company revised our definitions of adjusted net income

(loss), adjusted EBITDA, and adjusted earnings (loss) per share to

now adjust for all non-cash equity-based compensation in this line

item, excluding forfeitures and accelerations associated with

restructuring activities, which are included in certain

non-recurring costs. Prior to the third quarter of 2024, only

equity-based compensation for Replacement RSUs and Earnout Right

RSUs were included in our adjustments. As a result of this change,

prior period amounts have been recast to reflect the updated

presentation.

(5)

Reflects certain non-recurring

costs and adjustments that management believes should be excluded

as these do not relate to a recurring part of the core business

operations. These items include amounts recognized for settlement

of legal and regulatory matters, acquisition or divestiture-related

expenses, and other one-time charges.

(6)

Pro-forma income tax provision

(benefit) adjustments to apply an effective combined corporate tax

rate to adjusted net income (loss) before taxes.

Webcast and Conference Call

Management will host a webcast and conference call on Wednesday,

November 6th at 5:00 pm Eastern Time to discuss the Company’s

results for the third quarter ended September 30, 2024. A copy of

this press release will be posted prior to the call under the

“Investors” section on Finance of America’s website at

https://ir.financeofamericacompanies.com/.

To listen to the audio webcast of the conference call, please

visit the “Investors” section of the Company's website at

https://ir.financeofamericacompanies.com/. The conference call can

also be accessed by dialing the following:

- 1-800-715-9871 (Domestic)

- 1-646-307-1963 (International)

- Conference ID: 5706924

Replay

A replay of the call will also be available on the Company's

website approximately two hours after the conclusion of the

conference call until November 20, 2024. To access the replay,

visit the “Investors” section of the Company’s website at

https://ir.financeofamericacompanies.com/. The replay can also be

accessed by dialing 1-800-770-2030 (United States) or

1-609-800-9909 (International). The replay pin number is

5706924.

About Finance of America

Finance of America (NYSE: FOA) is a leading provider of home

equity-based financing solutions for a modern retirement. In

addition, Finance of America offers capital markets and portfolio

management capabilities primarily to optimize the distribution of

its originated loans to investors. Finance of America is

headquartered in Plano, Texas. For more information, please visit

www.financeofamericacompanies.com.

Forward-Looking Statements

This release includes “forward-looking statements” within the

meaning of the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are not historical facts or statements of current

conditions, but instead represent only the Company’s beliefs

regarding future events, many of which, by their nature, are

inherently uncertain and outside of the Company’s control. These

statements include, but are not limited to, statements related to

our expectations regarding the performance of our business, our

financial results, our liquidity and capital resources, and other

non-historical statements. In some cases, you can identify these

forward-looking statements by the use of words such as “outlook,”

“believes,” “expects,” “potential,” “continues,” “may,” “will,”

“should,” “could,” “seeks,” “projects,” “predicts,” “intends,”

“plans,” “estimates,” “budgets,” “forecasts,” “anticipates,” or the

negative version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties that could cause actual outcomes or results to differ

materially from those indicated in these statements, including

those risks described below. Given the significant uncertainties

inherent in the forward-looking statements included herein, the

inclusion of such information should not be regarded as a

representation by the Company or any other person that the results

or conditions described in such statements or the Company’s

objectives and plans will be achieved. The Company cautions readers

not to place undue reliance upon any forward-looking statements,

which are current only as of the date of this release. Results for

any specified quarter are not necessarily indicative of the results

that may be expected for the full year or any future period. The

Company does not undertake or accept any obligation or undertaking

to release publicly any updates or revisions to any forward-looking

statements to reflect any change in its expectations or any change

in events, conditions, or circumstances on which any such statement

is based, except as required by law. All subsequent written and

oral forward-looking statements concerning the Company or other

matters and attributable to the Company or any person acting on its

behalf are expressly qualified in their entirety by the cautionary

statements above. A number of important factors exist that could

cause future results to differ materially from historical

performance and these forward-looking statements. Factors that

might cause such a difference include, but are not limited to: our

ability to manage the unique challenges presented by operating as a

modern retirement solutions platform rather than a

vertically-integrated, diversified lending and complementary

services platform due to the transformation of our business; our

ability to successfully operate the recently integrated lending

platform that we acquired from American Advisors Group in March

2023 and generally, our ability to operate our business profitably;

