Core Scientific, Inc. (NASDAQ: CORZ) (“Core Scientific” or the

“Company”), a leader in digital infrastructure for bitcoin mining

and high-performance computing, today announced its intention to

offer, subject to market and other conditions, $500 million

aggregate principal amount of convertible senior notes due 2031

(the “notes”) in a private offering to persons reasonably believed

to be qualified institutional buyers pursuant to Rule 144A under

the Securities Act of 1933, as amended (the “Securities Act”). Core

Scientific also expects to grant the initial purchasers of the

notes an option to purchase, for settlement within a period of 13

days from, and including, the date the notes are first issued, up

to an additional $75 million principal amount of notes.

The notes will be senior, unsecured obligations of Core

Scientific, will accrue interest payable semi-annually in arrears

and will mature on June 15, 2031 unless earlier converted, redeemed

or repurchased. Noteholders will have the right to convert their

notes in certain circumstances and during specified periods. Core

Scientific will settle conversions by paying or delivering, as

applicable, cash, shares of its common stock or a combination of

cash and shares of its common stock, at Core Scientific’s

election.

The notes will be redeemable, in whole or in part (subject to

certain limitations), for cash at Core Scientific’s option at any

time, and from time to time, on or after June 22, 2028 and on or

before the 20th scheduled trading day immediately before the

maturity date, but only if the last reported sale price per share

of Core Scientific’s common stock exceeds 130% of the conversion

price for a specified period of time and certain other conditions

are satisfied. The redemption price will be equal to the principal

amount of the notes to be redeemed, plus accrued and unpaid

interest, if any, to, but excluding, the redemption date.

The notes will be subject to repurchase by Core Scientific for

cash at the noteholders’ option on December 15, 2027. In addition,

if certain corporate events that constitute a “fundamental change”

occur, then, subject to a limited exception, noteholders may

require Core Scientific to repurchase their notes for cash. The

repurchase price will be equal to the principal amount of the notes

to be repurchased, plus accrued and unpaid interest, if any, to,

but excluding, the applicable repurchase date or fundamental change

repurchase date.

The interest rate, initial conversion rate and other terms of

the notes will be determined at the pricing of the offering.

Core Scientific intends to use the net proceeds from the

offering for general corporate purposes, including working capital,

operating expenses, capital expenditures, acquisitions of

complementary businesses, or repurchases of its securities.

The offer and sale of the notes and any shares of Core

Scientific’s common stock issuable upon conversion of the notes

have not been, and will not be, registered under the Securities Act

or any other securities laws, and the notes and any such shares

cannot be offered or sold except pursuant to an exemption from, or

in a transaction not subject to, the registration requirements of

the Securities Act and any other applicable securities laws. This

press release does not constitute an offer to sell, or the

solicitation of an offer to buy, the notes or any shares of Core

Scientific’s common stock issuable upon conversion of the notes,

nor will there be any sale of the notes or any such shares, in any

state or other jurisdiction in which such offer, sale or

solicitation would be unlawful.

About Core Scientific

Core Scientific, Inc. is a leader in digital infrastructure for

digital assets mining and high-performance computing. We operate

dedicated, purpose-built facilities for digital asset mining and

are a premier provider of digital infrastructure to our third-party

customers. We employ our own large fleet of computers (“miners”) to

earn digital assets for our own account, we provide hosting

services for large bitcoin mining customers and we are in the

process of allocating and converting a significant portion of our

nine operational data centers in Alabama (1), Georgia (2), Kentucky

(1), North Carolina (1), North Dakota (1) and Texas (3), and our

facility in development in Oklahoma to support artificial

intelligence-related workloads under a series of contracts that

entail the modification of certain of our data centers to deliver

hosting services for high-performance computing.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“estimate,” “intend,” “will,” “expect,” “anticipate” or other

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

statements include, but are not limited to, statements regarding

the anticipated terms of the notes being offered, the completion,

timing and size of the proposed offering and the intended use of

the proceeds. Forward-looking statements represent Core

Scientific’s current expectations regarding future events and are

subject to known and unknown risks and uncertainties that could

cause actual results to differ materially from those implied by the

forward-looking statements. Among those risks and uncertainties are

market conditions, including market interest rates, the trading

price and volatility of Core Scientific’s common stock and risks

relating to Core Scientific’s business, including those described

in the Company’s Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q filed with the Securities and Exchange Commission (the

“SEC”). Core Scientific may not consummate the proposed offering

described in this press release and, if the proposed offering is

consummated, cannot provide any assurances regarding the final

terms of the offering or the notes or its ability to effectively

apply the net proceeds as described above.

These statements are provided for illustrative purposes only and

are based on various assumptions, whether or not identified in this

press release, and on the current expectations of the Company’s

management. These forward-looking statements are not intended to

serve, and must not be relied on by any investor, as a guarantee,

an assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of the Company.

These forward-looking statements are subject to a number of risks

and uncertainties, including those identified in the Company’s

reports filed with the SEC, and if any of these risks materialize

or our assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking

statements. Accordingly, undue reliance should not be placed upon

the forward-looking statements. The Company does not assume any

duty or obligation (and does not undertake) to update or supplement

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202140849/en/

Investors: ir@corescientific.com

Media: press@corescientific.com

For Core Scientific Joseph Sala / Mahmoud Siddig Joele Frank,

Wilkinson Brimmer Katcher (212) 355-4449

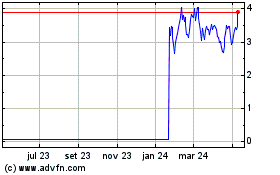

Core Scientific (NASDAQ:CORZ)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

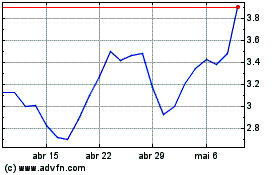

Core Scientific (NASDAQ:CORZ)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024