- FY2024 Net New Digital Media ARR exceeds $2.0

billion

- FY2024 Digital Experience revenue exceeds $5.3

billion

- Record Q4 operating cash flows of $2.92 billion

- Record RPO of $19.96 billion, 16 percent year-over-year

growth

Adobe (Nasdaq:ADBE) today reported financial results for its

fourth quarter and fiscal year 2024 ended Nov. 29, 2024.

“Adobe delivered record FY24 revenue, demonstrating strong

demand and the mission-critical role Creative Cloud, Document Cloud

and Experience Cloud play in fueling the AI economy,” said Shantanu

Narayen, chair and CEO, Adobe. “Our highly differentiated

technology platforms, rapid pace of innovation, diversified

go-to-market and the integration of our clouds position us for a

great year ahead.”

“Adobe drove FY24 records of $21.51 billion in revenue, $8.06

billion in cash flows from operations and $19.96 billion in RPO,”

said Dan Durn, executive vice president and CFO, Adobe. “Adobe’s

strategy, AI innovation and massive cross-cloud opportunity

position us well for 2025 and beyond.”

Fourth Quarter Fiscal Year 2024 Financial Highlights

- Adobe achieved revenue of $5.61 billion in its fourth quarter

of fiscal year 2024, which represents 11 percent year-over-year

growth as reported and in constant currency. Diluted earnings per

share was $3.79 on a GAAP basis and $4.81 on a non-GAAP basis.

- GAAP operating income in the fourth quarter was $1.96 billion

and non-GAAP operating income was $2.60 billion. GAAP net income

was $1.68 billion and non-GAAP net income was $2.13 billion.

- Record cash flows from operations were $2.92 billion.

- Remaining Performance Obligations (“RPO”) exiting the quarter

were $19.96 billion.

- Adobe repurchased approximately 4.6 million shares during the

quarter.

Fourth Quarter Fiscal Year 2024 Business Segment

Highlights

- Digital Media segment revenue was $4.15 billion, which

represents 12 percent year-over-year growth as reported and in

constant currency. Document Cloud revenue was $843 million,

representing 17 percent year-over-year growth as reported and in

constant currency. Creative revenue grew to $3.30 billion,

representing 10 percent year-over-year growth or 11 percent in

constant currency.

- Net new Digital Media Annualized Recurring Revenue (“ARR”) was

$578 million, exiting the quarter with Digital Media ARR of $17.33

billion. Document Cloud ARR grew to $3.48 billion and Creative ARR

grew to $13.85 billion.

- Digital Experience segment revenue was $1.40 billion,

representing 10 percent year-over-year growth as reported and in

constant currency. Digital Experience subscription revenue was

$1.27 billion, representing 13 percent year-over-year growth or 12

percent in constant currency.

Fiscal Year 2024 Financial Highlights

- Adobe achieved revenue of $21.51 billion in fiscal year 2024,

which represents 11 percent year-over-year growth as reported and

in constant currency. Diluted earnings per share was $12.36 on a

GAAP basis and $18.42 on a non-GAAP basis.

- GAAP operating income was $6.74 billion and non-GAAP operating

income was $10.02 billion. GAAP net income was $5.56 billion and

non-GAAP net income was $8.28 billion.

- Adobe generated $8.06 billion in operating cash flows during

the year.

- Adobe repurchased approximately 17.5 million shares during the

year.

Fiscal Year 2024 Business Segment Highlights

- Digital Media segment revenue was $15.86 billion, which

represents 12 percent year-over-year growth as reported and in

constant currency. Net new Digital Media ARR was $2.00 billion

during the fiscal year.

- Document Cloud revenue was $3.18 billion, representing 18

percent year-over-year growth as reported and in constant

currency.

- Creative revenue grew to $12.68 billion, representing 10

percent year-over-year growth or 11 percent in constant

currency.

- Digital Experience segment revenue was $5.37 billion,

representing 10 percent year-over-year growth as reported and in

constant currency. Digital Experience subscription revenue was

$4.86 billion, representing 12 percent year-over-year growth as

reported and in constant currency.

