Earned 314 Self-Mined Bitcoin for a Total of

6,304 Bitcoin Year-to-Date and Our Customers Earned an Estimated 29

Bitcoin at Our Data Centers in November

Core Scientific, Inc. (Nasdaq: CORZ) ("Core

Scientific" or “the Company”), a leader in digital infrastructure

for high-performance computing and bitcoin mining, today released

unaudited production and operations updates for November 2024.

Key Metrics Summary (unaudited)

Metric

November 2024

October 2024

Self-Mining Bitcoin Earned1

314

369

Hosting Bitcoin Earned by

Customers2

29

52

Average Self-Mined Bitcoin

Earned/Day

10.5

11.9

Self-Mining Energized Hash

rate3

19.3

19.7

Hosting Energized Hash rate4

1.0

2.1

Total Energized Hash rate

20.3

21.8

Bitcoin Sold5

272

370

Bitcoin Sales Proceeds ($USD)

Appx. $23.2 million

Appx. $24.2 million

Average Self-Mining Fleet Efficiency

(J/TH)6

24.8

24.8

Data Centers

As of month-end, the Company operated approximately 172,000

bitcoin miners in our data centers for both self-mining and

hosting, representing a total energized hash rate of 20.3 EH/s.

Digital Asset Self-Mining

Core Scientific earned 314 bitcoin in November from its owned

fleet of miners. As of month end, the Company operated

approximately 165,000 owned bitcoin miners, representing

approximately 96% of the bitcoin miners operating in its data

centers and a total energized hash rate of 19.3 EH/s.

Hosting Services for Bitcoin Mining

In addition to its self-mining fleet, Core Scientific provided

data center hosting services, technology and operating support for

approximately 7,200 hosted, customer-owned bitcoin miners,

representing approximately 4% of the bitcoin miners operating in

the Company’s data centers as of November 30, 2024. Customer-owned

bitcoin miners earned an estimated 29 bitcoin in November,

including bitcoin rewards paid to the Company pursuant to proceeds

sharing agreements.

Grid Support

The Company reduced the consumption of power at its data centers

on multiple occasions, delivering 23,309 megawatt hours to local

electrical grids.

Infrastructure Expansion

The Company has secured approval from the Denton City Council to

expand its operations, increasing its leased land and power

allocation up to 394 MW. This expansion marks one of many others we

intend to announce as we expand our power footprint to facilitate

an additional 300 MW of critical IT load at our existing

facilities.

ABOUT CORE SCIENTIFIC

Core Scientific, Inc. is a leader in digital infrastructure for

digital assets mining and high-performance computing. We operate

dedicated, purpose-built facilities for digital asset mining and

are a premier provider of digital infrastructure to our third-party

customers. We employ our own large fleet of computers (“miners”) to

earn digital assets for our own account, we provide hosting

services for large bitcoin mining customers and we are in the

process of allocating and converting a significant portion of our

nine operational data centers in Alabama (1), Georgia (2), Kentucky

(1), North Carolina (1), North Dakota (1) and Texas (3), and our

facility in development in Oklahoma to support artificial

intelligence-related workloads under a series of contracts that

entail the modification of certain of our data centers to deliver

hosting services for high-performance computing.

FORWARD LOOKING STATEMENTS AND EXPLANATORY NOTES

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding projections, estimates and forecasts of

revenue and other financial and performance metrics, projections of

market opportunity and expectations, the Company’s ability to scale

and grow its businesses, implement its business strategy, source

necessary electrical energy, the advantages and expected growth of

the Company and the Company’s ability to source and retain talent.

You can identify forward-looking statements by the fact that they

do not relate strictly to historical or current facts. These

statements may include words such as “aim,” “estimate,” “plan,”

“project,” “forecast,” “goal,” “intend,” “will,” “expect,”

“anticipate,” “believe,” “seek,” “target” or other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. All forward looking

statements are subject to risks and uncertainties that may cause

actual results to differ materially, including: our ability to earn

digital assets profitably and to attract customers for our current

and future expected hosting infrastructure; our ability to maintain

our competitive position in our businesses; our ability to raise

additional capital to continue our expansion efforts or other

operations; our need for significant electric power and the limited

availability of power resources; the potential failure in our

critical systems, facilities or services we provide; the physical

risks and regulatory changes relating to climate change; potential

significant changes to the method of validating blockchain

transactions; our vulnerability to physical security breaches,

which could disrupt our operations; a potential slowdown in market

and economic conditions, particularly those impacting artificial

intelligence, high value computing, the blockchain industry and the

blockchain hosting market; the identification of material

weaknesses in our internal control over financial reporting; price

volatility of digital assets and bitcoin in particular; the

“halving” and other reduction of rewards available on the Bitcoin

network, affecting our ability to generate revenue; the potential

that insufficient awards from digital asset mining could

disincentivize transaction processors from expending processing

power on a particular network, which could negatively impact the

utility of the network and further reduce the value of its digital

assets; potential changes in the interpretive positions of the SEC

or its staff with respect to digital asset mining firms; the

increasing likelihood that U.S. federal and state legislatures and

regulatory agencies will enact laws and regulations to regulate

digital assets and digital asset intermediaries; increasing

scrutiny and changing expectations with respect to our ESG

policies; the effectiveness of our compliance and risk management

methods; the adequacy of our sources of recovery if the digital

assets held by us are lost, stolen or destroyed due to third-party

digital asset services; and our level of indebtedness and our

current liquidity constraints affecting our financial condition and

ability to service our indebtedness. Any such forward-looking

statements represent management’s estimates and beliefs as of the

date of this press release. While we may elect to update such

forward-looking statements at some point in the future, we disclaim

any obligation to do so, even if subsequent events cause our views

to change.

Please follow us on:

https://www.linkedin.com/company/corescientific/

https://X.com/core_scientific

https://www.youtube.com/@Core_Scientific/featured

1 Self-Mining Bitcoin Earned represents bitcoin

rewards earned by bitcoin miners owned and operated by Core

Scientific

2 Hosting Bitcoin Earned represents estimated

bitcoin rewards earned by customer-owned miners installed and

operated by Core Scientific in our data centers, including bitcoin

rewards earned by customers and paid to the Company pursuant to

proceeds sharing agreements

3 Self-Mining Energized Hash Rate represents the total

rated capacity of all Company-owned bitcoin miners installed and

operating in Core Scientific’s data centers. Includes previous

generation miners removed to accommodate new miners and then

re-deployed opportunistically to exploit favorable mining

economics.

4 Hosting Energized Hash Rate represents the total rated

capacity of all hosted bitcoin miners owned by customers, installed

and operated by Core Scientific in our data centers

5 Bitcoin Sold represents all bitcoin sold by the Company

during the period, including self-mined and proceeds sharing

rewards.

6 Average Self-Mining Fleet Efficiency (J/TH) represents

the weighted average power consumption in Joules per terahash based

on the actual efficiency of each model of miner operating in Core

Scientific’s owned self-mining fleet

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205211821/en/

Investors: ir@corescientific.com Media:

press@corescientific.com

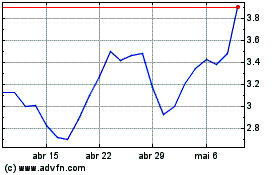

Core Scientific (NASDAQ:CORZ)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

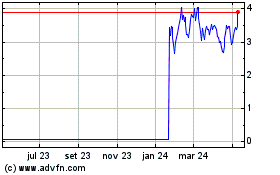

Core Scientific (NASDAQ:CORZ)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024