our ability to respond to significant changes in prevailing

interest rates and to resume profitable business operations; our

geographic market concentration if the economic conditions in our

current markets should decline or if our current markets are

impacted by natural disasters; our use of estimates in measuring or

determining the fair value of the majority of our financial assets

and liabilities, which may require us to write down the value of

these assets or write up the value of these liabilities if the

estimates prove to be incorrect; our ability to prevent cyber

intrusions and mitigate cyber risks; the possibility that the

Company may be adversely affected by other economic, business

and/or competitive factors in our business markets and worldwide

financial markets, including a sustained period of higher interest

rates; our ability to manage changes in our licensing status,

business relationships or servicing guidelines with the Government

National Mortgage Association, the United States Department of

Housing and Urban Development or other governmental entities; our

ability to obtain sufficient capital and liquidity to meet the

financing and operational requirements of our business and our

ability to comply with our debt agreements, including warehouse

lending facilities, and pay down our substantial debt; our ability

to refinance our debt on reasonable terms as it becomes due; our

ability to manage disruptions in the secondary home loan market,

including the mortgage-backed securities market; our ability to

finance and recover costs of our reverse mortgage servicing

operations; our ability to maintain compliance with the extensive

regulations we are subject to, including consumer protection laws

applicable to reverse mortgage lenders, which may be highly

complex; our ability to compete with national banks, which are not

subject to state licensing and operational requirements; our

ability to manage various legal proceedings, federal or state

governmental examinations and enforcement investigations we are

subject to from time to time, the results of which are difficult to

predict or estimate; our continued ability to remain in compliance

with the terms of the consent orders issued by the Consumer

Financial Protection Bureau, which we assumed in connection with

our acquisition of operational assets from American Advisors Group;

our holding company status and dependency on distributions from

Finance of America Equity Capital LLC; our ability to comply with

the continued listing standards of the New York Stock Exchange

(“NYSE”) and avoid the delisting of our common stock from trading

on its exchange; our common stock trading history has been

characterized by low trading volume, which may result in an

inability to sell your shares at a desired price, if at all; and

our “controlled company” status under NYSE rules, which exempts us

from certain corporate governance requirements and affords

stockholders fewer protections.

All of these factors are difficult to predict, contain

uncertainties that may materially affect actual results and may be

beyond our control. New factors emerge from time to time, and it is

not possible for our management to predict all such factors or to

assess the effect of each such new factor on our business. Although

we believe that the assumptions underlying the forward-looking

statements contained herein are reasonable, any of the assumptions

could be inaccurate, and any of these statements included herein

may prove to be inaccurate. Given the significant uncertainties

inherent in the forward-looking statements included herein, the

inclusion of such information should not be regarded as a

representation by us or any other person that the results or

conditions described in such statements, or our objectives and

plans will be achieved. Please refer to “Risk Factors” included in

our Annual Report on Form 10-K for the year ended December 31,

2023, filed with the U.S. Securities and Exchange Commission (the

“SEC”) on March 15, 2024, for further information on these and

other risk factors affecting us, as such factors may be amended and

updated from time to time in the Company’s subsequent periodic

filings with the SEC, which are accessible on the SEC’s website at

www.sec.gov.

Non-GAAP Financial Measures

The Company’s management evaluates performance of the Company

through the use of certain measures that are not prepared in

accordance with U.S. Generally Accepted Accounting Principles

(“GAAP”), including adjusted net income (loss), adjusted earnings

before interest, taxes, depreciation, and amortization (“EBITDA”),

and adjusted earnings (loss) per share.

The presentation of non-GAAP measures is used to enhance

investors’ understanding of certain aspects of our financial

performance. This discussion is not meant to be considered in

isolation, superior to, or as a substitute for the directly

comparable financial measures prepared in accordance with U.S.

GAAP. Management believes these key financial measures provide an

additional view of our performance over the long-term and provide

useful information that we use in order to maintain and grow our

business.

These non-GAAP financial measures should not be considered as an

alternative to net income (loss), operating cash flows, or any

other performance measures determined in accordance with U.S. GAAP.

Adjusted net income (loss), adjusted EBITDA, and adjusted earnings

(loss) per share have important limitations as analytical tools and

should not be considered in isolation or as a substitute for

analysis of our results as reported under U.S. GAAP. Some of the

limitations of these metrics are: (i) cash expenditures for future

contractual commitments; (ii) cash requirements for working capital

needs; (iii) cash requirements for certain tax payments; and (iv)

all non-cash income/expense items.

Because of these limitations, adjusted net income (loss),

adjusted EBITDA, and adjusted earnings (loss) per share should not

be considered as measures of discretionary cash available to us to

invest in the growth of our business or distribute to shareholders.

We compensate for these limitations by relying primarily on our

U.S. GAAP results and using our non-GAAP financial measures only as

a supplement. Users of our condensed consolidated financial

statements are cautioned not to place undue reliance on our

non-GAAP financial measures.

Change in Non-GAAP Measures

Prior to the third quarter of 2024, the Company’s adjusted net

income (loss), adjusted EBITDA, and adjusted earnings (loss) per

share were adjusted for equity-based compensation for only the

Replacement Restricted RSUs and Earnout Right RSUs. Beginning with

the third quarter of 2024, the Company revised our definitions of

adjusted net income (loss), adjusted EBITDA, and adjusted earnings

(loss) per share to now adjust for all non-cash equity-based

compensation in the aforementioned non-GAAP measures. As a result

of the change, prior period amounts have been recast to reflect the

updated presentation.

