52% plan to use a budget in 2025, while 36%

created a budget in 2024

Just over half (54%) of U.S. consumers plan to make a financial

resolution for 2025, according to a new national survey conducted

by Discover® Personal Loans. The top financial resolutions in

America are to save more in general (42%), earn more (35%), spend

less (35%), improve credit scores (27%), build an emergency fund

(26%) and pay off or consolidate debt (21%).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241211996767/en/

According to a new national survey from

Discover® Personal Loans, 54% of American consumers plan to make a

financial resolution in 2025. Top resolutions are to save more in

general, earn more, spend less, improve credit scores, build an

emergency fund, and pay off or consolidate debt. (Graphic: Business

Wire)

Meanwhile, nearly all Americans (94%) say they anticipate at

least one challenge that may prevent them from achieving their

financial resolutions. The top challenges cited as potential

blockers include inflation (47%), unexpected expenses (39%), the

state of the economy (38%), everyday expenses (37%), current income

level (32%) and existing personal debt (27%).

“I encourage those planning financial resolutions to take

actions now to position themselves to achieve their goals in the

year ahead,” said Dan Nickele, vice president, Discover Personal

Loans. “Think about, for example, creating a monthly budget that

helps you save more or spend less; and setting up automatic

transfers to a high-yield savings account to establish an emergency

fund. Also, the interest rate outlook may give you the opportunity

to refinance higher-rate debt. If you’re interested in exploring

debt consolidation options, it’s a good idea to research and

compare lenders that offer a great interest rate, with no

origination fees or prepayment penalties.”

Conversely, 46% of Americans don’t plan to make a financial

resolution. Many say it’s because they don’t like making New Year’s

resolutions for anything (35%) or that they’re happy with their

current financial situation (30%). Other reasons Americans said

they’re choosing not to make a financial resolution include that

thinking about finances causes them stress and anxiety (21%), not

being ready for change (15%) and not knowing where to start

(14%).

“It’s encouraging to see that so many Americans have a strong

interest in improving their personal financial situations in 2025.

Even if you’re not making a specific resolution, I would recommend

taking any small step to get started on a path toward a brighter

financial future – whether that’s saving for a specific goal or

creating a game plan to manage your existing debt,” adds

Nickele.

The survey also found that a majority of Americans have a

cautious sense of optimism about their personal finances for the

year ahead, with most saying they expect their situation to stay

the same (45%) or even improve (36%). Younger generations are even

more optimistic; 44% of Gen Zers and 45% of Millennials expect

their financial situation to get better in 2025.

2024 Budgeting Actions vs. 2025 Budgeting Plans

Budgeting Actions

2024

Budgeting Plans

2025

Created a budget

36%

Plan to budget

52%

Did not create a budget

64%

Do not plan to make a budget

48%

2024 Budgeting Actions

Nearly one-quarter (22%) of U.S. consumers created a budget in

2024 and stuck to it, which they say made them feel accomplished

(46%), prepared for the unexpected (38%), secure (38%), relieved

(37%) and confident (36%).

Fourteen percent of Americans created a budget but weren’t able

to stick with it due to unexpected expenses (45%), inflation (34%),

lack of money to set aside or save (32%), feeling overwhelmed with

debt (25%) and unexpected life events (25%).

Meanwhile, nearly two-thirds (64%) of Americans say they didn’t

create a budget in 2024, primarily because they didn’t want or need

one (57%). Other reasons consumers say they did not create a budget

include that their past attempts had not been successful (24%), it

felt too difficult (19%) and that they didn’t know which method to

use (19%).

2025 Budgeting Plans

Just over half (52%) of Americans say they plan to take at least

one budgeting action in 2025, which includes working towards a

specific financial goal (51%), following a specific budgeting

strategy (29%), using an app or spreadsheet (28%) and working with

a financial advisor or planner (20%). Meanwhile, 25% of Americans

do not plan to make a budget for 2025, and 23% don’t have a

specific plan but say they will try to be generally aware of where

their money is being allocated in 2025.

“I recommend consumers research common budgeting methods to help

them choose an option they are most likely to stick with,” said

Nickele. “For consumers who don’t plan to use a budget next year, I

encourage them to financially prepare for the unexpected and to

learn about options for managing any existing debt.”

Discover Personal Loans has many resources available to help

consumers learn about managing debt, financing major expenses and

reaching their financial goals. A personal loan calculator can help

consumers find a loan term that works for their individual

situation, and a debt consolidation calculator can help consumers

see what they could potentially save if they were to consolidate

higher-interest debt with a personal loan.

About the Survey

This poll was conducted by Morning Consult on behalf of Discover

between November 8-10, 2024, among a weighted U.S. national sample

of 2,201 adults. The interviews were conducted online. Results have

a margin of error of +/- 2 percentage points.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and

payment services company with one of the most recognized brands in

U.S. financial services. Since its inception in 1986, the company

has become one of the largest card issuers in the United States.

The company issues the Discover® card, America's cash rewards

pioneer, and offers personal loans, home loans, checking and

savings accounts and certificates of deposit through its banking

business. It operates the Discover Global Network® comprised of

Discover Network, with millions of merchants and cash access

locations; PULSE®, one of the nation's leading ATM/debit networks;

and Diners Club International®, a global payments network with

acceptance around the world. For more information, visit

https://www.discover.com/company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211996767/en/

Matt Miller Discover mattmiller@discover.com 224-405-0653

@Discover_News

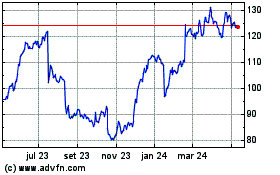

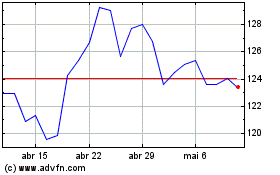

Discover Financial Servi... (NYSE:DFS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Discover Financial Servi... (NYSE:DFS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024