Financial Targets

We measure ARR on a constant currency basis during the fiscal

year and revalue ending ARR at year-end. Foreign exchange rate

changes between the end of fiscal year 2023 and the end of fiscal

year 2024 have resulted in a $117 million decrease to the Digital

Media ARR balance entering fiscal year 2025, from $17.33 billion to

$17.22 billion and is reflected in our investor data sheet. We

expect an approximate $200 million headwind to fiscal year 2025

revenue, as a result of the effect of foreign exchange and a

smaller impact of the continued move to subscriptions from

perpetual offerings.

The following table summarizes Adobe’s fiscal year 2025

targets1:

Total revenue

$23.30 billion to $23.55

billion

Digital Media segment revenue

$17.25 billion to $17.40

billion

Digital Media ending ARR growth

11.0% year over year

Digital Experience segment revenue

$5.80 billion to $5.90

billion

Digital Experience subscription

revenue

$5.375 billion to $5.425

billion

Earnings per share

GAAP: $15.80 to

$16.10

Non-GAAP: $20.20 to $20.50

1

Targets assume non-GAAP operating margin

of ~46 percent, non-GAAP tax rate of ~18.5 percent and diluted

share count of ~433 million for fiscal year 2025.

The following table summarizes Adobe’s first quarter fiscal year

2025 targets2:

Total revenue

$5.63 billion to $5.68

billion

Digital Media segment revenue

$4.17 billion to $4.20

billion

Digital Experience segment revenue

$1.38 billion to $1.40

billion

Digital Experience subscription

revenue

$1.27 billion to $1.29

billion

Earnings per share

GAAP: $3.85 to

$3.90

Non-GAAP: $4.95 to $5.00

2

Targets assume non-GAAP operating margin

of ~47 percent, non-GAAP tax rate of ~18.5 percent and diluted

share count of ~439 million for first quarter fiscal year 2025.

Adobe to Host Conference Call

Adobe will webcast its fourth quarter and fiscal year 2024

earnings conference call today at 2:00 p.m. Pacific Time from its

investor relations website: http://www.adobe.com/ADBE. Earnings

documents, including Adobe management’s prepared conference call

remarks with slides and an investor datasheet are posted to Adobe’s

Investor Relations Website in advance of the conference call for

reference.

Forward-Looking Statements, Non-GAAP and Other

Disclosures

In addition to historical information, this press release

contains “forward-looking statements” within the meaning of

applicable securities laws, including statements related to our

business, strategy, artificial intelligence and innovation

momentum; our market opportunity and future growth; market trends;

current macroeconomic conditions; fluctuations in foreign currency

exchange rates; strategic investments; customer success; revenue;

operating margin; annualized recurring revenue; tax rate; earnings

per share; and share count. Each of the forward-looking statements

we make in this press release involves risks, uncertainties and

assumptions based on information available to us as of the date of

this press release. Such risks and uncertainties, many of which

relate to matters beyond our control, could cause actual results to

differ materially from these forward-looking statements. Factors

that might cause or contribute to such differences include, but are

not limited to: failure to innovate effectively and meet customer

needs; issues relating to development and use of AI; failure to

realize the anticipated benefits of investments or acquisitions;

failure to compete effectively; damage to our reputation or brands;

service interruptions or failures in information technology systems

by us or third parties; security incidents; failure to effectively

develop, manage and maintain critical third-party business

relationships; risks associated with being a multinational

corporation and adverse macroeconomic conditions; failure to

recruit and retain key personnel; complex sales cycles; changes in,

and compliance with, global laws and regulations, including those

related to information security and privacy; failure to protect our

intellectual property; litigation, regulatory inquiries and

intellectual property infringement claims; changes in tax

regulations; complex government procurement processes; risks

related to fluctuations in or the timing of revenue recognition

from our subscription offerings; fluctuations in foreign currency

exchange rates; impairment charges; our existing and future debt

obligations; catastrophic events; and fluctuations in our stock

price. Further information on these and other factors are discussed

in the section titled “Risk Factors” in Adobe’s most recently filed

Annual Report on Form 10-K and Adobe's most recently filed

Quarterly Reports on Form 10-Q. The risks described in this press

release and in Adobe’s filings with the U.S. Securities and

Exchange Commission should be carefully reviewed.

Undue reliance should not be placed on the financial information

set forth in this press release, which reflects estimates based on

information available at this time. These amounts could differ from

actual reported amounts stated in Adobe’s Annual Report on Form

10-K for our fiscal year ended Nov. 29, 2024, which Adobe expects

to file in Jan. 2025. Adobe assumes no obligation to, and does not

currently intend to, update these forward-looking statements.