Subsequent to granting the Replacement RSUs and Earnout Right

RSUs, the Company has granted other equity-based awards. As these

awards are non-cash expenses that are not directly correlated with

operating results, the Company believes that analysts, investors,

and other users of the financial statements may find this change

beneficial when analyzing our operating performance and

comparability to peers.

Adjusted Net Income (Loss)

We define adjusted net income (loss) as consolidated net income

(loss) from continuing operations adjusted for:

- Income taxes

- Changes in fair value of loans and securities held for

investment and related obligations due to market inputs or model

assumptions, deferred purchase price obligations (including

earnouts and Tax Receivable Agreements (“TRA”) obligation),

contingent earnout, warrant liability, and minority

investments.

- Amortization or impairment of intangibles and impairment of

certain other long-lived assets.

- Equity-based compensation, excluding forfeitures and

accelerations associated with restructuring activities, which are

included in certain non-recurring costs.

- Certain non-recurring costs and adjustments that management

believes should be excluded as these do not relate to a recurring

part of the core business operations. These items include amounts

recognized for settlement of legal and regulatory matters,

acquisition or divestiture-related expenses, and other one-time

charges.

- Pro-forma income tax benefit (provision) adjustments to apply

an effective combined corporate tax rate to adjusted net income

(loss) before taxes.

Management considers adjusted net income (loss) important in

evaluating our Company as a whole. This supplemental metric is

utilized by our management team to assess the underlying key

drivers and operational performance of the continuing operations of

the business. In addition, analysts, investors, and creditors may

use this measure when analyzing our operating performance and

comparability to peers. Adjusted net income (loss) is not a

presentation made in accordance with U.S. GAAP, and our definition

and use of this measure may vary from other companies in our

industry.

Adjusted net income (loss) provides visibility to the underlying

operating performance by excluding the impact of certain items that

management does not believe are representative of our core

earnings. Adjusted net income (loss) may also include other

adjustments, as applicable, based upon facts and circumstances,

consistent with our intent of providing a supplemental means of

evaluating our operating performance.

Adjusted EBITDA

We define adjusted EBITDA as net income (loss) from continuing

operations adjusted for:

- Income taxes

- Change in fair value of loans and securities held for

investment and related obligations due to market inputs or model

assumptions, deferred purchase price obligations (including

earnouts and TRA obligation), contingent earnout, warrant

liability, and minority investments.

- Amortization or impairment of intangibles and impairment of

certain other long-lived assets.

- Equity-based compensation, excluding forfeitures and

accelerations associated with restructuring activities, which are

included in certain non-recurring costs.

- Certain non-recurring costs and adjustments that management

believes should be excluded as these do not relate to a recurring

part of the core business operations. These items include amounts

recognized for settlement of legal and regulatory matters,

acquisition or divestiture-related expenses, and other one-time

charges.

- Depreciation

- Interest expense on non-funding debt

We evaluate the performance of our company and segments through

the use of adjusted EBITDA as a non-GAAP measure. Management

considers adjusted EBITDA important in evaluating the Company as a

whole. Adjusted EBITDA is a supplemental metric utilized by our

management team to assess the underlying key drivers and

operational performance of the continuing operations of the

business. In addition, analysts, investors, and creditors may use

this measure when analyzing our operating performance. Adjusted

EBITDA is not a presentation made in accordance with U.S. GAAP, and

our use of this measure and term may vary from other companies in

our industry.

Adjusted EBITDA provides visibility to the underlying operating

performance by excluding the impact of certain items that

management does not believe are representative of our core

earnings. Adjusted EBITDA may also include other adjustments, as

applicable, based upon facts and circumstances, consistent with our

intent of providing a supplemental means of evaluating our

operating performance.

Adjusted Earnings (Loss) Per Share

We define adjusted earnings (loss) per share as adjusted net

income (loss) (defined above) divided by the weighted average

outstanding shares, which includes outstanding Class A Common Stock

plus the Class A Units of Finance of America Equity Capital owned

by the noncontrolling interest on an if-converted basis and any

shares under the treasury stock method.

Analysts, investors, and creditors may use this measure when

analyzing our operating performance and comparability to peers.

Adjusted earnings (loss) per share is not a presentation made in

accordance with U.S. GAAP, and our definition and use of this

measure may vary from other companies in our industry.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106517018/en/

For Finance of America Media: pr@financeofamerica.com For

Finance of America Investor Relations: ir@financeofamerica.com

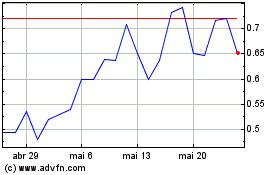

Finance of America Compa... (NYSE:FOA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Finance of America Compa... (NYSE:FOA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025