The Chemours Company Announces Completion of U.S. Dollar-denominated Term Loan Repricing

29 Novembro 2024 - 6:30PM

Business Wire

The Chemours Company (Chemours) (NYSE: CC) today announced the

successful repricing of its Tranche B-3 U.S. Dollar-denominated

Term Loan under its senior secured term loan facility due in August

2028.

The repricing reduces the applicable margin in respect of the

Company’s $1,070,000,000 senior secured U.S. dollar-denominated

term loan facility, the “Term Loan B-3 US$ Facility,” from, at the

election of the Company, adjusted Term SOFR + 3.50% to adjusted

Term SOFR + 3.00%, or adjusted base rate plus 2.50% to adjusted

base rate plus 2.00%. There are no changes to the maturity of the

Term Loan B-3 US$ Facility following this repricing, and all other

terms are substantially unchanged.

About The Chemours Company The Chemours Company (NYSE:

CC) is a global leader in providing industrial and specialty

chemicals products for markets, including coatings, plastics,

refrigeration and air conditioning, transportation, semiconductor

and advanced electronics, general industrial, and oil and gas.

Through our three businesses – Thermal & Specialized Solutions,

Titanium Technologies, and Advanced Performance Materials – we

deliver application expertise and chemistry-based innovations that

solve customers’ biggest challenges. Our flagship products are sold

under prominent brands such as Opteon™, Freon™, Ti-Pure™, Nafion™,

Teflon™, Viton™, and Krytox™. Headquartered in Wilmington, Delaware

and listed on the NYSE under the symbol CC, Chemours has

approximately 6,100 employees and 28 manufacturing sites and serves

approximately 2,700 customers in approximately 110 countries.

For more information, we invite you to visit chemours.com or

follow us on X (formerly Twitter) @Chemours or LinkedIn.

Forward-Looking Statements This press release contains

forward-looking statements, within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, which involve risks and uncertainties.

Forward-looking statements provide current expectations of future

events based on certain assumptions and include any statement that

does not directly relate to a historical or current fact. The words

“believe,” “expect,” “will,” “anticipate,” “plan,” “estimate,”

“target,” “project” and similar expressions, among others,

generally identify “forward-looking statements,” which speak only

as of the date such statements were made. Forward-looking

statements are based on certain assumptions and expectations of

future events that may not be accurate or realized. Forward-looking

statements also involve risks and uncertainties, many of which are

beyond Chemours’ control. Additionally, there may be other risks

and uncertainties that Chemours is unable to identify at this time

or that Chemours does not currently expect to have a material

impact on its business. Factors that could cause or contribute to

these differences include the risks, uncertainties and other

factors discussed in Chemours’ filings with the U.S. Securities and

Exchange Commission, including in Chemours’ Quarterly Report on

Form 10-Q for the quarter ended September 30, 2024, and in

Chemours’ Annual Report on Form 10-K for the year ended December

31, 2023. Chemours assumes no obligation to revise or update any

forward-looking statement for any reason, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241129945492/en/

INVESTORS Brandon Ontjes Vice President, Investor

Relations +1.302.773.3300 investor@chemours.com

Kurt Bonner Manager, Investor Relations +1.302.773.0026

investor@chemours.com

NEWS MEDIA Cassie Olszewski Media Relations &

Reputation Leader +1.302.219.7140 media@chemours.com

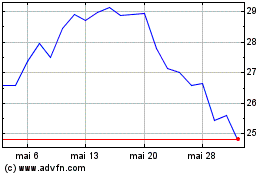

Chemours (NYSE:CC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Chemours (NYSE:CC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024