A reconciliation between GAAP and non-GAAP earnings results and

financial targets and a statement regarding use of non-GAAP

financial information are provided at the end of this press release

and on Adobe’s investor relations website.

About Adobe

Adobe is changing the world through personalized digital

experiences. For more information, visit www.adobe.com.

©2024 Adobe. All rights reserved. Adobe, Creative Cloud,

Document Cloud and the Adobe logo are either registered trademarks

or trademarks of Adobe (or one of its subsidiaries) in the United

States and/or other countries. All other trademarks are the

property of their respective owners.

Condensed Consolidated Statements of

Income

(In millions, except per share data;

unaudited)

Three Months Ended

Year Ended

November 29, 2024

December 1, 2023

November 29, 2024

December 1, 2023

Revenue:

Subscription

$

5,365

$

4,763

$

20,521

$

18,284

Product

81

114

386

460

Services and other

160

171

598

665

Total revenue

5,606

5,048

21,505

19,409

Cost of revenue:

Subscription

475

505

1,799

1,822

Product

6

6

25

29

Services and other

135

123

534

503

Total cost of revenue

616

634

2,358

2,354

Gross profit

4,990

4,414

19,147

17,055

Operating expenses:

Research and development

999

889

3,944

3,473

Sales and marketing

1,536

1,368

5,764

5,351

General and administrative

456

372

1,529

1,413

Acquisition termination fee

—

—

1,000

—

Amortization of intangibles

42

42

169

168

Total operating expenses

3,033

2,671

12,406

10,405

Operating income

1,957

1,743

6,741

6,650

Non-operating income (expense):

Interest expense

(50

)

(28

)

(169

)

(113

)

Investment gains (losses), net

14

4

48

16

Other income (expense), net

70

89

311

246

Total non-operating income (expense),

net

34

65

190

149

Income before income taxes

1,991

1,808

6,931

6,799

Provision for income taxes

308

325

1,371

1,371

Net income

$

1,683

$

1,483

$

5,560

$

5,428

Basic net income per share

$

3.81

$

3.26

$

12.43

$

11.87

Shares used to compute basic net income

per share

441

455

447

457

Diluted net income per share

$

3.79

$

3.23

$

12.36

$

11.82

Shares used to compute diluted net income

per share

443

459

450

459

Condensed Consolidated Balance

Sheets

(In millions; unaudited)

November 29, 2024

December 1, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

7,613

$

7,141

Short-term investments

273

701

Trade receivables, net of allowances for

doubtful accounts of $14 and $16, respectively

2,072

2,224

Prepaid expenses and other current

assets

1,274

1,018

Total current assets

11,232

11,084

Property and equipment, net

1,936

2,030

Operating lease right-of-use assets,

net

281

358

Goodwill

12,788

12,805

Other intangibles, net

782

1,088

Deferred income taxes

1,657

1,191

Other assets

1,554

1,223

Total assets

$

30,230

$

29,779

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Trade payables

$

361

$

314

Accrued expenses

2,336

1,942

Debt

1,499

—

Deferred revenue

6,131

5,837

Income taxes payable

119

85

Operating lease liabilities

75

73

Total current liabilities

10,521

8,251

Long-term liabilities:

Debt

4,129

3,634

Deferred revenue

128

113

Income taxes payable

548

514

Operating lease liabilities

353

373

Other liabilities

446

376

Total liabilities

16,125

13,261

Stockholders’ equity:

Preferred stock

—

—

Common stock

—

—

Additional paid-in capital

13,419

11,586

Retained earnings

38,470

33,346

Accumulated other comprehensive income

(loss)

(201

)

(285

)

Treasury stock, at cost

(37,583

)

(28,129

)

Total stockholders’ equity

14,105

16,518

Total liabilities and stockholders’

equity

$

30,230

$

29,779

Condensed Consolidated Statements of

Cash Flows

(In millions; unaudited)

Three Months Ended

November 29, 2024

December 1, 2023

Cash flows from operating activities:

Net income

$

1,683

$

1,483

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, amortization and

accretion

218

222

Stock-based compensation

441

427

Lease-related asset impairments

78

—

Unrealized investment (gains) losses,

net

(11

)

(3

)

Other non-cash adjustments

(105

)

(129

)

Changes in deferred revenue

353

467

Changes in other operating assets and

liabilities

264

(870

)

