Salesforce Data Reveals New Cyber Week All-Time High: $314.9B in Global Sales

04 Dezembro 2024 - 10:00AM

Business Wire

Cyber Week online orders grow 7% in the United

States and 6% globally

AI and agents drive $60 billion in online sales

through personalized offers and engagements

Mobile devices facilitate 70% of U.S. and

worldwide online purchases

Salesforce (NYSE: CRM), the #1 AI CRM, today announced its 2024

Cyber Week results (Nov. 26 - Dec. 2), revealing a record $314.9

billion in global online sales, with U.S. consumers contributing

$76 billion.

The report also revealed mobile devices drove 70% of U.S. and

global online orders this year, and Black Friday proved its staying

power as a cornerstone of the shopping season by driving $74.4

billion in global digital sales. AI, including agents, also played

a pivotal role, influencing $60 billion in sales and showing how

this technology is reshaping the retail landscape and boosting

consumer engagement.

Based on an analysis of 1.5 billion shoppers and 1.6 trillion

page views across the Salesforce Platform, the annual report found

that consumers held off on spending to capitalize on Cyber Week

deals.

“Shoppers were waiting all of 2024 for the right moment to buy

the goods they wanted, and they clearly made the most of this Cyber

Week,” said Caila Schwartz, Director of Consumer Insights at

Salesforce. “Strong year-over-year (YoY) order growth indicates

that even modest discounts were enough to convince consumers to

open their wallets. And retailers who invested in AI and agents

were able to reap even greater revenues during this critical

shopping period through personalized promotions, recommendations,

and support.”

Top Cyber Week 2024 Salesforce shopping insights from the

Salesforce report include:

- Online sales and order growth reached new peaks: After

months of slow sales growth, Cyber Week and the lead-up to it was

the pressure release valve that drove consumers to spend more this

year.

- Growth for the first four weeks of the holiday season (Nov. 5 -

Dec. 2) was strong, up 8% in the U.S. and worldwide.

- Cyber Week: Digital sales across Cyber Week reached $76

billion in the U.S. (up 7% YoY) and $314.9 billion globally (up 6%

YoY).

- Black Friday: Global online sales reached $74.4 billion

(up 5% YoY) and $17.5 billion (up 7% YoY) in the U.S. This was the

strongest shopping day of the week.

- Cyber Monday: Global online sales reached $12.8 billion

in the U.S. (up 3% YoY) and $49.7 billion globally (up 2%

YoY).

- AI and agents play a big part in Cyber Week: Retailers

like Saks doubled down on the use of AI, including agents, to power

shopping experiences this season.

- $60 billion of global online sales were influenced by AI and

agents for product recommendations, targeted offers, and

conversational customer service support.

- Retailers using generative AI and agents to fuel service

experiences saw a 2% higher conversion rate compared to retailers

who didn't use the technology.

- Retailers used generative AI and agents 18% more during Cyber

Week than the previous week, likely to drive efficiency and

personalization for customers.

- Shoppers used AI- and agent-powered chat for customer service

38% more than they did in the previous week.

- Mixed bag of discounts drove mixed bag of results:

Despite the threat of growing consumer appeal and low prices

offered Chinese marketplaces like Temu, Shein, and AliExpress,

Western retailers did not offer significant discounts to compete.

- The global average discount rate was 26% and the U.S. discount

rate was 28%, both down 1% YoY.

- Verticals with the highest global average discount rates

included:

- Makeup (40%)

- General apparel (34%)

- Skincare (33%)

- Verticals with the highest U.S. average discount rates

included:

- General apparel (37%)

- Health and beauty (35%)

- Home appliance, decor, and furniture (23%)

- Mobile conversion picks up the pace: As consumers of all

ages grow increasingly comfortable with mobile shopping and the

mobile buying experience gets easier, the gap between mobile

traffic and mobile orders is narrowing. This trend underscores a

growing consumer willingness to make significant and high-value

purchases directly from their smartphones.

- More than 80% of both U.S. and global ecommerce traffic

originated from a mobile device during Cyber Week.

- Exactly as predicted, mobile orders drove 70% of U.S. and

global sales, up from 67% in 2023.

- In total, mobile accounted for $220 billion in sales globally

and $53.3 billion in the United States.

- Mobile wallet usage also increased 16% globally during the

week.

- Social commerce plays a critical role for retailers

- Retailers implementing social commerce strategies saw 19% of

their Cyber Week sales generated through platforms like TikTok Shop

and Instagram.

Salesforce powers Cyber Week shopping with trust, scale, and

AI

This year, the Salesforce Platform helped digital retailers

around the world drive profitable growth and scale, with nearly

100% uptime, to reach shoppers across all buying channels with

agentic and personalized experiences. This was made possible

by:

- Commerce Cloud: Commerce Cloud powered nearly 50 million

orders on digital storefronts across Cyber Week with 99.999%

uptime.

- Marketing Cloud: Nearly 56.5 billion marketing messages

were sent via Marketing Cloud, accounting for a 5% YoY

increase.

- Service Cloud: Service Cloud helped customers field and

resolve more than 3.8 billion cases.

- AI: Salesforce powered nearly 60 billion AI-powered

product recommendations across Cyber Week, signaling 21% YoY

growth. Salesforce also observed a 32.2% YoY increase in AI-powered

chatbots during the week.

- Agentforce: Agentforce generated 1.67 million Large

Language Model (LLM) replies and decisions to execute actions for

retailers during Cyber Week.

Explore further:

- Compare Cyber Week to Salesforce’s 2024 holiday season

forecast

- Visit the Holiday Shopping HQ for real-time Cyber Week

results

2024 Salesforce holiday insights and predictions

methodology

Powered by Agentforce, Commerce Cloud, Marketing Cloud, and

Service Cloud, Salesforce analyzed aggregated data to produce

holiday insights from the activity of more than 1.5 billion global

shoppers across more than 89 countries, with a focus on 18 key

markets: the United States, Canada, United Kingdom, Germany,

France, Italy, Spain, Japan, the Netherlands, Australia, New

Zealand, the Asia-Pacific (excluding Japan, Australia, and New

Zealand), Switzerland, Latin America (LAM), the Middle East and

Africa (MEA), Eastern Europe, Belgium, and the Nordics. This

battery of benchmarks provides a deep look into the last nine

quarters and the current state of digital commerce. Several factors

are applied to extrapolate macroeconomic figures for the broader

retail industry. These and these results are not indicative of

Salesforce performance.

The prediction data that we present are from proprietary

Salesforce research. The calculations we use blend first-party and

third-party data, as well as several market assumptions, to

generate the data points we present.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204489496/en/

pr@salesforce.com

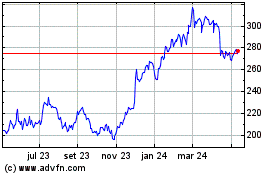

Salesforce (NYSE:CRM)

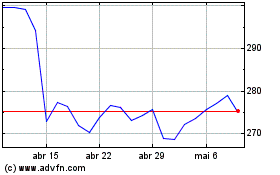

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Salesforce (NYSE:CRM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024