Net cash provided by operating

activities

2,921

1,597

Cash flows from investing activities:

Purchases, sales and maturities of

short-term investments, net

50

219

Purchases of property and equipment

(48

)

(47

)

Purchases and sales of long-term

investments, intangibles and other assets, net

17

(19

)

Net cash provided by investing

activities

19

153

Cash flows from financing activities:

Repurchases of common stock

(2,500

)

(1,000

)

Taxes paid related to net share settlement

of equity awards, net of proceeds from treasury stock

re-issuances

(152

)

(202

)

Other financing activities, net

151

(15

)

Net cash used for financing activities

(2,501

)

(1,217

)

Effect of exchange rate changes on cash

and cash equivalents

(19

)

7

Net change in cash and cash

equivalents

420

540

Cash and cash equivalents at beginning of

period

7,193

6,601

Cash and cash equivalents at end of

period

$

7,613

$

7,141

Non-GAAP Results

The following table shows Adobe’s

GAAP results reconciled to non-GAAP results included in this

release.

(In millions, except per share data)

Three Months Ended

Year Ended

November 29,

2024

December 1,

2023

August 30, 2024

November 29,

2024

December 1,

2023

Operating income:

GAAP operating income

$

1,957

$

1,743

$

1,992

$

6,741

$

6,650

Stock-based and deferred compensation

expense

455

431

485

1,881

1,735

Amortization of intangibles

84

91

83

334

373

Acquisition-related expenses (1)

—

34

—

1,007

116

Loss contingency (reversal) (2)

—

44

(45

)

(44

)

44

Lease-related asset impairments and other

charges (3)

100

—

—

100

—

Non-GAAP operating income

$

2,596

$

2,343

$

2,515

$

10,019

$

8,918

Net income:

GAAP net income

$

1,683

$

1,483

$

1,684

$

5,560

$

5,428

Stock-based and deferred compensation

expense

455

431

485

1,881

1,735

Amortization of intangibles

84

91

83

334

373

Acquisition-related expenses (1)

—

34

—

1,007

116

Loss contingency (reversal) (2)

—

44

(45

)

(44

)

44

Lease-related asset impairments and other

charges (3)

100

—

—

100

—

Investment (gains) losses, net

(14

)

(4

)

(12

)

(48

)

(16

)

Income tax adjustments

(176

)

(120

)

(115

)

(509

)

(303

)

Non-GAAP net income

$

2,132

$

1,959

$

2,080

$

8,281

$

7,377

Diluted net income per share:

GAAP diluted net income per share

$

3.79

$

3.23

$

3.76

$

12.36

$

11.82

Stock-based and deferred compensation

expense

1.03

0.94

1.08

4.18

3.78

Amortization of intangibles

0.19

0.20

0.19

0.75

0.81

Acquisition-related expenses (1)

—

0.07

—

2.24

0.25

Loss contingency (reversal) (2)

—

0.10

(0.10

)

(0.10

)

0.10

Lease-related asset impairments and other

charges (3)

0.23

—

—

0.22

—

Investment (gains) losses, net

(0.03

)

(0.01

)

(0.03

)

(0.10

)

(0.03

)

Income tax adjustments

(0.40

)

(0.26

)

(0.25

)

(1.13

)

(0.66

)

Non-GAAP diluted net income per share

$

4.81

$

4.27

$

4.65

$

18.42

$

16.07

Shares used to compute diluted net income

per share

443

459

448

450

459

(1)

Associated with the Figma

transaction, and includes deal costs, certain professional fees and

the termination fee

(2)

Associated with an IP litigation

matter

(3)

Associated with the optimization

of our leased facilities, and primarily includes impairment charges

related to certain operating lease right-of-use assets and

leasehold improvements

Non-GAAP Results

(continued)

The following table shows Adobe’s

fourth quarter fiscal year 2024 GAAP tax rate reconciled to the

non-GAAP tax rate included in this release.

Fourth Quarter Fiscal

2024

Effective income tax rate:

GAAP effective income tax rate

15.5

%

Income tax adjustments

5.0

Stock-based and deferred compensation

expense

(1.4

)

Amortization of intangibles

(0.3

)

Lease-related asset impairments and other

charges (3)

(0.3

)

Non-GAAP effective income tax rate (4)

18.5

%

(3)

Associated with the optimization

of our leased facilities, and primarily includes impairment charges

related to certain operating lease right-of-use assets and

leasehold improvements

(4)

Represents Adobe’s fixed

long-term non-GAAP tax rate based on projections and currently

available information through fiscal 2025

Reconciliation of GAAP to

Non-GAAP Financial Targets and Assumptions

The following tables show Adobe's

annual fiscal year 2025 financial targets and assumptions

reconciled to non-GAAP financial targets and assumptions included

in this release.

(Shares in millions)

Fiscal Year 2025

Low

High

Diluted net income per share:

GAAP diluted net income per share

$

15.80

$

16.10

Stock-based and deferred compensation

expense

4.69

4.69

Amortization of intangibles

0.71

0.71

Income tax adjustments

(1.00

)

(1.00

)

Non-GAAP diluted net income per share

$

20.20

$

20.50

Shares used to compute diluted net income

per share

433

433

Fiscal Year 2025

Operating margin:

GAAP operating margin

36.0

%

Stock-based and deferred compensation

expense

8.7

Amortization of intangibles

1.3

Non-GAAP operating margin

46.0

%

Reconciliation of GAAP to

Non-GAAP Financial Targets and Assumptions (continued)

The following tables show Adobe's

first quarter fiscal year 2025 financial targets and assumptions

reconciled to non-GAAP financial targets and assumptions included

in this release.

(Shares in millions)

First Quarter Fiscal

2025

Low

High

Diluted net income per share:

GAAP diluted net income per share

$

3.85

$

3.90

Stock-based and deferred compensation

expense

1.13

1.13

Amortization of intangibles

0.19

0.19

Income tax adjustments

(0.22

)

(0.22

)

Non-GAAP diluted net income per share

$

4.95

$

5.00

Shares used to compute diluted net income

per share

439

439

First Quarter Fiscal

2025

Operating margin:

GAAP operating margin

37.0

%

Stock-based and deferred compensation

expense

8.5

Amortization of intangibles

1.5

Non-GAAP operating margin

47.0

%

First Quarter Fiscal

2025

Effective income tax rate:

GAAP effective income tax rate

19.0

%

Stock-based and deferred compensation

expense

(1.7

)

Amortization of intangibles

(0.3

)

Income tax adjustments

1.5

Non-GAAP effective income tax rate (4)

18.5

%

(4)

Represents Adobe’s fixed

long-term non-GAAP tax rate based on projections and currently

available information through fiscal 2025

Use of Non-GAAP Financial Information

Adobe continues to provide all information required in

accordance with GAAP, but believes evaluating its ongoing operating

results may not be as useful if an investor is limited to reviewing

only GAAP financial measures. Adobe uses non-GAAP financial

information to evaluate its ongoing operations and for internal

planning and forecasting purposes. Adobe's management does not

itself, nor does it suggest that investors should, consider such

non-GAAP financial measures in isolation from, or as a substitute

for, financial information prepared in accordance with GAAP. Adobe

presents such non-GAAP financial measures in reporting its

financial results to provide investors with an additional tool to

evaluate Adobe's operating results. Adobe believes these non-GAAP

financial measures are useful because they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making. This allows

institutional investors, the analyst community and others to better

understand and evaluate our operating results and future prospects

in the same manner as management.

Adobe's management believes it is useful for itself and

investors to review, as applicable, both GAAP information as well

as non-GAAP measures, which may exclude items such as stock-based

and deferred compensation expenses, amortization of intangibles,

investment gains and losses, income tax adjustments, and the income

tax effect of the non-GAAP pre-tax adjustments from the provision

for income taxes. Adobe uses these non-GAAP measures in order to

assess the performance of Adobe's business and for planning and

forecasting in subsequent periods. Whenever such a non-GAAP measure

is used, Adobe provides a reconciliation of the non-GAAP financial

measure to the most closely applicable GAAP financial measure.

Investors are encouraged to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measure

as detailed above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211684094/en/

Investor Relations Contact Steve Day Adobe

ir@adobe.com

Public Relations Contact Ashley Levine Adobe

adobepr@adobe.com

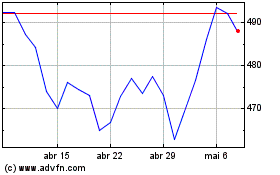

Adobe (NASDAQ:ADBE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Adobe (NASDAQ:ADBE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024